This week's newsletter co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($16,563): 0% / -65%

- ETH ($1,176): -4% / -68%

- XRP ($0.38): +10% / -55%

- UNI ($5.54): -6% / -68%

- Crypto Market Cap ($822B): -1% / -63%

- BTC Dominance: 39%

- ETH Dominance: 18%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($66B): -1% / -16%

- USDC ($44B): +1% / +5%

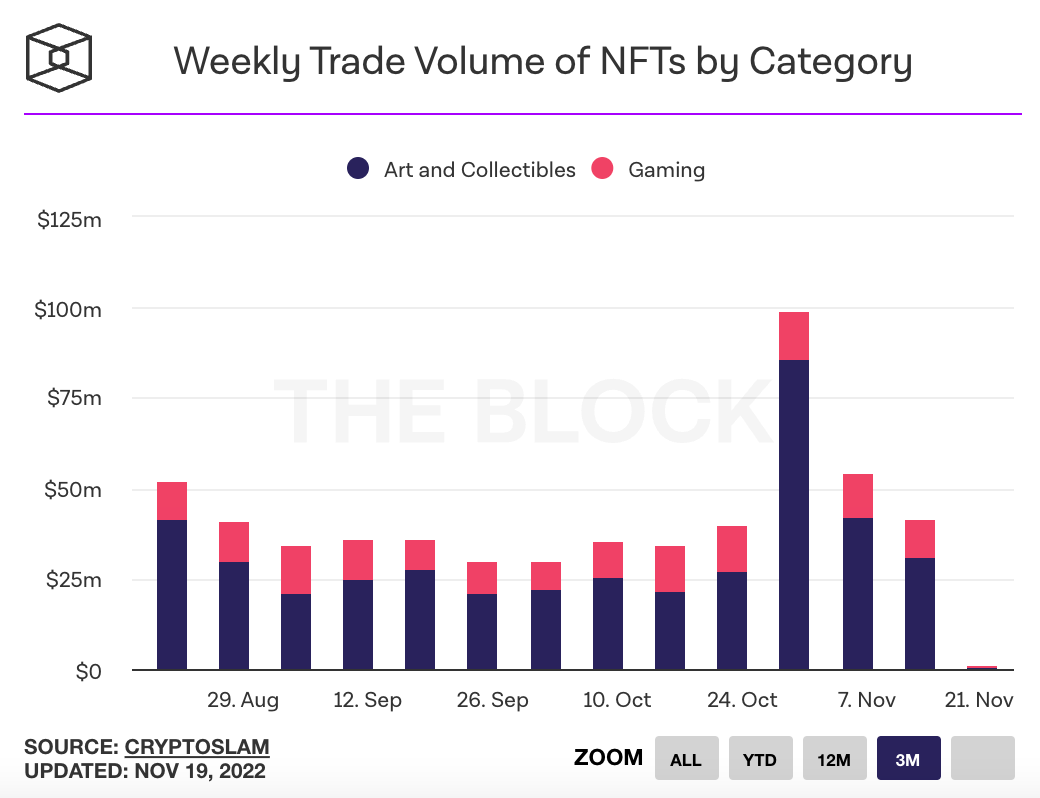

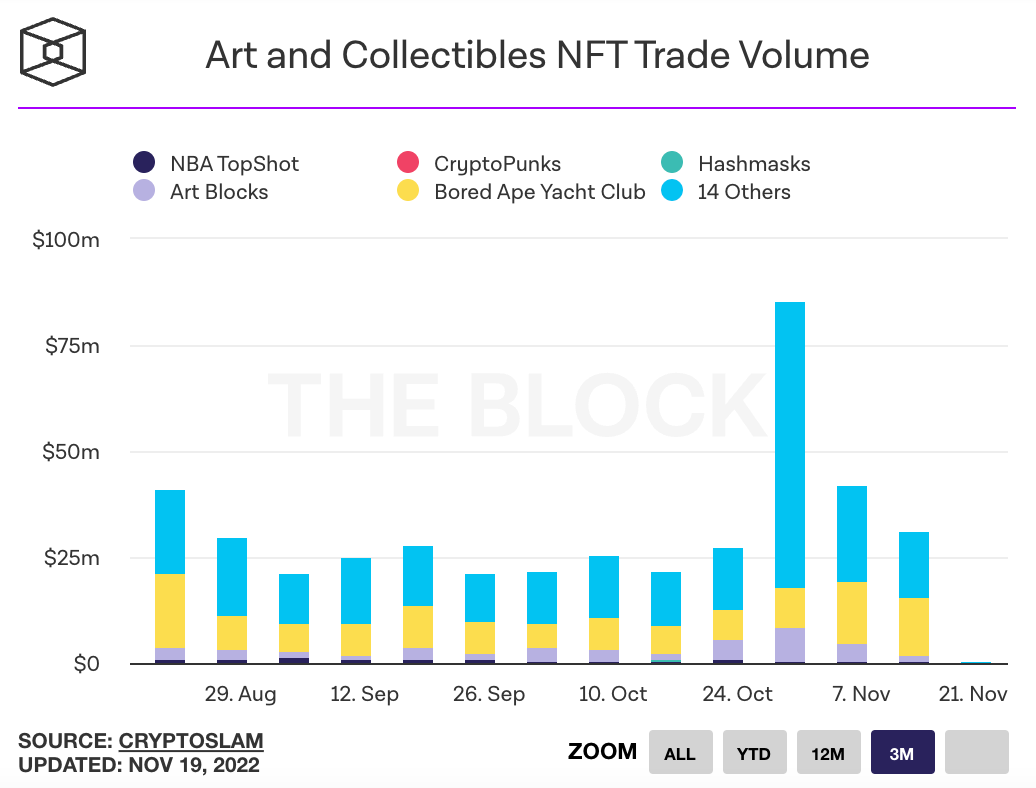

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Total market capitalization of digital assets briefly fell below $800 billion, a level not seen since early 2021. Link.

- Decentralized exchange Uniswap overtook Coinbase as the second largest exchange for trading Ethereum this past week. Binance was the largest with $1.9 billion of volumes, followed by Uniswap at $1.1 billion and Coinbase at $0.6 billion. Link. Tweet.

- Roughly 2.3 million US taxpayers traded cryptocurrencies in 2020 according to IRS data, a 149% increase from 2019 when there were nearly 1 million crypto users. Link.

- FTX owes its 50 biggest unsecured creditors a total of $3.1 billion according to court documents, with a few customers owed more than $200 million each. Link. Link.

- The FTX fallout spread to Genesis, the crypto prime broker owned by Digital Currency Group (DCG). Genesis halted withdrawals after facing a liquidity crunch, and is reportedly seeking to raise $1 billion. Genesis had $175 million deposited on FTX when the exchange