PRICE CHANGE: WTD/YTD

- BTC ($20,087): +4% / -57%

- ETH ($1,105): +3% / -70%

- XRP ($0.32): -2% / -62%

- UNI ($5.60): +14% / -68%

- Crypto Market Cap ($896B): +2% / -60%

- BTC Dominance: 43%

- ETH Dominance: 15%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($66B): 0% / -16%

- USDC ($56B): -1% / +31%

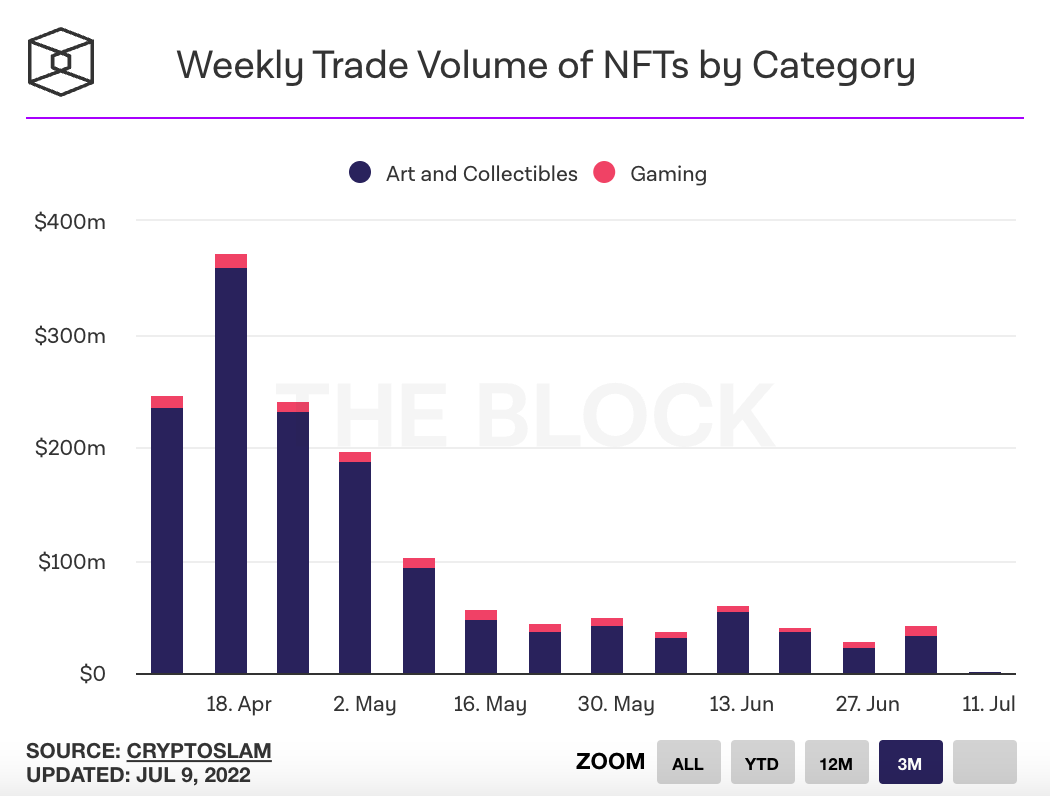

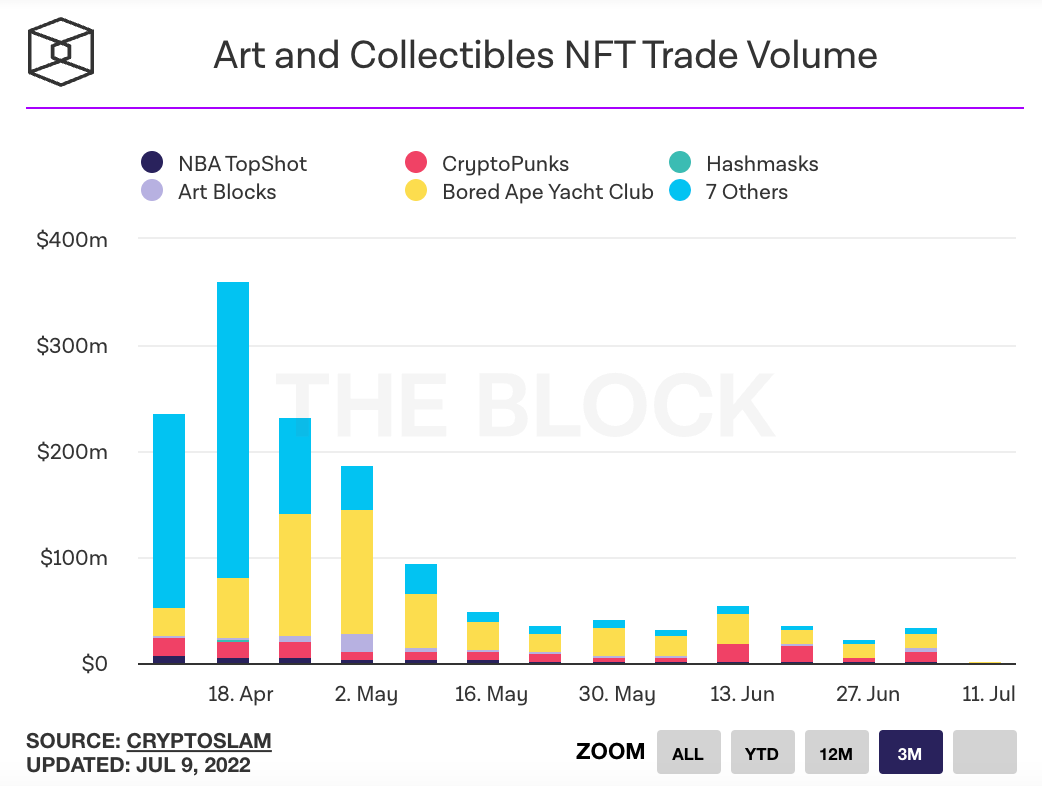

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Ethereum developers performed a successful merge on the Sepolia test network, taking Ethereum one step closer to a mainnet upgrade to proof of stake later this year. There is now only the Goerli testnet left to be merged in the coming weeks. Link. Link.

- Reddit plans to release "Collectible Avatars" in the coming weeks that will come with unique benefits such as the ability to mix-and-match avatar gear with other accessories, and having a glow-like effect to their profile image. The avatars will be sold in fiat. Link.

- Korean crypto startup Uprise lost 99% of client funds while shorting LUNA during its price crash and getting caught on the bounces. Uprise billed itself as using artificial intelligence-enabled automatic trading strategies to trade crypto on behalf of its clients. Link.

- Crypto broker Voyager Digital filed for Chapter 11 bankruptcy. The broker has between $1 billion and $10 billion in assets and more than 100,000 creditors and owes $75 million to Sam Bankman-Fried’s Alameda Research and $960 million to Google. It did not name other firms to whom it owes money. Link.

- Voyager had indicated that the "USD held with Voyager was FDIC insured" via its banking partnership with Metropolitan Commercial Bank. However, bankruptcy filings contradict this claim and it appears that USD held with Voyager is not insured. Link.

- Crypto exchange Binance will drop fees on 13 spot bitcoin trading pairs including BTC/AUD, BTC/BUSD, BTC/EUR, BTC/GBP, BTC/RUB, BTC/TUSD, BTC/USDC, BTC/USDP and BTC/USDT. Link.

- Lido token holders voted not to reduce the protocol's Ethereum staking dominance. Lido Finance is behind staked ETH tokens (stETH), which it issues to users in exchange for staking ETH on Ethereum's Beacon chain ahead of the move to proof of stake. Lido currently accounts for over 31% of all staked ETH on the Beacon chain. The debate was triggered by concerns that Lido’s dominance of the ETH2 staking pool will pose a security risk to Ethereum after it transitions from proof of work to proof of stake. Link. Lido Tweet. Eth PoS Dune Dashboard. Snapshot.

