PRICE CHANGE: WTD/YTD

- BTC ($20,950): +4% / -56%

- ETH ($1,348): +22% / -64%

- XRP ($0.35): +10% / -59%

- UNI ($7.09): +27% / -59%

- Crypto Market Cap ($962B): +7% / -57%

- BTC Dominance: 42%

- ETH Dominance: 17%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($66B): 0% / -16%

- USDC ($55B): -1% / +29%

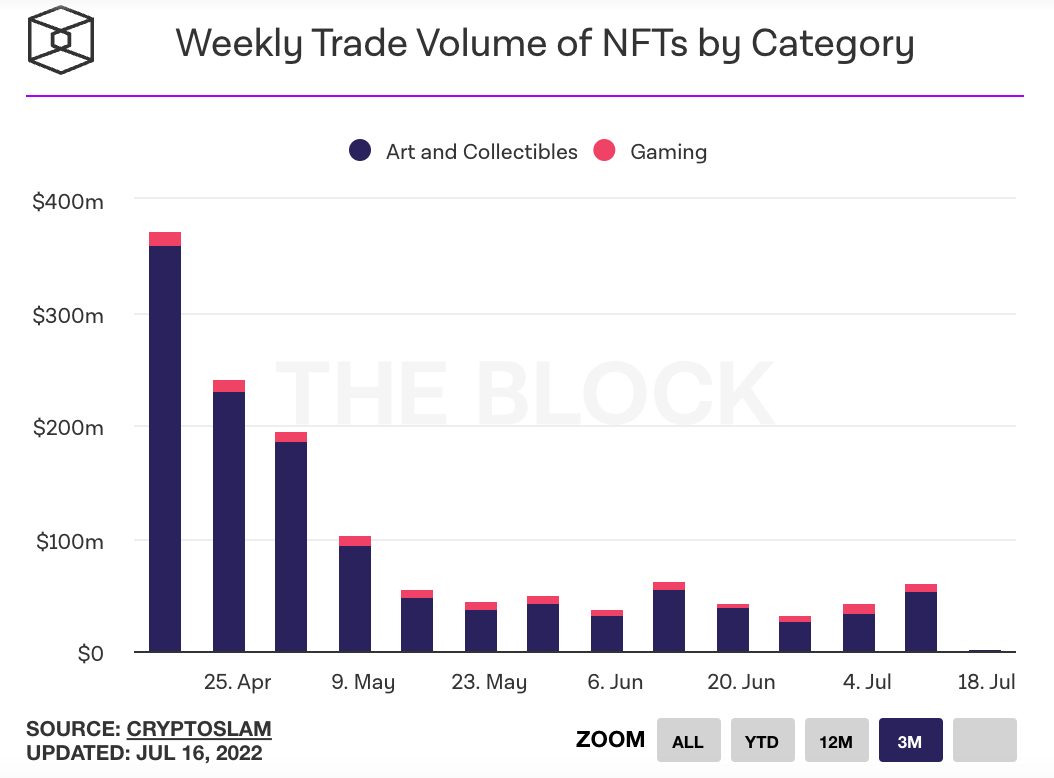

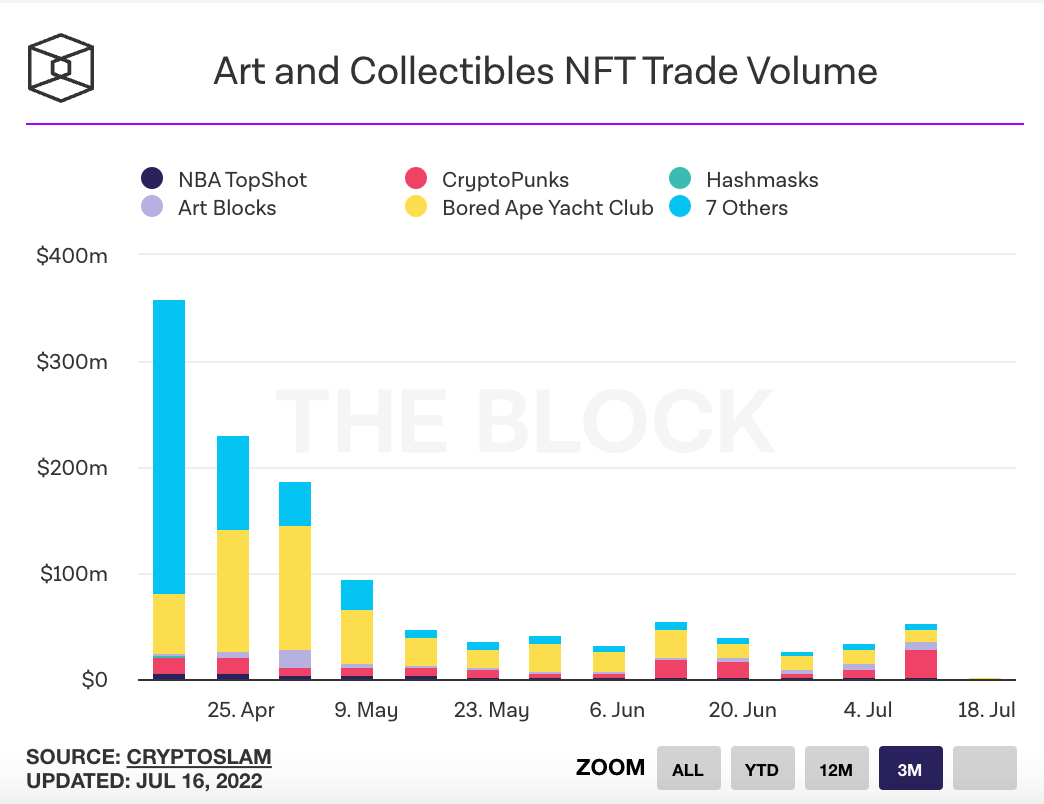

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- The price of ETH rallied over 12% on the news that the upcoming Merge was tentatively planned for September. Ethereum's Merge will switch the protocol from the energy-intensive proof-of-work consensus mechanism to the more energy-efficient proof of stake system. Miners will be replaced with "validators" who can stake 32 ETH with the network for the chance to add blocks and earn fees. Ethereum rallied on the news. Link. Link. Link.

- Crypto spot trading volumes fell more than 28% in June to $1.41 trillion, the lowest seen since December 2020. Cryptocurrencies have struggled amid a higher interest-rate environment along with other risk assets. Link.

- OpenSea laid off roughly 20% of its staff as it prepares for a prolonged market downturn. Link. Link. Tweet.

