This week's crypto weekly was co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($31,190): +3% / +88%

- ETH ($1,958): +4% / +64%

- SOL ($19.26): +13% / +97%

- UNI ($5.63): +6% / +9%

- MATIC ($0.72): +7% / -5%

MARKET CAP CHANGE: WTD/YTD

- Crypto Market Cap ($1.22T): +3% / +54%

- BTC Dominance: 50%

- ETH Dominance: 19%

- Tether ($83B): 0% / +26%

- USDC ($28B): -3% / -38%

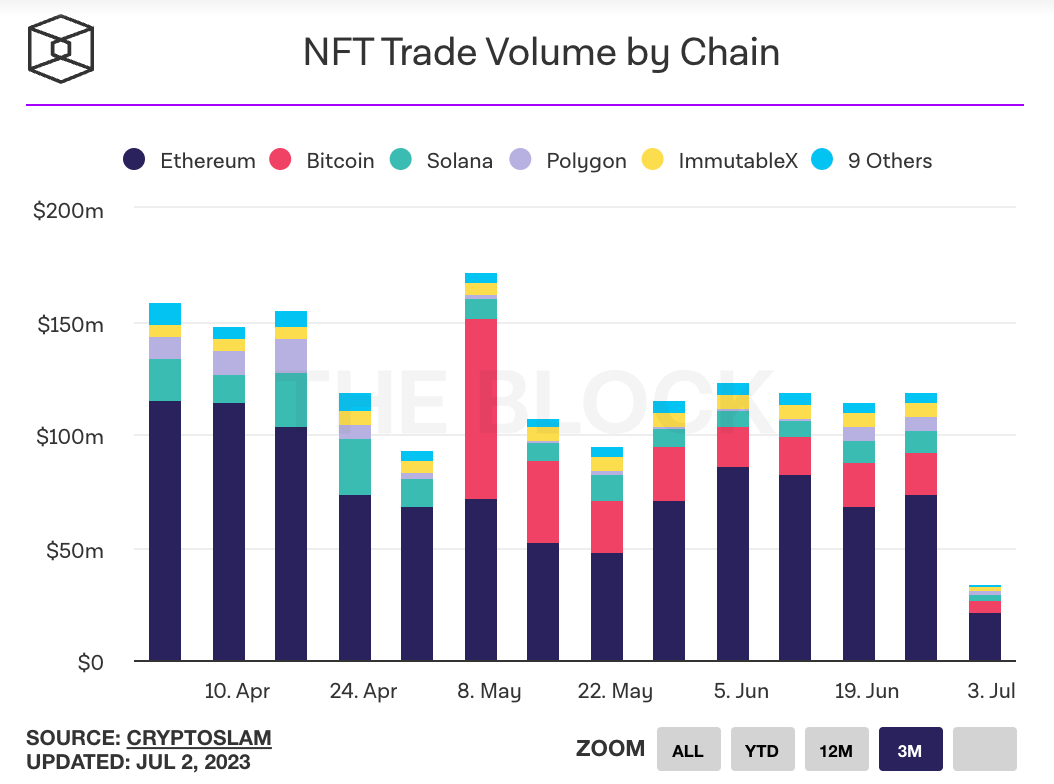

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- BlackRock refiled its application for a Bitcoin spot ETF, after the SEC had called its original filing "inadequate" for failing to address the agency's concern over market manipulation and failing to name its partner exchange. In its new filing BlackRock indicated that Coinbase would provide market surveillance and exchange services. Link. Link. Link.

- Fidelity, one of the largest asset managers in the US, refiled paperwork for a Bitcoin spot ETF after the SEC rejected its prior application in 2022. The filing mimicked the structure of BlackRock and ARK Invest recent ETF filings. Link.