- Lido's native token LDO rose more than 20% as the trading gap between stETH and ETH fell to 3%, from its peak discount of 6% last month. Link.

- Decentralized finance lender Teller launched a new BNPL (buy now, pay later) feature for some of the most popular NFTs, including Bored Ape Yacht Club, Doodles, Meebits, Cool Cats, and others. BNPL borrowers can submit loan requests through Teller and lenders will provide funding on a case-by-case basis. Lenders can earn up to 30% APR on these loans. Link.

- Yuga Labs completed the first two load tests of its Otherside metaverse. Thousands of active players were able to run around as 3D models without lag. Feedback from land holders was generally positive. Link.

- MakerDAO approved a $100 million stablecoin loan for US-based Huntingdon Valley Bank. The DAI borrowed from the vault will support the bank's operations and will generate an estimated 3% yield for MakerDAO. The loan will begin at $100 million but will grow to over $1 billion in the next 12 months. Link. Official DAO proposal.

- RTFKT, owned by Nike, is giving commercial rights to CloneX NFT holders. Owners can now create derivative projects, mint fan art and make and sell merchandise featuring their avatar. The 20,000 CloneX NFTs were marketed as 3D characters to use in the metaverse. Link.

- Meta will be sunsetting its digital wallet Novi in September. The company had launched a payments pilot last October. Instead Novi tech will be repurposed for future products around its metaverse development. Link. Link.

- Nexo has signed a term sheet to acquire rival crypto lender Vauld, which had $1 billion AUM at its peak. Vauld had stopped customer deposits and withdrawals after it had received requests for $198 million since June 12. Link. Link.

- Crypto lender Celsius has hired new lawyers from Kirkland & Ellis LLP to advise it on possible restructuring options amid its unstable liquidity position. In late June it was reported that Celsius would be filing for Chapter 11 bankruptcy. Link.

- The founders of bankrupt crypto hedge fund Three Arrows Capital (3AC) are missing and its offices have been completely abandoned. 3AC filed for Chapter 15 bankruptcy after the collapse of Voyager, which had unpaid loans to 3AC totaling $646 million. Link.

- South Korea and US investigators are discussing ways to share data on crypto investigations amid the countries' separate probes into Terraform Labs and its co-founder Do Kwon. Terraform Labs was behind UST and Luna. Link.