- Coinbase may no longer be one of the top 10 crypto exchanges by volume. The firm is the 14th largest exchange by volume so far in July, down from the 4th largest in late 2021. It had a 2.9% average market share among the top 30 exchanges globally so far this month, down from 5.3% in Q1. Link. Link.

- Putin signed a law banning digital assets and utility tokens as a means of payment for goods, services and products in Russia. The amendment adds to the 2020 digital assets law which banned cryptocurrencies from being used in payments. Link. Link.

- Crypto lending firm Celsius filed for bankruptcy, citing $5.5 billion of liabilities and $4.3 billion of assets. User liabilities are $4.7 billion. The $1.2 billion shortfall may increase as $600 million of assets are in the devalued CEL token which is trading at $0.80. CEL had hit an all-time high of $8.04 last June. In October 2021 Celsius had $25 billion in assets under management, which fell to $11.8 billion in May. Link. Link. Press Release.

- VC investments into crypto companies fell 26% y-o-y to $9.3 billion in the first half of 2022. VC investments are down across the board though -- overall deals in the US were down 22% y-o-y to $123.1 billion in the first half of 2022. Link. Link. Pitchbook report.

- Plaid is adding crypto account data such as balances, transactions, and the types of assets held in exchanges like Binance, Kraken and Gemini. Link. Link.