filed for bankruptcy, and earlier this year it had lent $2.3 billion to the now defunct 3AC. The significant capital infusion being sought has led the market to speculate that parent co DCG will sell other assets it owns to pay its outstanding debt, such as the Grayscale Bitcoin Trust. Link. Link. Link.

- Crypto exchange Gemini was forced to delay withdrawals on its Earn product, which used Genesis as a counterparty. Earn allows depositors to earn yield on their crypto assets. Link.

- Shares of the Grayscale Bitcoin Trust (GBTC), the world’s largest publicly traded crypto fund, are trading at a new record discount of 43% relative to the price of bitcoin. Grayscale is owned and managed by DCG, which investors fear may be suffering a significant financial impact from the FTX collapse. Grayscale assured investors it was fine, but would not share proof of reserves of its funds. Link. Link. Tweet.

- Crypto marketplace X2Y2 announced it would begin enforcing creator royalties, reversing an earlier decision of optional royalties. OpenSea confirmed it was enforcing creator royalties last week. Link.

- Nike is debuting a new Web3 platform on Polygon called .Swoosh, where customers can collect digital wearables and collaborate on creating new collections. Link.

- Yuga Labs acquired Beeple’s WeNew Labs and its flagship NFT collection, 10KTF. Beeple and WeNew Labs’ CEO Michael Figgie will join Yuga Labs as an advisor and Chief Content Officer respectively. Link.

