This week's crypto weekly was co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($30,278): -3% / +83%

- ETH ($1,867): -5% / +56%

- SOL ($21.35): +11% / +119%

- UNI ($5.25): -7% / +2%

- MATIC ($0.70): -3% / -8%

MARKET CAP CHANGE: WTD/YTD

- Crypto Market Cap ($1.18T): -3% / +49%

- BTC Dominance: 50%

- ETH Dominance: 19%

- Tether ($83B): 0% / +26%

- USDC ($28B): -1% / -38%

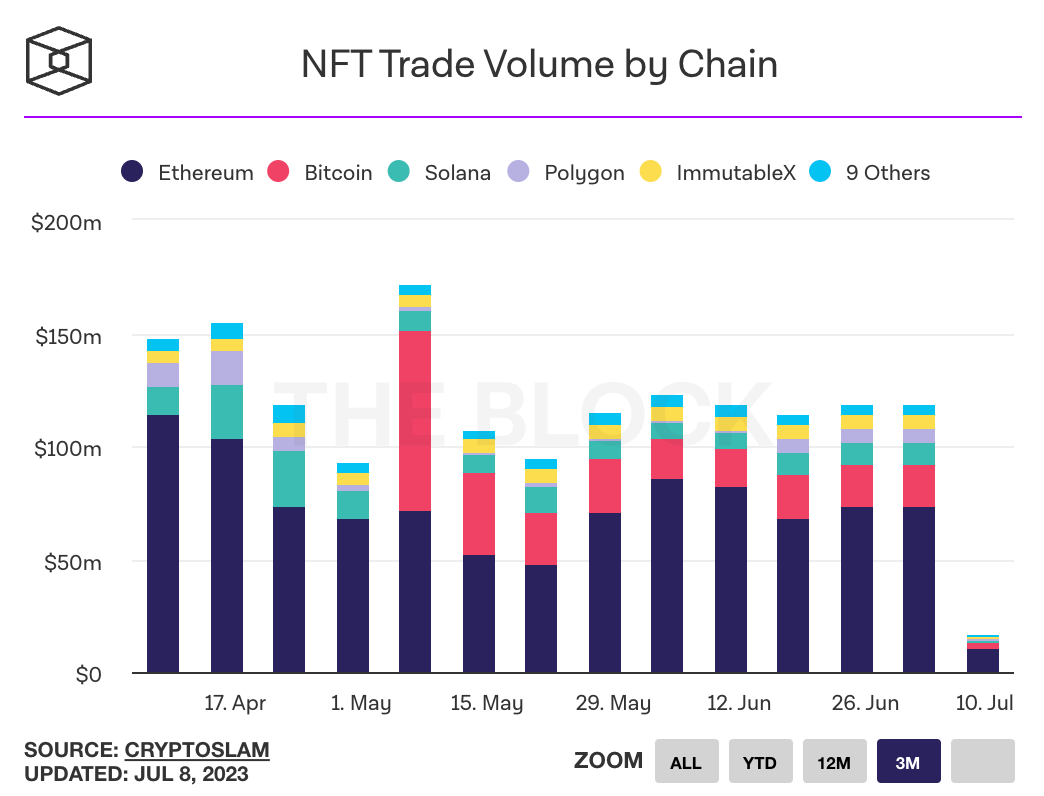

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Binance’s market share among global exchanges has slipped from 72% to 58% since it announced it’s being investigated by the DOJ and the SEC. Binance US also saw its market share drop to 1% down from a record high of 27% in April. Link. Link.

- Crypto exchange Gemini is suing Digital Currency Group (DCG) and its founder Barry Silbert for fraud related to the $1.2 billion of assets stuck in its subsidiary Genesis Global, which ran the Gemini Earn program. Genesis filed for bankruptcy earlier this year after taking a hit following the collapse of 3AC and FTX. Gemini alleges that DCG and Silbert misled creditors about the solvency of Genesis. Link. Tweet.

- BlackRock CEO Larry Fink, a previous crypto skeptic, called Bitcoin an “international asset” and said that digital asset technology could “revolutionize finance”. Blackrock, the world’s largest asset manager, recently filed for a Bitcoin spot ETF. Link. Link. Link.

- Valuations for crypto companies have fallen almost 70% year over year. Link. Link.

- The founder of crypto exchange Kraken, Jesse Powell, is being investigated on allegations that he hacked and cyberstalked a non-profit that he founded. Link.

- The next Bitcoin “halving” is anticipated in April 2024, and will cut miners’ rewards to 3.125 BTC (~ $94k) from its current 6.25 BTC (~$188k). Link.

- Tom Brady’s NFT platform Autograph is shifting its strategy to a broader focus on helping celebrities foster loyalty with their fans. Autograph raised $170 million in Series B funding at the start of 2022 but has struggled amid the wider digital asset downturn. Link.

- Uniswap v4 will launch after the successful implementation of Ethereum’s Cancun upgrade targeted for the end of September. Uniswap v4 introduces a flash accounting system that transfers net balances for swaps, resulting in lower fees for liquidity providers. The new system relies on “transient storage” which will be enabled by EIP-1153, which is set to be integrated in the upcoming Cancun upgrade. Link.

- Multiple executives at Binance resigned this week, including Chief Strategy Officer Patrick Hillmann, compliance executive Steven Christie and General Counsel Hon Ng. Binance CEO CZ denied the resignations were connected to investigations by the DOJ and SEC. Link. Link. Tweet.

- Sega has decided to pull back from blockchain gaming for its most popular IP, though it will continue to allow lesser-known IP to be used in NFTs. Link.

- New documents filed by the SEC indicate that Binance US was unprofitable and lost $181 million in 2022. Link.

