This week's crypto weekly was co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($30,388): +14% / +84%

- ETH ($1,887): +10% / +58%

- SOL ($16.98): +8% / +74%

- UNI ($5.30): +20% / +3%

- MATIC ($0.67): +9% / -11%

MARKET CAP CHANGE: WTD/YTD

- Crypto Market Cap ($1.2T): +10% / +49%

- BTC Dominance: 50%

- ETH Dominance: 19%

- Tether ($83B): 0% / +26%

- USDC ($28B): 0% / -36%

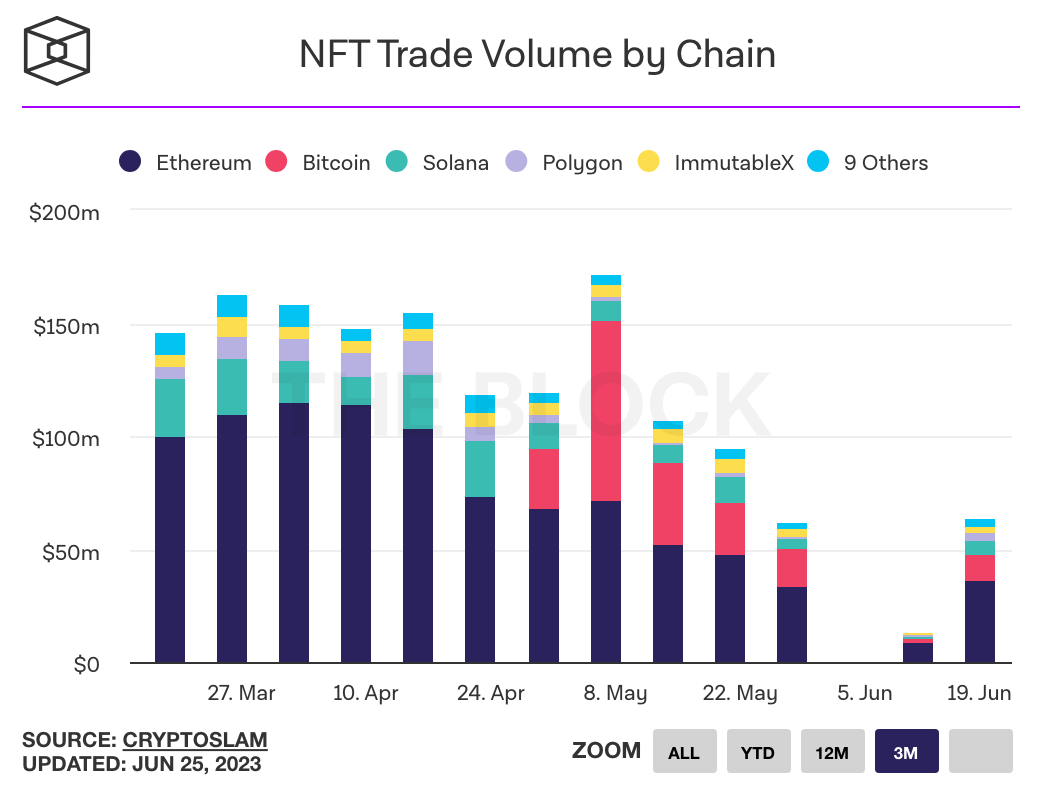

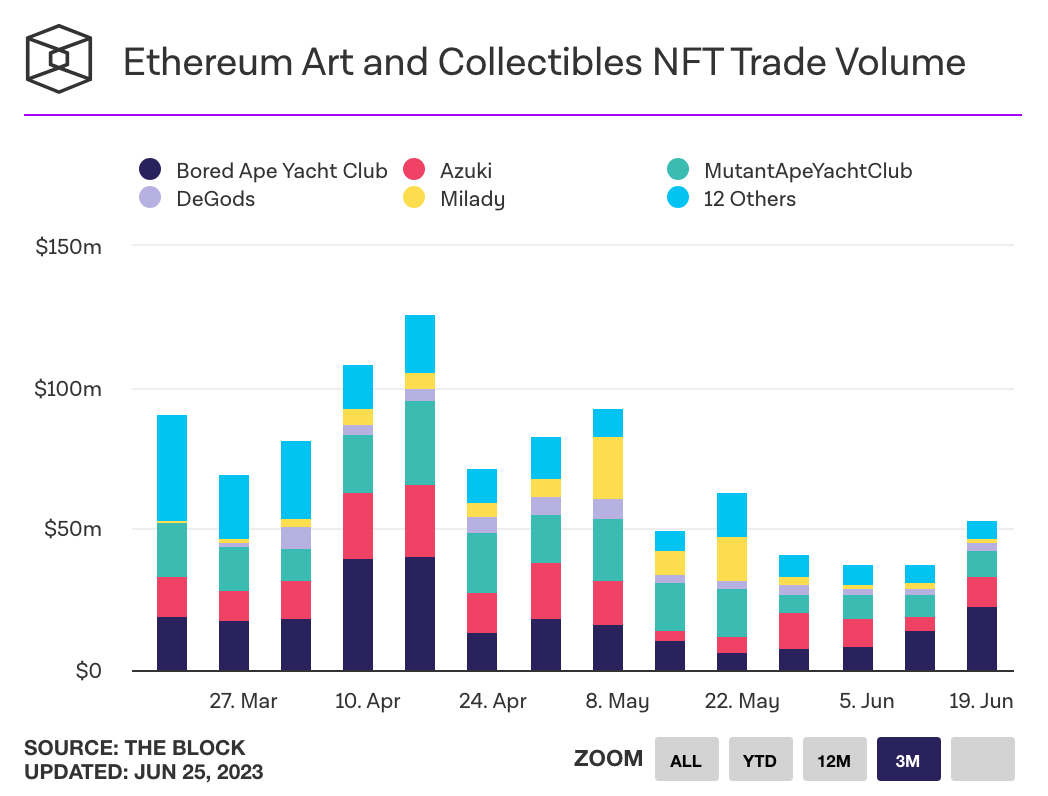

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Fed Chair Jerome Powell said that cryptocurrencies like Bitcoin have “staying power” during a hearing on monetary policy. Powell also called stablecoins a form of money, and recommended that they have strong federal oversight. Link. Video.

- The Internal Monetary Fund said banning cryptocurrencies is not effective in the long term, and countries should instead focus on risk mitigation. Link. Link.

- Bitcoin crossed $31k, its highest level since June 2022 and the 2nd time this year it crossed the $30k mark. Interest in the cryptocurrency has increased over the past week following BlackRock's filing for a US spot Bitcoin ETF. Link. Link.

- Mythical Games' free-to-play game, NFL Rivals, which uses NFTs as player cards, achieved over a million downloads this week with users playing 2 hours per day on average. Approximately 10% of users used the marketplace to trade player cards. Link.

- Bankrupt exchange FTX is suing to recover $700 million that it paid to venture capital firm K5 Global and its principals after they provided access to celebrities and politicians. Link. Link.

- Crypto custodian BitGo terminated its planned acquisition of Prime Trust, just weeks after the SEC revealed close financial ties between Prime Trust and Binance in the agency's lawsuit against Binance. Prime Trust halted withdrawals of both fiat and digital currencies shortly after the termination. Link.

- Amazon is piloting the use of ‘purpose-bound’ digital money and the use of escrow services for online retail orders, where payments are released to merchants only after the customers receive their purchases. The pilot is being tested in Singapore and includes plans to use central bank digital currencies and stablecoins. Link. Link. Link. White Paper (PDF).

- The U.S. Supreme Court sided with Coinbase in a ruling that reinforces the ability to channel customer and employee disputes into arbitration. Link. Link.