- Hardware wallet manufacturers Ledger and Trezor saw an exponential rise in sales this week as consumers rushed to self-custody solutions to safeguard their digital assets. Ledger saw their biggest day of sales ever this week. Link.

- New filings from FTX’s bankruptcy lawyers claim the exchange lacked corporate controls and that its financial statements were untrustworthy. The exchange had virtually no accounting practice or governance, and power was concentrated in the hands of a few individuals. The report shows that the exchanges private keys were shared via an unsecured group email account. Link. Link. Link. Bankruptcy Filing.

- The Securities Commission of the Bahamas announced it had moved FTX assets to wallets in the control of the government agency, though it did not specify which assets and how much it had transferred. Link. Link.

- Shortly after filing for bankruptcy, SBF corresponded with a Vox reporter over Twitter DMs and said he regretted filing for chapter 11. Screenshots of the exchange were published and cover a breadth of topics, including regulators about whom SBF wrote, “F*ck regulators. They make everything worse”. Link. Link.

- Yuga Labs is donating CryptoPunk #305 to the Institute of Contemporary Art in Miami. Link.

- Crypto lender BlockFi paused withdrawals on its platform and is reportedly preparing for a potential bankruptcy filing due to “significant exposure” to FTX and Alameda. Link.

- Binance announced the formation of a “recovery fund” aimed at investing in crypto projects that are otherwise strong, but are facing a liquidity crisis in the current market. Link.

- Centralized exchanges like Crypto.com and Binance are showing ‘proof of reserves’ by disclosing their asset holdings. So far proof of reserves leave out liabilities, so don’t provide the full financial picture of the exchanges. Link.

- Treasury Secretary Janet Yellen called for regulatory oversight of crypto markets, noting that her department's reports in September on digital assets outlined many of the risk factors that led to FTX’s demise. US lawmakers in both the House and Senate plan to hold hearings with FTX executives to discuss circumstances around the exchange’s collapse. Link. Link. Link. Link. FSOC Report (PDF).

- Users staking ether on service provider Lido are earning as much as 10.7%, an all-time high since the Merge. Link.

- Paradigm and a16z filed an amicus brief in the lawsuit against Ooki DAO, alleging that the CFTC’s method of serving the DAO via a chatbot was illegal. A hearing is set for November 30th. Link.

- New bankruptcy filings show that FTX’s corporate funds were used to purchase homes in the Bahamas among other personal purchases. Link. Link.

- Over $700 million has exited DeFi products on Solana over the past few weeks, causing performance issues on the network. Binance and OKX suspended USDC and USDT withdrawals from Solana, and Tether announced it was moving $1 billion USDT from Solana to Ethereum. Link. Link. Link.

- New reports indicate that $300 million of the $420 million raised by FTX in October 2021 was used to purchase shares directly from SBF. Link.

- A group of investors filed a class action lawsuit against FTX and celebrities who promoted the exchange, including Tom Brady, Gisele Bundchen, Naomi Osaka, Shaquille O’Neal, Kevin O’Leary and the Golden State Warriors. Link.

- Binance.US is reportedly preparing to bid for bankrupt crypto lender Voyager, after losing the bid to FTX.US in July. Link.

- Crypto.com accidentally transferred $400 million in digital assets to rival exchange Gate.io last week. The funds were returned just in time for a proof-of-reserves audit done by the exchange. Link.

- The head of Twitter’s crypto team resigned this week, joining the mass exodus of employees who have left since new owner Elon Musk took over the company. Link. Link.

- Matter Labs raised a $200 million Series C round co-led by Blockchain Capital and Dragonfly. Matter Labs is known for its work on Ethereum scaling solution zkSync. Link.

- A leaked slide deck from earlier this year shows that Sino Capital, one of Asia’s most notorious crypto investment funds, had significant ties to FTX and Alameda. The Fund was an equity investor in FTX and had significant exposure to FTX-backed tokens, including Solana’s SOL, Serum (SRM), Maps (MAPS), Oxygen (OXY) and Jet (JET). Link.

- Crypto prime broker FalconX cut ties with Silvergate’s SEN network after the bank disclosed it held deposits on FTX. Silvergate is a popular bank with institutional investors and crypto companies. Link.