PRICE CHANGE: WTD/YTD

- BTC ($22,795): +9% / -52%

- ETH ($1,622): +20% / -56%

- XRP ($0.36): +5% / -57%

- UNI ($7.02): -1% / -59%

- Crypto Market Cap ($1.05T): +9% / -53%

- BTC Dominance: 42%

- ETH Dominance: 19%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($66B): 0% / -16%

- USDC ($55B): +1% / +30%

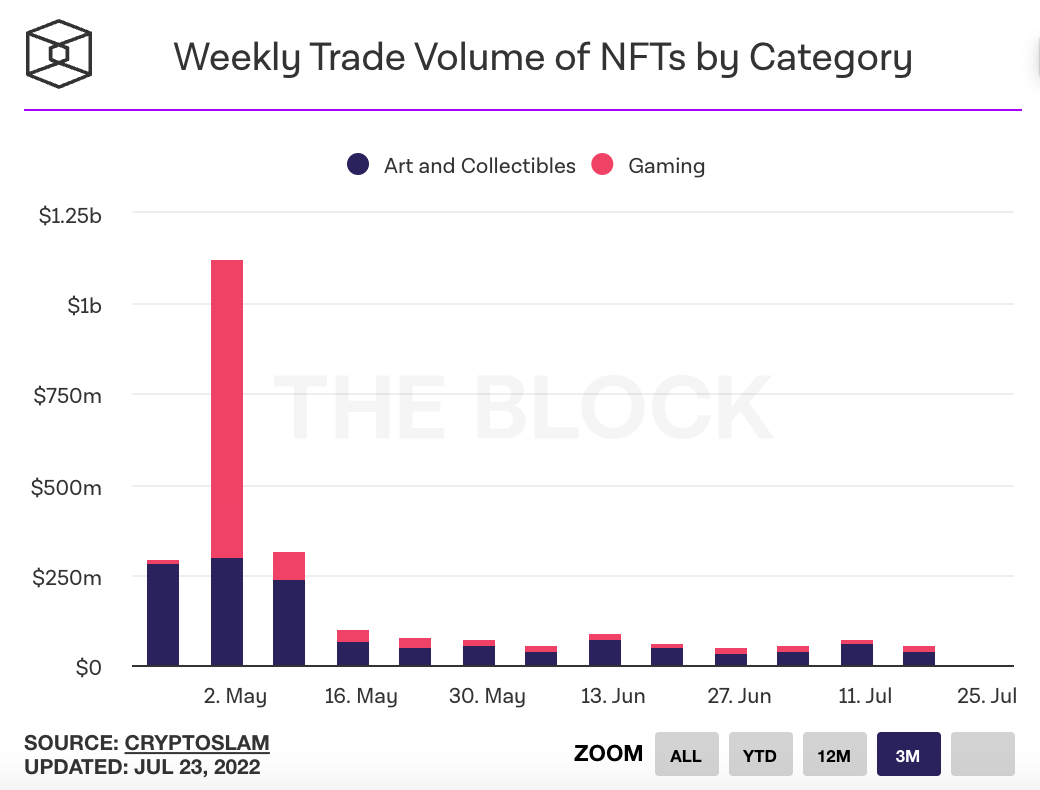

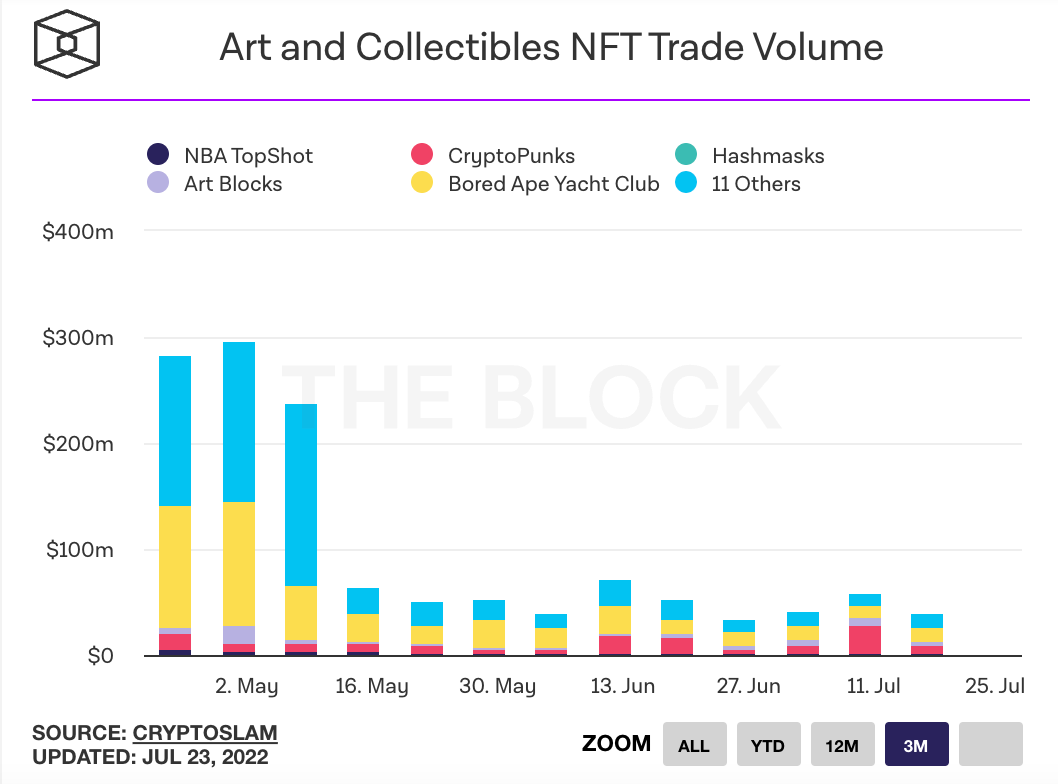

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- The DoJ filed criminal charges against a former Coinbase product manager and 2 others for wire fraud. The group bought tokens based on insider knowledge of their upcoming listings on Coinbase, and are alleged to have made $1.5 million across 25 different tokens. Link. Link. Link. DoJ PR.

- The SEC simultaneously filed a civil suit against the trio for insider trading. The case is being used by the SEC to formally declare 9 digital asset as securities, though it did not formally bring charges against any of the tokens. Coinbase separately filed a petition with the SEC asking for it to start a rulemaking process to detail how it would apply federal securities laws to crypto assets. In an unprecedented move the CFTC also criticized the SEC's categorization of the assets as securities. Link. Link. Link. Link. Link. Coinbase Blog Post. SEC charges. CFTC response.

- A bill giving CFTC the power to regulate crypto as a commodity could go to vote later this year. Commodities are less regulated and are subject to fewer restrictions on who can invest. The bill is hugely popular in the crypto industry and could effectively disenfranchise the SEC. Link.

- The floor price of the CryptoPunks collection topped $100k for the first time in 2 months. Link. Punks for sale.

- ETH broke $1.6k on Merge hype and a broader run-up in the equity markets. Global stocks had their best week in over a month, over speculation that the worst of the sell-off has passed. Odds show a 77% change of a 75-bp interest rate hike from the Fed (vs 100-bp hike). Link. Link.

