PRICE CHANGE: WTD/YTD

- BTC ($17,100): +6% / -64%

- ETH ($1,277): +9% / -66%

- XRP ($0.39): +2% / -53%

- UNI ($6.23): +19% / -64%

- Crypto Market Cap ($858B): +5% / -61%

- BTC Dominance: 38%

- ETH Dominance: 18%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($66B): 0% / -16%

- USDC ($43B): -7% / +2%

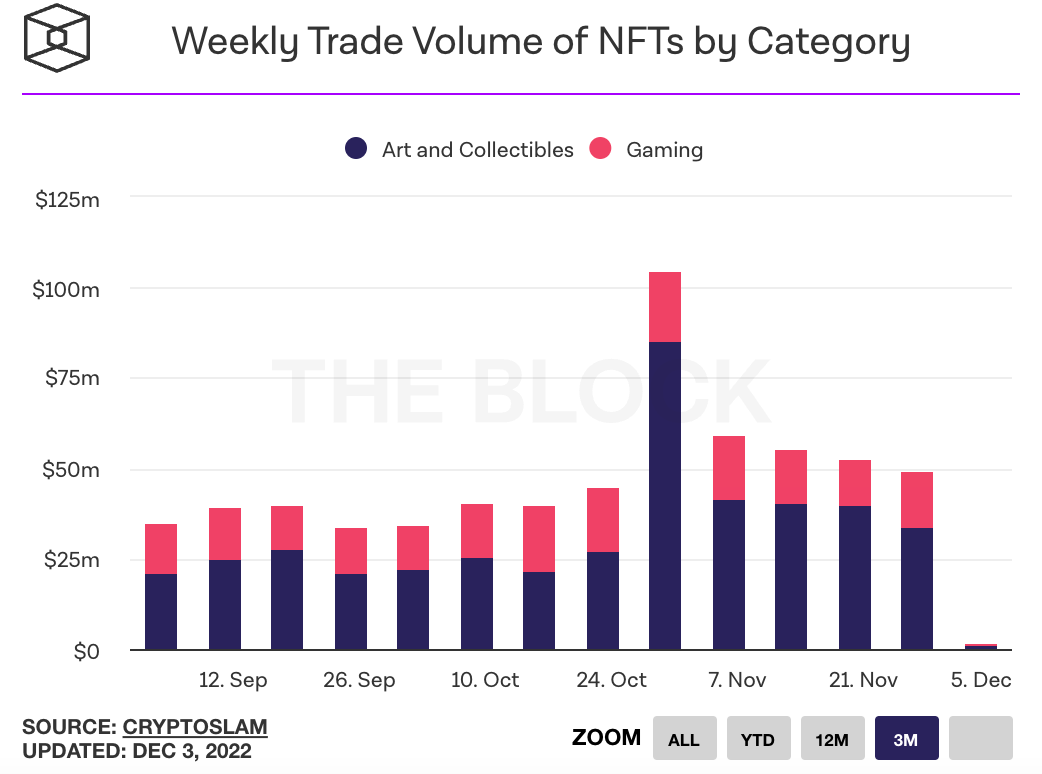

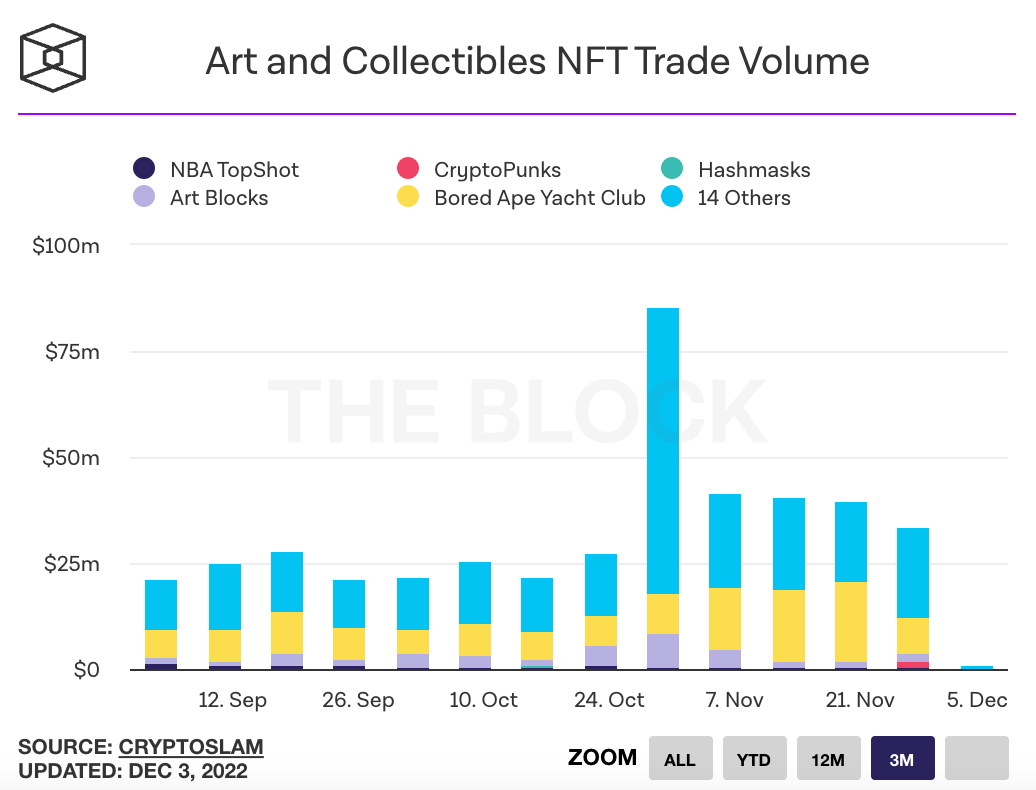

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Apple is blocking Coinbase Wallet iOS users from sending NFTs on the mobile app, claiming that gas fees are subject to its 30% in-app purchase tax. Link. Coinbase Tweet.

- Uniswap's community is voting on piloting a "fee switch" on select pools on the DEX. The fee switch would allow the protocol to retain a small amount of the transaction fees, which are currently passed through to liquidity providers today. The fee switch would not increase fees for users. Link. Proposal.

- Payments processor Stripe announced a fiat-to-crypto onramp widget that customers could embed directly into their DEX, NFT platform, wallet, or dApp. Stripe said it would handle fraud, compliance, and KYC on behalf of customers. Launch partners include Magic Eden and Audius. Link. Blog Post.

- NFT aggregator Blur overtook X2Y2 to become the second largest marketplace on Ethereum by volume in November. OpenSea remained the largest at $259 million in volume, followed by Blur ($132 million) and X2Y2 ($120 million). Link.

- Uniswap Labs launched its NFT marketplace aggregator, which it had been building since purchasing Genie in June. Historical Genie users received a $5 million USDC airdrop as part of the launch. Link. Link. Link. Tweet.

- OpenSea has generated over $1 billion in royalties for creators since Jan 1, even as its market share has shrunk from 96% in January to just under 45% at the end of November. Link.

- Bitcoin security startup Casa announced it would start support Ethereum. The platform allows users to safely self-custody digital assets with a multi-key management solution. Link. Link.

