PRICE CHANGE: WTD/YTD

- BTC ($24,053): +6% / -49%

- ETH ($1,740): +7% / -53%

- XRP ($0.40): +9% / -53%

- UNI ($9.07): +29% / -47%

- Crypto Market Cap ($1.1T): +5% / -50%

- BTC Dominance: 41%

- ETH Dominance: 19%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($66B): +1% / -16%

- USDC ($55B): -1% / +28%

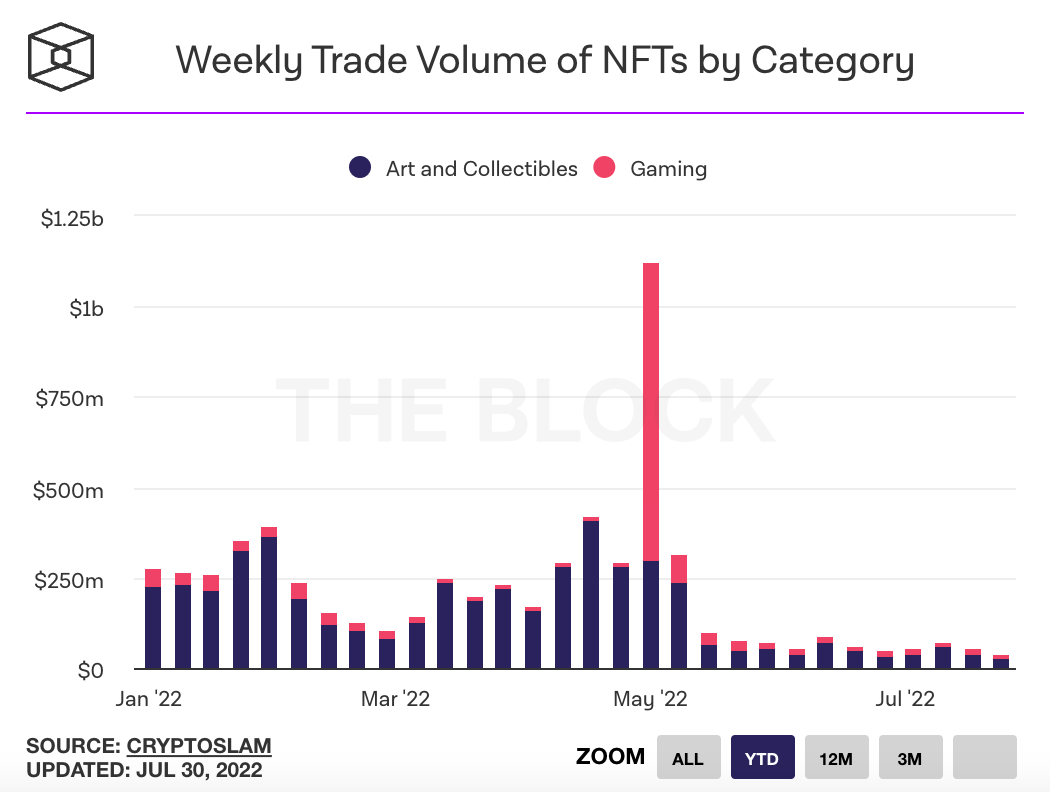

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Bitcoin was up 21% in July, its best performing month since October when BTC was up almost 40%. BTC hit its all-time high in November 2021 at just above $69,000. Link.

- Ethereum jumped 16% this week after the Fed announced it was raising interest rates by 75 basis points and Ethereum Foundation scheduled the third and final testnet merge for August. The spike resulted in a short squeeze and over $200 million in liquidations. Link. Link.

- Ethereum's third and final testnet merge, Goerli, is expected to happen August 10. Link. Link. Announcement.

- Algorand COO Sean Ford will succeed Steven Kokinos as CEO of the company. ALGO is down about 90% from its all-time high in September of last year. Link. Link.

- The SEC is investigating Coinbase on suspicion of allowing trading of unregistered securities on its platform, just days after the agency alleged that 7 cryptocurrencies listed on Coinbase were securities in an unrelated insider trading case. Coinbase filed a petition asking the SEC to offer guidance on securities definitions for tokens. Coinbase shares dropped 21% on the news. Link. Link. Coinbase petition.

- Wall Street has soured on Coinbase stock, with analysts forecasting a price target of $108, the lowest since the stock IPO'd. The stock has fallen 80% since November and is currently trading at $63, down almost 75% YTD. Link.

- Aave DAO voted to create an overcollateralized stablecoin called GHO. GHO will be similar to MakerDAO's DAI stablecoin. Link. Link. Snapshot.