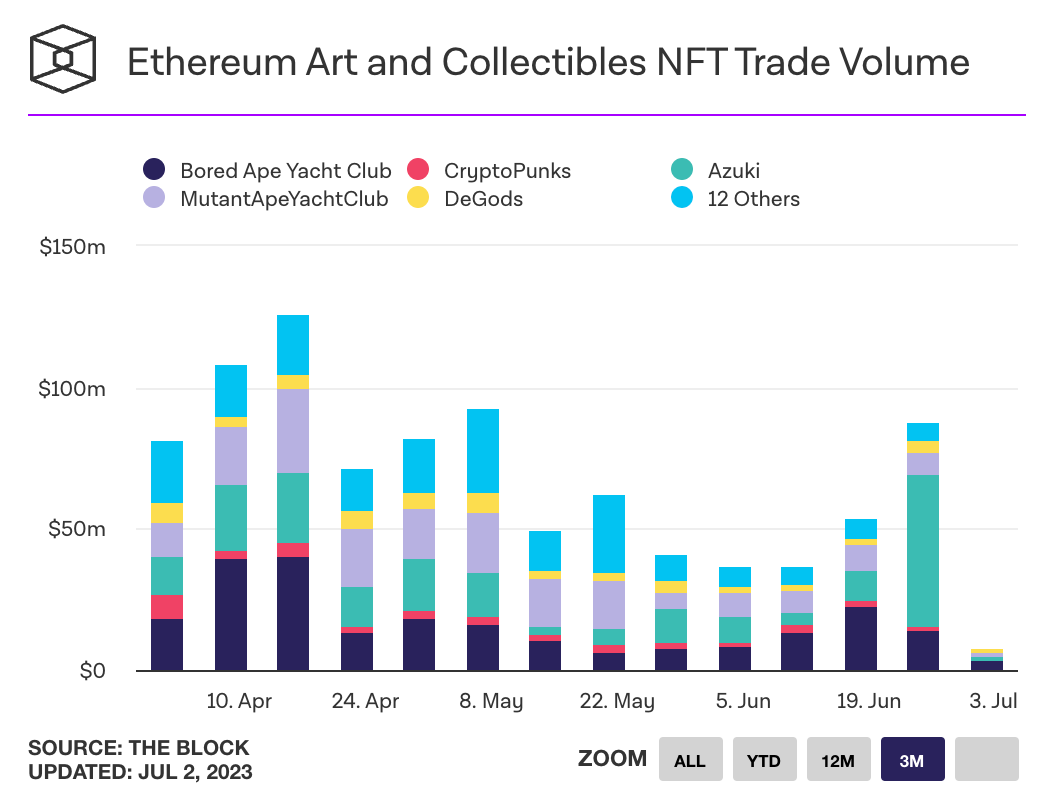

- Chiru Labs, the company behind the Azuki NFT collection, sold out its new 20,000 NFT Elementals collection in 15 minutes, earning $38 million worth of ETH. Many purchasers felt the art was too similar to the original Azuki collection. The floor price of Azuki’s fell over 50% following the Elementals mint and art reveal. Link.

- Crypto brokerage firm Prometheum plans to use Rule 144 to allow for trading of crypto assets on its platform. The rule allows owners of restricted securities to sell in the public markets after they hold shares for a year. It's unclear whether Rule 144 can apply to all digital assets or only digital assets that the SEC has declared are "in compliance", though Prometheum has said that crypto assets including Filecoin, Flow, The Graph, Compound, and Celo can be traded on its platform. Link.

- Canadian lawmakers are seizing an opportunity for the country to provide regulatory clarity and clear standards for blockchain companies and become a major hub for the industry. Link. Report (PDF).

- Mythical Games, creator of football-themed Web3 game NFL Rivals, raised $37 million in new funding at a valuation of more than $1 billion. Mythical Games last raised $150 million at a $1.25 billion valuation in 2021. Link.

- A judge ordered crypto exchange Kraken to provide the IRS with information on roughly 59,351 US-based users who have transacted more than $20,000 on the exchange. Link.

- Crypto lost $204 million to hacks, scams, and rug pulls in Q2 2023, 55% less than was lost in the previous quarter. So far the industry has lost $666 million to scams and hacks this year. Link. Data.

- A federal judge denied FTX founder Sam Bankman-Fried's request to dismiss the criminal charges against him for his role in the collapse of the crypto exchange. SBF is set to go to trial in October. Link.

- FTX bankruptcy reports allege an unnamed senior legal executive assisted SBF in misusing customer deposits by lying to banks and auditors and executing false documents. Link.

- Robert Leshner, CEO of decentralized lender Compound, submitted filings for “Superstate”, a new short-term government bond fund that will use the Ethereum blockchain as a secondary record-keeping tool. Link.

- The EU published legislative plans to underpin a digital euro, saying it would ensure Europeans can pay digitally for free across the region. The bill includes safeguards for privacy and financial stability. The ECB said it will decide in the fall whether to move forward with the project. Link.

- Scaling blockchain Polygon released a new zero-knowledge architecture called Polygon 2.0 which creates a coordination layer for cross-chain transactions powered by zero-knowledge proofs. The architecture allows for improved UX because tokens are mapped directly to tokens deposited on Ethereum, and are not required to be ‘wrapped’. Polygon 2.0 also introduces restaking, whereby users can use their crypto assets to secure many assets on a blockchain. Link. Link. Blog Post.

- UK based fintech app Revolut will stop offering Solana, Cardano, and Polygon tokens for US customers after its provider Bakkt Holdings delisted the cryptocurrencies in response to the SEC's labeling of those tokens as unregistered securities. Link.

- Founders of bankrupt crypto hedge fund 3AC, Kyle Davies and Su Zhu, said they would donate ‘future earnings’ to creditors who lost money after 3AC’s implosion last year, despite claims from liquidators that the duo have hindered court-ordered activities. Earlier this year Davies and Zhu launched Open Exchange, a platform for trading crypto bankruptcy claims. Link.

- Bankrupt crypto lender Celsius will begin liquidating its altcoin holdings, as it prepares to distribute BTC and ETH to creditors. Link.

- The SEC vs Coinbase case will hold its first hearing on July 13, where the judge will consider Coinbase’s motion to dismiss. Link. Coinbase Filing.

- Institutional interest in BTC is increasing, with digital asset funds seeing $199 million of inflows last week, the largest in almost a year. Link.

- Digital collectibles company Candy Digital and NFT sidechain Palm NFT announced they were merging. Link. Press Release.

- Thailand joined Singapore in banning crypto exchanges from offering lending and staking services to retail customers. Last year Thailand also banned crypto payments, while still allowing consumers to invest in crypto as an asset. Link.

- $520 million of venture capital funding went to crypto companies in June, compared to $1.81 billion in June 2022. Link.

- Dior’s new line of men’s footwear will include a limited run of 470 sneakers, which will come with “digital twin” NFTs and an encrypted online authentication system. Link.

- Coinbase’s Ethereum layer-2 network Base is close to mainnet launch, after it ran an audit contest during which no major vulnerabilities were found. Link. Blog Post.

- US-based stablecoin company Reserve announced it would suspend deposits and withdrawals in Venezuela, where it has around 500,000 users, and 5 other LatAm countries. Reserve faced opposition from crypto regulators in Venezuela as well as the US government, which limits financial services US companies can offer to Venezuela. Link.