- Texas and Alabama are examining whether Voyager and Celsius fully disclosed information on their loans and the creditworthiness of borrowers. Both firms have been struggling and have frozen client funds. Link.

- Justin Sun, the creator of Tron, said he's ready to join FTX's Sam Bankman-Fried and Binance's Changpeng Zhao in offering support to ailing crypto firms. Tron is engaging an investment bank to advise on potential deals and could spend up to $5 billion on acquisitions. Link.

- Sam Bankman-Fried said he and FTX still have a "few billion" on hand to shore up struggling firms that could further destabilize the digital asset industry, but that the worst of the liquidity crunch has likely passed. Link.

- Troubled crypto lending firm Celsius reportedly used its $534 million of customer funds to execute high-risk, leveraged crypto trading strategies through a third party asset manager. The trading strategies resulted in $350 million of capital losses. Link.

- A former Celsius contractor has filed a lawsuit claiming its owed money based on hundreds of millions in profits generated, and is accusing the firm of mismanagement and fraud. Link.

- The SEC rejected Grayscale Bitcoin Trust’s application to convert its product, GBTC, into an ETF. GBTC was launched in 2013 as a solution for institutional investors looking to gain exposure to bitcoin. It holds about 3.5% of bitcoin's circulating supply and it holds 638,725 bitcoin worth around $13 billion. Link.

- Tether, the company behind stablecoin USDT, said it had liquidated a loan to struggling crypto lender Celsius without incurring any losses. Tether has been dealing with fears about its reserves stemming from exposure to bad corporate debt in the form of Chinese commercial paper and loans to struggling crypto lenders like Celsius. Link.

- Hedge funds have increased their short interest on the largest stablecoin Tether. A DeFi liquidity pool on Curve which allows traders to swap between the three largest stablecoins (USDC, USDT, and DAI) shows an elevated supply of Tether, with the token accounting for 65% of the total pool. Link. Link.

- Crypto exchange Blockchain.com stands to lose $270 million it lent to the liquidated crypto hedge fund Three Arrows Capital (3AC). 3AC collapsed in recent weeks due to poor risk management and declining crypto prices. Link.

- Hidden Road Partners closed a $50M Series A round led by Castle Island Ventures with participation from FTX, Greycroft, and Coinbase Ventures. The firm's platform is "quantitatively-driven" and provides real-time risk management and seamless credit across products and asset classes. It offers prime brokerage, clearing and financing services for both traditional and digital assets. Link.

- A hacker drained more than 1,300 WETH ($1.4 million) from NFT money market protocol Omni. The attacker used Doodle NFTs as collateral to borrow wrapped ETH and withdrew all but one NFT, and used a malicious callback function to use the borrowed funds to buy tokens. Link.

- A senior engineer at Axie Infinity unwittingly downloaded malware when he was duped into applying for a job that didn't exist. Using the malware hackers were able to take over four of the nine validators on Axie's Ronin bridge, allowing hackers to steal hundreds of millions from the bridge. Link.

- DeFi protocol Yam Finance prevented a malicious governance attack designed drain its treasury of $3.1 million worth of crypto assets. The attacker submitted a governance proposal via internal transactions. Link.

- Crypto market maker Wintermute has paid back hundreds of millions in loan obligations. Link.

- Virtu Financial, one of traditional finance's most important market makers, is hiring a crypto trader for the weekend. Link.

- Crypto losses hit $670M in Q2, up 52% yoy. 97% of losses were the result of hacks while rug pulls and fraud made up the balance. Link. Report.

- Panelists at the Federal Reserve inaugural conference on role of the dollar were lukewarm on the potential for a Fed-issued CBDC. The biggest roadblock cited was the dearth of institutional investment in crypto due to "the lack of a regulatory framework." Link.

- Binance.US has hired former Acorns, PayPal exec Jasmine Lee as CFO. Link.

- The government seized control of $3.6 billion of bitcoin tied to the Bitfinex hack in 2016, assumed to be the largest hack ever. With the crypto market crashing, the value of those coins has fallen to about $2 billion. Bitfinex's owners say they have already paid most users back, and owe only about $30 million more. Link.

- Enterprise software maker MicroStrategy began purchasing bitcoin in 2020 as a hedge against inflation. The value of its bitcoin holdings fell 58% (roughly $3.4 billion) in Q2. Its holdings were worth $5.9 billion at the end of Q1 and $2.45 billion at the end of Q2. Link.

- The hacker responsible for stealing $100 million from Horizon, a cross-chain bridge tied to the Harmony blockchain protocol, has sent $21 million of the hacked funds to three other wallet addresses. These transfers come even as Harmony offered a $1 million bounty for the return of the stolen funds. Link.

- Metaverse tokens in Decentraland, The Sandbox, Enjin Coin, and Axie Infinity have tumbled roughly 6% over the past 24 hours. Link.

- Elon Musk's Boring Company will accept DOGE as a payment method for its Vegas Loop system. Link.

- Tencent, Baidu, JD.com, and several other leading Chinese tech companies will require ID checks for NFT purchases going forward. Link.