- JPMorgan said crypto retail demand was growing, driven largely by reduced leverage in the system and increased demand ahead of the Ethereum Merge. Link.

- NFT volumes fell 74% from May ($4B) to June ($1B). OpenSea represented 67% of volume. Link.

- Minecraft banned NFTs from its platform, causing prices of NFT Worlds, a web3 project focused on third-party blockchain integrations in Minecraft, to fall 70%. Link. Link. Link. Minecraft Statement.

- Epic Games said it would not ban NFT-games from its store. Epic's Store had 194 million users in 2021 and expects a number of NFT games to be released later this year. Link.

- DeFi analytics dashboard Zapper added NFTs and DAOs to its v2 dashboard. Link. Zapper v2.

- Curve Finance, the fourth largest DeFi protocol with almost $6 billion TVL, hinted the project may be launching an overcollateralized stablecoin. CRV rallied over 20% in 24 hours on the news. Link. Link.

- 3AC founders Su Zhu and Kyle Davies made their first public statements since filing for bankruptcy. They say they are working with liquidators and are planning to relocate to Dubai. Link. Link. Bloomberg interview.

- Seoul prosecutors raided the home of Terraform Lab's co-founder, Daniel Shin, over allegations that fraud caused the collapse of the TerraUSD (UST) stablecoin. Earlier this week major South Korean crypto exchanges, including Bithumb and Upbit, were also raided by authorities. Link. Link.

- Tesla sold $936 million worth of bitcoin, roughly 75% of its holdings, for a $106 million loss in Q1. Musk said Tesla was concerned about COVID lockdowns in China and wanted to increase its cash position. Tesla had purchased $1.5 billion bitcoin in Feb 2021. Link. Link. Musk also disclosed that Tesla held Dogecoin and had not sold any of it. Link. Link.