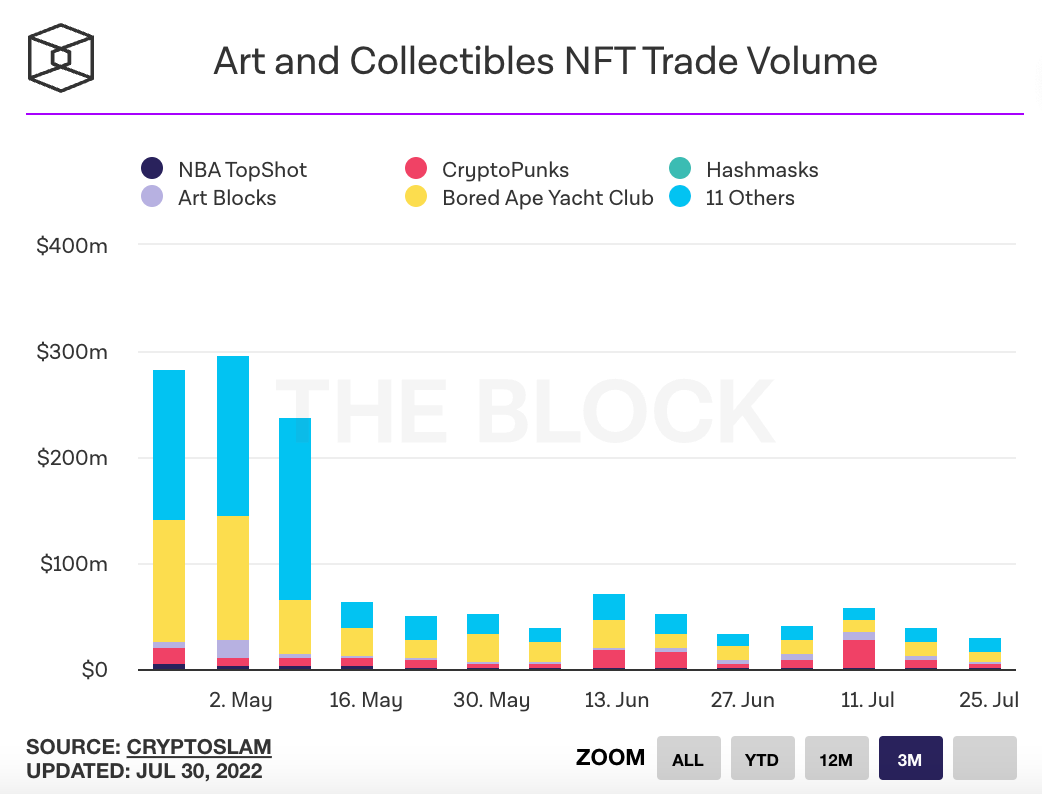

- NFT marketplace volumes fell to $626 million in July, down from $884 million the previous month. OpenSea made up over 75% of volumes. Link.

- a16z's Chris Dixon is taking over Katie Haun's OpenSea board seat. Haun had joined the board in 2021 after leading the Series B while at a16z. She left a16z to launch Haun Ventures earlier this year. Link. Blog Post.

- Stablecoin issuer Tether said it holds no Chinese commercial paper, and that it currently holds only $3.7 billion of commercial paper in its reserves, down 88% from $30 billion in July 2021. Link. Tether statement.

- The UK Law Commission proposed recognizing a new category of personal property called "data objects" under which NFTs and other tokens could be regulated. Link. Blog Post.

- DeFi exchange SushiSwap has proposed Jonathan Howard as Head Chef, an official title given to the project's CEO. SushiSwap is the 7th largest DeFi exchange with $660 million TVL. Link. Proposal.

- US senators sent a letter to Fidelity criticizing the firm's decision to allow clients to hold up to 20% of their 401ks in bitcoin. Fidelity managed $2.4 trillion in 401k assets as of 2020, more than a third of the market at the time. Link.

- Schwab Asset Management is launching a crypto ETF that will track companies digital asset trading and brokerage services, crypto mining, and companies that may benefit from validating consensus mechanisms. Link. Link. Link. Press Release.

- Unstoppable Domains raised $64 million at a $1 billion valuation, in a Series A round led by Pantera Capital. Unstoppable Domains sells NFTs of domain names including .crypto and .blockchain. The firm has registered 2.5 million domains to date. Link. Link.

- KuCoin is the first exchange to offer NFT ETFs. The ETF will allow retail investors to purchase fractional ownership of top NFTs like Bored Ape Yacht Club. KuCoin partnered with Fracton Protocol to create the offering. Link.

- Asian crypto lender Babel Finance reportedly lost $280 million trading customer funds. It suspended withdrawals last month due to the losses. Link.

