This week's newsletter co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($16,188): -2% / -66%

- ETH ($1,170): -1% / -69%

- XRP ($0.38): +2% / -54%

- UNI ($5.25): -5% / -70%

- Crypto Market Cap ($818B): -1% / -63%

- BTC Dominance: 38%

- ETH Dominance: 18%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($65B): -1% / -17%

- USDC ($47B): +5% / +10%

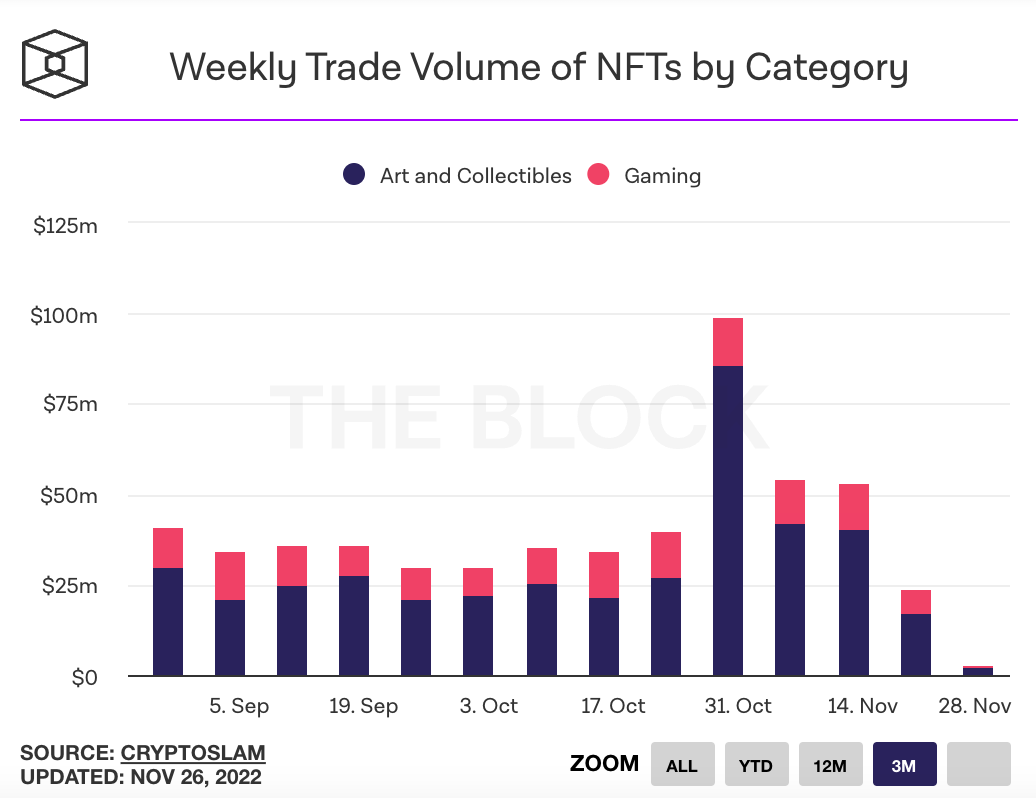

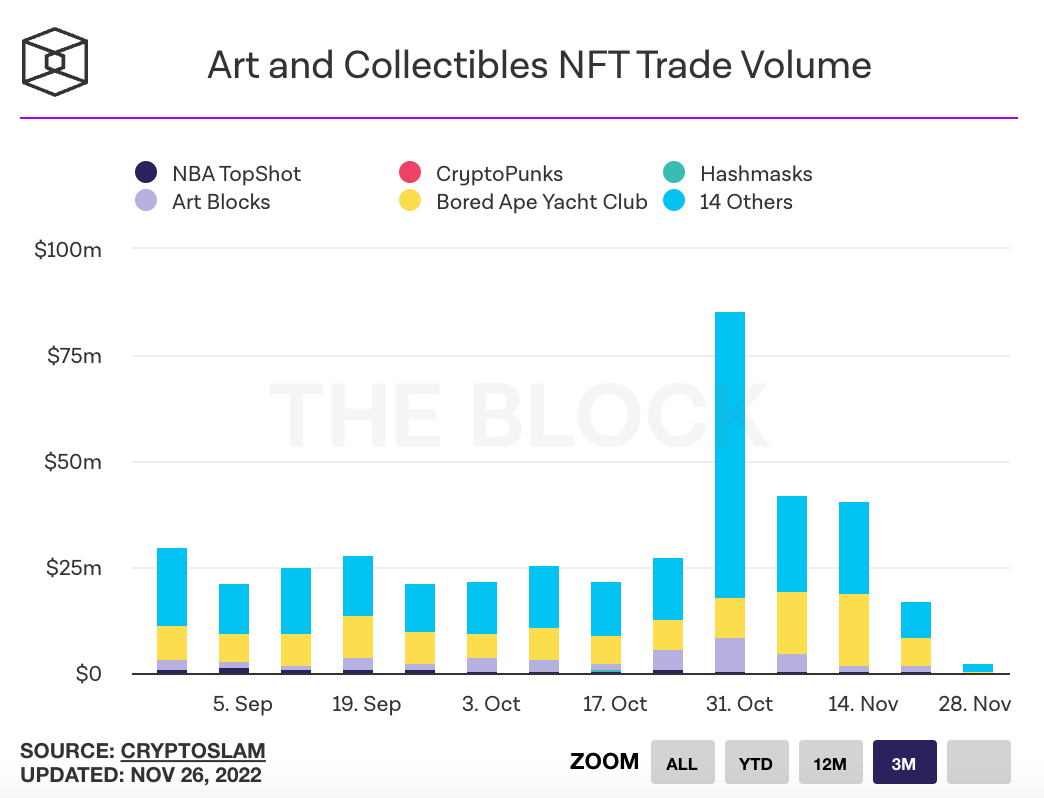

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Cryptocurrencies fell as markets continue to deal with the impact of FTX’s collapse, as well as broader investor anxiety around the protests in China against Covid restrictions. Link.