- Binance filed a motion in its lawsuit with the SEC alleging that the regulator made false and misleading statements about the exchange’s ability to co-mingle customers' assets. If the order is approved, the SEC would be prevented from making certain public statements about the lawsuit. Link.

- Key management startup Casa expanded its multi-sig wallet product to support ETH and other ethereum assets. The company previously only supported Bitcoin. Link.

- NFT platform Zora launched an Ethereum Layer 2 called the Zora Network, built on the Optimism tech stack, in an effort to lower costs and improve the user experience for artists and creators. Link.

- Azuki announced a new 20k NFT collection called Elementals that will go on sale at the end of this month. Link. Tweet.

- Belgium has ordered Binance to immediately cease offering products and services in the country, claiming the exchange has violated anti-money laundering laws. Link.

- Bankrupt crypto lender BlockFi reached an agreement with the SEC to use a portion of its penalties ($30 million) owed to the regulator to prioritize repayment to its investors. Link.

- JPMorgan has expanded its blockchain-based JPM Coin, initially launched for dollar transactions, to include euro-denominated payments. Link.

- Volatility Shares is launching the first leveraged Bitcoin futures ETF on 6/27. The ETF aims to provide 2x the return of Bitcoin. Link.

- Binance.US announced it resumed USD withdrawals after pausing on June 9th, though the exchange made no promises as to how long withdrawals would be open. Link.

- Bankrupt hedge fund Three Arrows Capital appeared to relaunch as Three Arrows Ventures. OPNX, a bankruptcy claims exchange linked to the founders of 3AC, announced that the new entity is one of its ecosystem partners. Link.

- Ripple was granted an in-principle approval to operate in Singapore. Link.

- Gemini is expanding its Ethereum staking service to UK-based institutional clients. Gemini Staking Pro is currently available in 30+ countries including the US. Link.

- EDX Market, a cryptocurrency exchange for institutional investors that’s backed by Charles Schwab, Citadel Securities, and Fidelity Digital Assets, conducted its first trade this week. The firm offers investors exposure to Bitcoin, Ethereum, Litecoin and Bitcoin Cash. Link. Link.