- Troubled crypto lender Voyager Digital has been ordered by US banking regulators to stop making claims that deposits on its platform are FDIC insured. Link. Link. Press Release.

- Crypto investment firm Variant raised $450 million for its third dedicated crypto fund. Link. Link.

- The Bored Ape Gazette won community support from the ApeCoin DAO to fund a 24-hour news site focused on Yuga Labs and ApeCoin. Link. Link.

- Open options on Ether have reached record highs, as an updated timeline for the long-awaited Merge has spurred demand for call options. Link.

- Bipartisan stablecoin regulation has been formally delayed until after the August congressional break. Link. Link.

- FTX becomes the first crypto exchange in the US to offer stock and ETF trading on its platform. Link. Link.

- CFTC head Caroline Pham said the SEC should not regulate by enforcement, and that there needs to be clarity on which agency is spearheading regulations. Link. The CFTC announced it was transforming its LabCFTC fintech team into a new Office of Technology Innovation that would focus on digital currency regulation. Link.

- Kraken is under investigation for violating federal sanctions by allowing Iranian users to use its site. Link.

- FTX received full approval to operate its exchange services in Dubai. Link.

- Yuga Labs said it would begin taking a 5% royalty fee on secondary sales of Meebits. Link. Tweet.

- Miami is releasing an NFT collection in December with Mastercard, Salesforce and Time. 56 local artists are designing 5,000 NFTs that represent the city. NFT holders will receive access to Mastercard's Priceless Miami program, which offers experiences, private tours and other activities. The NFTs will be minted on Salesforce's new product, NFT Cloud. Link. Link.

- Apple listed a job posting for a creative director and an art director with Web3 experience. Link. Job Posting.

- NFT marketplace OneOf is releasing an NFT collection that will allow holders to approve artist samples of a previously unreleased Notorious B.I.G. track. Link.

- FTX is in discussions to purchase South Korean crypto exchange Bithumb. Link.

- Senators Toomey and Sinema are introducing a bill that would exempt Americans from reporting taxes on crypto transactions up to $50. Link.

- A US bill to boost computer chip manufacturing includes a new crypto advisory role in the administration who will work with the Office of Science and Technology Policy. Link.

- Tesla sold 75% of its bitcoin holdings in Q2 2022, resulting in a $936 million impairment charge and a gain on sale of $64 million. Link.

- Aptos Labs, a new L1 blockchain founded by former Meta employees, raised $150 million in Series A funding led by FTX Ventures and Jump Crypto. Aptos plans to bring the Diem blockchain to life by creating the "safest and most production-ready blockchain in the world". Link.

- UK bank Barclays is reportedly investing millions in crypto custodian Copper at a $2 billion valuation. Barclays is one of the UK's largest banks with total assets of around $1.4 trillion as of 2021. Link.

- Retail traders purchased $1 billion worth of shares of crypto-exposed companies including Marathon Digital, Coinbase, and Riot Blockchain. Link.

- Alameda Research lead a $3.25 million seed round for Trustless Media, which allows content creators to tokenize their shows using NFTs. Shows can use NFTs to crowdfund production, and to allow for audience participation through on-chain voting. Link. Link.

- Crypto exchange CoinFLEX laid off a significant number of employees in an effort to cut costs by 50-60%. CoinFLEX suspended account withdrawals last month after June's market volatility. It has also been trying to recover $84 million in debt owed by a large individual customer, rumored to be Roger Ver. Link. Blog Post.

- Blockchain network Harmony wants to cover $99 million in losses from a hacking attack back in June by issuing its native ONE tokens to cover losses. The team does not want to use its native treasury funds to reimburse users. Community voting begins on August 1, but so far responses have been generally negative with users concerned about the effect of increasing token supply. Link. Link.

- Gnosis Safe will be rebranding as Safe and will spin off from Gnosis, with its Safe token expected to launch in September or October. 5% of tokens will be airdropped to Safe and Gnosis users and at least 15% will be given to GnosisDAO. Link. Blog Post.

- Lido Finance has a revamped proposal for the sale of LDO tokens to Dragonfly Capital, after the community voted against the previous treasury diversification plan. The proposal calls for selling 10 million LDO tokens to Dragonfly with a 1 year lockup and a sale price between $1.45 and $2.25. Link. Discourse Proposal.

- Pro-Russia groups have raised $2.2 million in crypto to fund war efforts in Ukraine according to Chainalysis. Link.

- Move to earn project Sweatcoin raised $13 million from the NEAR foundation and Jump. Sweatcoin has over 100 million users. Link.

- Solana Spaces is opening in New York City's Hudson Yards. The physical space will teach visitors about Solana, help them set up a wallet and purchase their first NFTs. Link. Twitter.