- DeFi lending protocols Aave and Compound implemented new security measures and risk parameters to block attacks on low liquidity assets. Aave froze markets for 17 tokens and Compound added borrowing caps for 10 tokens. Link.

- FTX Japan is likely to restart withdrawals after receiving approval from US bankruptcy lawyers. Customer funds were held in wallets segregated from FTX Global and FTX US. Link.

- Indexing service The Graph is adding support for Polygon. Link. Blog Post.

- More than 4.4 million Reddit Collectible Avatars have been minted since July. To date 40,000 avatars have been sold in the secondary market. Link. Dune Analytics.

- Timex will make 500 watches personalized with the NFTs of Bored Ape Yacht Club and Mutant Ape Yacht Club owners. Link.

- SBF suggested an FTX employee was responsible for the $650 million “hack” of FTX assets that occurred the night the exchange filed for bankruptcy. Interview. Link.

- Treasury Secretary Janet Yellen called FTX’s collapse a “Lehman moment” for the crypto industry. Link. Link. Clip.

- Crypto brokerage Genesis owes $900 million to customers of crypto exchange Gemini. Genesis was a partner in Gemini’s Earn program, where users could lend out their crypto for returns. Genesis paused withdrawals earlier this month. Link. Link. Link.

- Ethereum’s Ropsten test network is shutting down at the end of this month followed by the Rinkeby test network in the middle of 2023. Developers are advised to migrate to Goerli and Sepolia test networks which have better proof of stake support. Link. Blog Post.

- BlackRock, the world's largest asset manager, said it had invested $24 million in FTX and that it may have received faulty information during diligence. Interview.

- Grayscale’s GBTC Bitcoin Trust, which passively invests in bitcoin, holds over 633,000 BTC worth nearly $11 billion and roughly 3.3% of all coins mined. DCG is the largest holder with 10% of GBTC shares. Link.