- BlockFi filed for Chapter 11 bankruptcy. BlockFi has $257 million in assets and owes $729 million in liabilities, including $275 million to FTX. Peter Thiel’s Valar Ventures reportedly owned 19% of BlockFi shares. Link. Link. Link. Announcement.

- Crypto prime broker Genesis hired restructuring advisors after reportedly failing to secure a $1 billion capital infusion from investors. DCG, parent company of Genesis, sent a letter to investors assuring them that Genesis pausing withdrawals would not impact DCG. DCG also shared that it owes Gensis $575 million due in May 2023. Link. Link. Link. Link. Link.

- FTX founder SBF reportedly lobbied to make the CFTC the primary agency regulating major cryptocurrencies, and to have the CFTC approve an application related to crypto derivatives. Link.

- Miami-Dade County is pushing to terminate the 19-year, $135 million arena naming-rights agreement it had with FTX. Miami wants to find a new sponsor for the arena where the NBA’s Miami Heat play. Link.

- The Ethereum foundation is discussing details around its planned Shanghai upgrade. Developers are set on withdrawing staked ETH and rewards being included in the upgrade (though they are noncommittal on the timing of the upgrade) but are currently debating whether other EIPs will be included such as the highly anticipated scaling proposal EIP-4844. Link. Link. Link. EIP-4844. EIP-4895 (Shanghai).

- A new privacy policy from Uniswap Labs said it collects certain on-chain data from users to improve their products. It doesn’t collect personal data, and the data collected is not shared with any third parties. Link. Blog Post (deleted). Tweet.

- Consensys (developer of Metamask) said it collects some data related to user identification, such as contact details, profile information along with some other user data. It also noted that its default RPC provider, Infura (also owned by Consensys) collects user’s IP addresses and Ethereum wallet addresses for transactions. Link. Privacy Policy.

- Aave and Curve were victims of an exploit by Mango Markets hacker Avraham Eisenburg, whose $50 million CRV loan liquidation led to Aave accumulating ~$1.6 million in bad debt. Aave put forward a governance proposal to avoid future exploits. Link. Link. Link. Link. Governance Proposal.

- A “whale” address moved 73,224 ETH, worth $85.7 million, to Binance during Asian trading hours, sparking fears of further selling pressure on the currency. Link.

- A CoinShares report shows that 75% of new crypto investments by institutional investors are shorts, the largest on record. Total crypto assets under management currently sit at $22 billion, a two year low. Link.

- FTX bankruptcy attorneys found $482 million in unencumbered cash in various FTX bank accounts, some of which will be used for payroll and operating expenses. Roughly $459 million will be available for the bankruptcy case itself. Link.

- Singapore said it is investigating defunct crypto lender Hodlnaut for possible cheating and fraud. Hodlnaut halted withdrawals after the UST / Luna collapse, and also held assets on FTX that it was unable to withdraw. Link.

- The Bahamas’ FTX liquidators agreed to transfer a related case they'd filed in New York to Delaware, where the company had already filed for bankruptcy protection. The distressed crypto exchange and Securities Commission of the Bahamas continued to publicly feud over the Bahamian regulator’s decision to take custody of FTX’s digital assets last week. Link. Link.

- US Senators sent a letter to attorney general Merrick Garland asking the DOJ to investigate SBF and other FTX executives for financial crimes. Link.

- Former FTX CEO SBF apologized to current employees, and explained in his own words how the exchange’s collapse transpired but did not address the various allegations of fraud lobbied at him. Link.

- Binance released its proof-of-reserves system for BTC, with other tokens and networks to be added in the next couple of weeks. The new protocol uses zk-Snarks to cryptographically prove that an exchange has enough reserves to cover all users’ assets 1:1. Link. Link.

- Coinbase shares hit an all-time low last Monday of $42 as investors' confidence in centralized exchanges was rattled by the collapse of FTX. Link.

- NFT marketplace Magic Eden added support for Polygon. Link.

- US Senators Elizabeth Warren, Tina Smith and Dick Durbin sent a letter to Fidelity urging them to scrap its plan to offer Bitcoin to 401(k) retirement plans. Link.

- Rewards to validators using MEV-boost relays like flashbots increased by 6x the week of the FTX collapse due to a large increase of on-chain transactions. Link.

- Binance allocated another $1 billion to its crypto recovery fund this week, increasing the fund’s total to $2 billion. The fund will be used to buy distressed crypto assets and support the industry. Link. Link.

- WBTC DAO is moving to a new multisig, replacing inactive signers FTX, MakerDAO and Airswap with Compound, Loopring, Kyber and BitGo. WBTC recently lost its peg with BTC, trading at a 0.86% discount. Link.

- The state of New York signed a two year moratorium on new permits for proof-of-work cryptocurrency mining operators that rely on carbon-based fuel to power their activities. Link. Link.

- Several US state regulators are looking into whether Genesis persuaded residents of their states to invest in crypto securities without having the proper registrations. Link. Link.

- Bitcoin miner Core Scientific reported a $435 million loss in Q3, compared with $16.6 million a year ago. Operations were impacted by the drop in bitcoin prices, rising electricity prices, and debt it had taken on to expand operations. Link.