- California ended a four-year ban on crypto campaign donations for candidates in the state. Link. Link.

- Ethereum founder Vitalik Buterin said the roadmap after the Merge includes the Surge, which increases scalability for rollups through sharding. Ultimately Buterin believes Ethereum will be able to process 100,000 transactions per second. Link.

- Lido Finance will support staking of its native stETH on L2 networks starting with Arbitrum and Optimism. Link. Link.

- Genesis filed a $1.2 billion claim against insolvent hedge fund 3AC, after it was disclosed it had issued $2.36 billion in undercollateralized loans to the firm. The collateral was comprised of shares in GBTC, ETHE, and AVAX tokens. Link.

- Decentralized music streaming protocol Audius had $6M worth of its native AUDIO tokens stolen in a governance hack. The hacker was only able to get $1.1M ETH for the tokens due to slippage. Link. Certik Tweet. Audius Tweet.

- Animoca Brands is launching a gaming interoperability DAO called the Open Metaverse Alliance for web3 (OMA3). All blockchain-based metaverse companies are able to join the DAO. Link. Link.

- SEC's Gary Gensler called out general 'non-compliance' across the crypto industry, and said the agency would continue to develop its regulatory framework. Gensler said the SEC needs to be "tech netural" yet still protect the public. Link. Video.

- Lido DAO is voting on a $14.5 million token sale to Dragonfly, roughly 1% of total LDO supply. This is part of a broader treasury diversification plan, where Lido DAO wants to sell its native LDO token for stablecoins that can fund the foundation's ongoing operations. Link.

- Crypto custodian BitGo adds custodial support for NEAR and will custody the protocol's treasury and custodial assets. Link. Link.

- Difficulty of mining a bitcoin block dropped by 5%, as American miners turned off machines to reduce electricity usage during the current heatwave. Link.

- BlockFi had $1.8 billion of loans outstanding and $1.2 billion of assets at the end of Q2, a deficit of $600 million. $300 million of loans were to retail investors while $1.5 billion was to institutions. Link.

- FTX is in talks to buy South Korean crypto exchange Bithumb, which processes around $570 million in daily trading volume. Bithumb was recently raided as part of an investigation into Terra's UST collapse. Link.

- Coinbase says it had no exposure to bankrupt crypto firms Voyager, Celsius, and 3AC. Link. Blog Post.

- Dubai's crown prince laid out an ambitious "Metaverse Strategy" which aims to create 40,000 virtual jobs and add $4 billion to Dubai's economy over the next 5 years. Tweet. Link.

- Arkive launched this week having raised $9.7 million, bringing its community curated and owned museum to life. Members vote on the items they want to acquire. The pieces procured will be viewable in Arkive's digital museum. Link.

- Matter Labs will launch zkSync 2.0 on mainnet in October. Matter Labs is the first to introduce a rollup that can handle any EVM smart contract. Link.

- Coinbase is shutting down its US affiliate marketing program as it prepares for a bear market. It told partners it would restart the program in 2023. Link.

- The FBI issued a public warning about fraudulent crypto investment apps posing as legitimate that have stolen $42 million in 8 months between Oct 2021 and May 2022. Link.

- FTX is offering early liquidity to Voyager's customers. Customers who take the offer will have a cash balance funded by an early distribution on a portion of their bankruptcy loans. FTX said it wouldn't be acquiring any of Voyager's loans to hedge fund 3AC, which also filed for bankruptcy this month. Link. Link.

- 3AC co-founders Su Zhu and the wife of Kyle Davies are both named as creditors that lent $5M and $65M respectively to the collapsed hedge fund. Link.

- Auction house Christie's is launching a web3 focused investment fund called Christie's Ventures. Link.

- Fans can now tip artists on music streaming service Audius using the native Audius token. Link.

- The Texas GOP wants to add a clause to its state's Bill of Rights that gives citizens the right to own, hold, and use whatever medium of exchange they choose, including digital currency. Link.

- Taiwan is banning crypto purchases using credit cards, and giving credit card firms 3 months to comply. Link.

- Blockchain.com cut 25% of its workforce, or roughly 150 people, bringing staffing back to Jan 22 levels.

Anthony Scaramucci's SkyBridge Capital is raising a dedicated Web3 and crypto fund. Link.