- Video game retailer GameStop saw almost $3.5 million of trading volume on its NFT marketplace, which it launched with Layer-2 solution Immutable X. By comparison, Coinbase's NFT marketplace has seen roughly $1.8 million of trading volume since its May launch. GameStop stock (GME) rose 10% on the news. Link. Link.

- Circle holds $55.7 billion in liquid reserves for its USDC stablecoin which has a circulating supply of $55.5 billion. $42.1 billion is held in 3-mo US treasuries and $13.6 billion is held in cash. Link. Blog Post. Reserve assets (PDF).

- Uniswap's governance token UNI surged 20% in 24 hours after Robinhood added the token to its crypto trading platform. Robinhood now supports 13 cryptocurrencies on its platform. Link. Tweet.

- A rare ape CryptoPunk sold for 2,500 ETH, or roughly $2.6 million. It's the 32nd-rarest punk in the 10,000 edition collection, and was the fifth largest sale in the collections history. Link.

- Adam Neumann's crypto startup Flowcarbon is delaying the launch of its token as well as slowing operations due to bear market conditions. Flowcarbon's tokens are expected to be backed by carbon credits and can be burned when the owner wants to offset emissions. Link. Link.

- Yuga Labs released a litepaper for Otherside laying out the foundation for developers to build on the platform. Yuga also demo'd the technology to 4,300 Otherside NFT holders, called "Voyagers". Link. Link. Litepaper.

- Multi-sig platform Gnosis Safe raises $100 million and rebrands to Safe. Gnosis employs smart contracts to provide recovery mechanisms and authentications using multiple private keys to address the risk of complete loss of assets should a private key be lost. The company has secured digital assets worth $40 billion. Link. Link.

- After 8 years, creditors of failed bitcoin exchange Mt. Gox are close to seeing their money again. Creditors are able to choose between receiving a mix of BTC, bitcoin cash and yen or cash. The liquidations will come from the roughly 141k bitcoin and 70B yen held by Mt. Gox after it was hacked for 850,000 BTC. Worst case scenario is 100% of creditors opt for cash payouts, and the trustee sells 141k BTC at once which would represent 8.8% of total daily exchange volume. Experts say this is an unlikely scenario. Link.

- Bitcoin's production cost has fallen to $13,000 down from $20,000 last month. Miners will turn a profit as long as the price of BTC remains above $13,000. During a bear market, production cost is perceived by some as the lower bound of the price range. Link. Link.

- STEPN, a Solana-based "move to earn" platform, reported $122.5 million in Q2 profits, up from $26 million in Q1. STEPN said 5% of the profits would be used to initiate a buyback and burn program for its native GMT tokens. Link. Link.

- More than 48 projects previously built on the Terra network have begun migrating to Polygon almost two months after the implosion of UST. Polygon Studios raised a $20 million fund in May to assist Terra projects looking to switch blockchains. Link.

- NFT and metaverse investor Animoca Brands raised $75 million at a valuation of $5.5 billion, doubling its value in less than 3 months. Link.

- Toonstar, the Web3 animation that co-produces The Gimmicks with Sixth Wall, is partnering with retail chain Hot Topic to facilitate physical NFT merch redemption and in-store NFT sales. Link.

- Polygon's MATIC token surged this week on the announcement that it was partnering with Disney to develop AR, NFT and AI experiences. Polygon is one of six companies participating in Disney's 2022 Accelerator program where it will receive guidance from Disney's senior leadership team. Link.

- Scalability protocol StarkWare confirmed it would be releasing a native StarkNet token to operate its ecosystem. The token will be required for governance, payment of transaction fees on StarkNet, and participation in its consensus mechanism. 17% of tokens are earmarked for StarkWare investors and a community airdrop is planned for next year. The existence of a StarkNet token was hinted at by emails posted to Twitter by 3AC founder Su Zhu. Link. Link. Medium Post. Su Zhu Tweet.

- A UK court ruling will allow legal documents to be served via NFTs. This is significant in crypto, where scams and hacks can often only be tied to wallet addresses. Italy-based gambling company is filing a lawsuit against anonymous people using NFTs. Link.