- Chat application Telegram sold more than $50 million in usernames on its native The Open Network using Fragment. Fragment also has plans to build crypto wallets and decentralized exchanges for Telegram. Link.

- 10 rare Pudgy Penguins NFTs sold for $129,000 at a Sotheby’s auction. Link.

- Former FTX US president Brett Harrison is raising money for a crypto trading software startup that will make it easier for professional investors to trade digital assets across centralized and decentralized exchanges. Harrison stepped down from FTX five weeks before the exchange began to face troubles. Link.

- Bitcoin miners made $472 million in revenue in November, down 20% from the previous month. Link.

- The Red Cross is testing distributing aid to people in conflict zones through blockchain technology in partnership with Layer 1 network Partisia Blockchain. If successful, it could result in aid being distributed by a digital asset pegged to the price of an asset, similar to a stablecoin. Link.

- Crypto exchange Kraken laid off 1,100 staffers. Link. Blog Post.

- TBD, the Bitcoin-focused division of payments company Block (fka Square), killed its plans to trademark the term “Web5”. Link. Link.

- Avalanche-based DEX Trader Joe is launching on Ethereum scaling platform Arbitrum, its first deployment on a new chain since its 2021 launch. Link.

- The liquidation advisor of crypto hedge fund Three Arrows Capital (3AC) has taken control of $35 million of fiat currency and other digital assets as it begins to liquidate the fund’s assets. Link.

- OpenSea now supports digital assets built on Binance’s BNB blockchain. Link.

- Six exchanges, including Binance, Coinbase, and Kraken, were ordered to share user data to help trace $10.7 million in stolen funds from a UK-based exchange in 2020. Link. Link.

- Daylight, an API solution for aggregating web3 perks based on a user’s wallet address, raised $3 million in seed funding from Framework Ventures and Chapter One. Link.

- Crypto payments startup MoonPay is rolling out a soul bound NFT loyalty program called the “Web3 Passport”, which will give users access to exclusive events. Link. Blog Post.

- Infrastructure provider Ankr and stablecoin issuer Helio were hacked for $20 million in a series of exploits that allowed the hacker to mint tokens and drain Helio’s liquidity pools. Link.

- Alameda Research was given outsized borrowing limits compared to other FTX clients. Link. Link.

- Alameda Research invested $1.15 billion into crypto miner Genesis Digital Assets (unrelated to Genesis Trading), including most recently at a $5.5 billion valuation in April. Link.

- The US Justice Department wants the bankruptcy court to appoint an independent examiner to probe potential wrongdoing at FTX. Link. Court Filing.

- Decentralized perpetuals exchange GMX earned more in daily trading fees than Uniswap for the first time. GMX earned $1.15 million in trading fees, surpassing Uniswap’s $1.06 million. Link.

- Animoca Brands is raising up to $2 billion for a new fund called Animoca Capital, that will invest in metaverse businesses. Link. Link.

- Blockchain publishing platform LBRY said that LBRY Inc. had been “killed by legal and SEC debts”. LBRY Inc. lost a year-long battle with the SEC last week and will likely pay more than $20 million for issuing unregistered securities. Link. Tweet.

- Magic Eden’s shift to optional royalties has expanded its market share from 80% of Solana NFT volumes in October to 93% at the end of November. Link.

- Coinbase announced it would delist XRP, Bitcoin Cash, and Ethereum Classic from its crypto wallet “due to low usage”. Link. Post.

- Sam Bankman-Fried appeared at the New York Times DealBook Summit and asserted that he “didn’t ever try to commit fraud” and had not knowingly commingled customer assets with trading firm Alameda Research. Link. Link. Link.

- A CFTC commissioner wants to narrow the current definition of a “retail investor” by segmenting it into two categories: average households and milionaires/hedge funds. Link.

- Coinbase said it had paused production of its Bored Ape Yacht Club-themed “Degen Trilogy” short film series. Link.

- Brazil’s Congress passed a new bill that would give legal status to payments made in cryptocurrencies for goods and services - though it doesn’t give crypto currencies the status of legal tender. Link.

- Candy Digital, a sports and entertainment NFT startup that raised at a $1.5 billion valuation last year, laid off more than one-third of its staff. Link.

- TIME President Keith Grossman is leaving the media brand to lead MoonPay’s enterprise efforts. Under Grossman TIME launched NFT collections for its magazine covers and also began accepting crypto payments for subscriptions. Link. Tweet.

- CFTC Chair Rostin Behnam testified before the Senate Agriculture Committee about crypto regulation and the agency’s relationship with collapsed exchange FTX. Link.