- Less than 10% of Bitcoin trading volume occurs on US exchanges like Coinbase and Kraken. Coinbase has seen $30 billion in Bitcoin volumes YTD, compared to Binance’s $250 billion. Link.

- The SEC filed a response to Coinbase’s request for summary judgment in the agency’s lawsuit against the exchange, in which it alleges that Coinbase knowingly violated securities laws. Link. Filing.

- Blackrock filed an updated application for a BTC spot ETF, naming Coinbase as its custodian and for its spot market data for pricing, after the SEC called the initial application inadequate. The SEC has rejected every BTC spot ETF but has approved numerous futures ETFs. Link.

- Ryan Wyatt is stepping down as president of Polygon Labs and will be replaced by Chief Legal Officer Marc Boiron. Chief Policy Officer Rebecca Rettig will assume Marc’s role as Chief Legal Officer. Link.

- The CFTC finished its internal investigation of bankrupt crypto lender Celsius and concluded the company and its CEO Alex Mashinsky broked US laws by misleading investors and failing to register with the regulator. The CFTC commissioners will review the findings and determine whether to file charges in a federal court. Link.

- NFT royalty payments hit a two year low this week, with $3.8 million collected this week vs. $76 million collected at its high in April 2022. Link.

- DeFi protocol Barnbridge announced in their discord that they are being investigated by the SEC. The protocol’s token BOND slipped 10% after the news. Link.

- FTX reportedly pulled out of a $100 million sponsorship deal with Taylor Swift, despite previous reports suggesting it was Swift who backed out. Link. Link.

- Cross-chain bridge Multichain was reportedly hacked for $126 million. The hacked assets were stored on a Multichain MPC account and were moved to an unknown address. Link. Tweet.

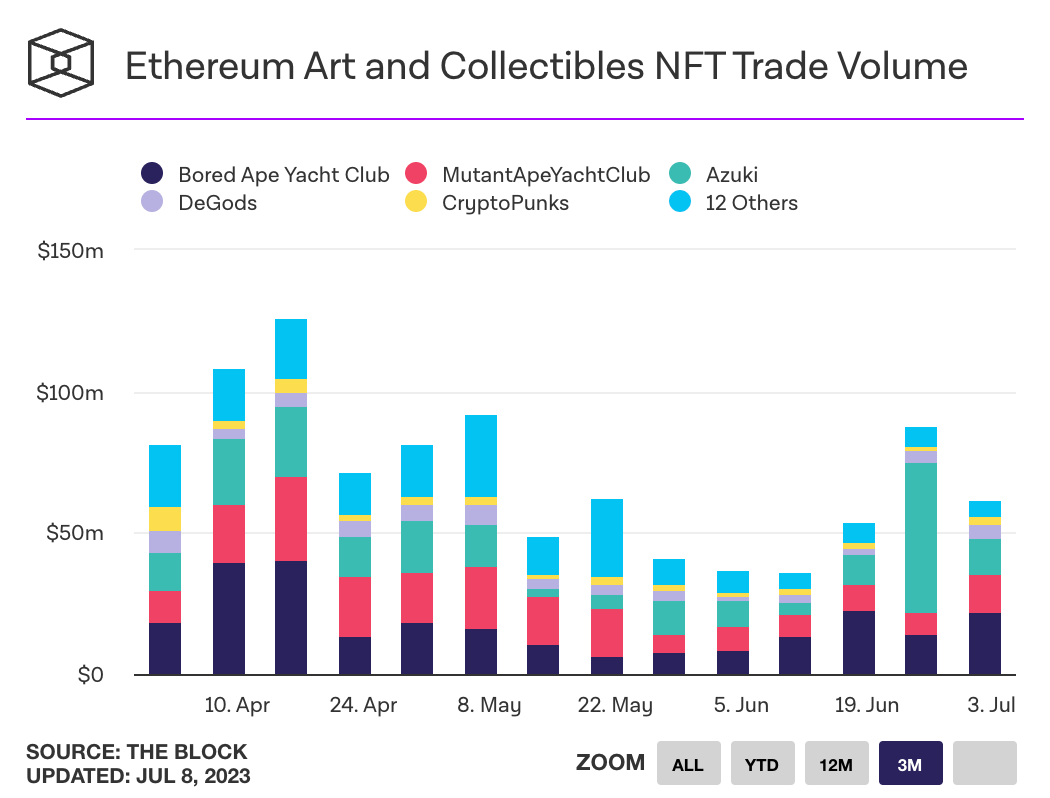

- NFT trading volumes on Ethereum were up 63% week over week, the largest jump since February. Link.

- Opensea announced its supporting the Zora network, the new L2 launched by NFT marketplace Zora. The Zora Network is a fork of popular L2 Optimism. Link.

- Bitcoin miners made $184 million in fees last quarter, more than the past five quarters combined, largely due to the rising popularity in Ordinals and BRC-20 tokens. Link.

- South Korea passed the Virtual Asset User Protection Act, which provides a legal framework for digital assets, including defining them and outlining penalties for unfair transactions. The legislation takes effect next year. Link.

- Fxhash, a platform for generative artwork, is expanding from Tezos to Ethereum. Link.

- The price of popular “blue-chip” PFPs like Bored Apes, Azuki and Moonbirds dropped 25 - 50% over the past week. The price of a Bored Ape is down 88% from all time highs. Link.

- A DAO of Azuki NFT holders is voting on a proposal to retrieve 20,000 ETH from the recent Elementals NFT mint, alleging the Azuki team scammed its holders. Link.

- Layer 2 Starknet is releasing a major upgrade called “Quantum Leap” which will increase the number of transactions per second the protocol can process to at least 100. Link.