- Tony Hawk will create a skatepark and 3D avatar collection in The Sandbox. Link.

- Kevin Rose's Proof acquired Divergence, a London-based smart contract engineering firm. Proof is bolstering engineering resources in preparation for the launch of its 'social universe' later this summer. Link. Link.

- Paradigm leads a $16 million Series A funding round in Hang, a web3-powered platform that helps brands use NFTs to build loyalty rewards programs. Link.

- Crypto exchange CoinFlex will be making 10% of user balances available for withdrawal, a month after it had suspended withdrawals during the market crash. CoinFlex recently began arbitration in an attempt to recover $84 million in debt owed by a "large individual customer", which is suspected to be prominent crypto investor Roger Ver. Link. Link.

- Bankrupt crypto lending platform Voyager Digital saw its native coin (VGX) more than triple in three days driven by a short squeeze. Link.

- Starry Night, the $21 million NFT fund raised by 3AC and Vincent Van Dough last summer, has a portfolio value of $4.2 million now. There's speculation that the NFTs will be a part of 3AC's bankruptcy proceedings. Link.

- Voyager, the crypto exchange platform that declared Chapter 11 bankruptcy last week, assured customers that its "FDIC insured" USD deposits would be returned in full, pending a reconciliation and fraud process. Voyager has $1.3 billion of crypto assets on its platform and claims against 3AC of more than $650 million. Link.

- Mysten Labs are said to be raising $200 million in Series B funding at a $2 billion valuation in a round led by FTX Ventures. Mysten was founded by former Meta executives. It plans to launch a more scalable Layer 1 blockchain. Link.

- Decentralized lending protocol Morpho Labs raised $18 million in a round co-led by a16z and Variant. Morpho plugs into existing lending protocols such as Compound and Aave to offer higher yields through p2p liquidity. Morpho-Compound launched a few weeks ago and has $30 million in liquidity. Link. Link.

- Multicoin Capital raised $430 million for its 3rd crypto-focused fund. Link.

- Change, a startup that develops APIs to help companies and charities process donations, will support donations made in cryptocurrencies. The nonprofits can choose whether to accept the crypto directly or convert it into fiat first. Link.

- Crypto lending platform BlockFi reversed its decision to accept shares in the Grayscale Bitcoin Trust (GBTC) as collateral for loans. Link.

- Magic Eden, the largest NFT marketplace on Solana, is launching an investment arm to back web3 gaming companies. Link.

- The Treasury is asking the public for comments on the risks and benefits of cryptocurrencies, as it works on a response to Biden's executive order on cryptocurrencies. Link.

- 38% of all NFT and GameFi M&A deals since 2013 occurred in the first two quarters of 2022. Link.

- Democrats want US bitcoin miners to report their energy usage. Data shows that 7 of the largest bitcoin mining companies in the US could use as much electricity as would power almost all homes in Houston. Surging demand from cryptominers has been blamed for driving up local electricity bills. Link.

- Empiric Network, a new decentralized oracle on StarkNet, raised $7 million in a funding round led by Variant. Link.

- Crypto lending firm Celsius is owed $439 million by lending platform EquitiesFirst which began offering crypto collateralized loans in 2016. Celsius froze withdrawals in June after having liquidity issues amid "extreme market conditions". Link.

- Celsius paid off $716 million in loans to Maker, Aave and Compound, closing out the last of its outstanding loans. The firm was able to reclaim almost $1.4 billion in tokens, mostly held in the form of wrapped bitcoin (wBTC) and stETH. Link. Link.

- Crypto hedge fund DeFiance Capital said it was "materially affected" by the liquidation of rival fund Three Arrows Capital (3AC). Link. Statement.

- Creditors to defund hedge fund 3AC say that the two founders, Zhu Su and Kyle Davies, are missing. Link.

- Ukrainian prosecutors seized almost $3.4 million in assets from OTC brokers who illegally facilitate crypto purchases for users from Russia. Link.