PRICE CHANGE: WTD/YTD

- BTC ($45,943): -9% / +58%

- ETH ($3,426): -13% / +364%

- XRP ($1.11): -14% / +403%

- UNI ($24): -18% / +385%

- Crypto Market Cap ($2.1T): -8% / +178%

- BTC Dominance: 41%

- ETH Dominance: 19%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($68B): +2% / +226%

- USDC ($29B): +5% / +653%

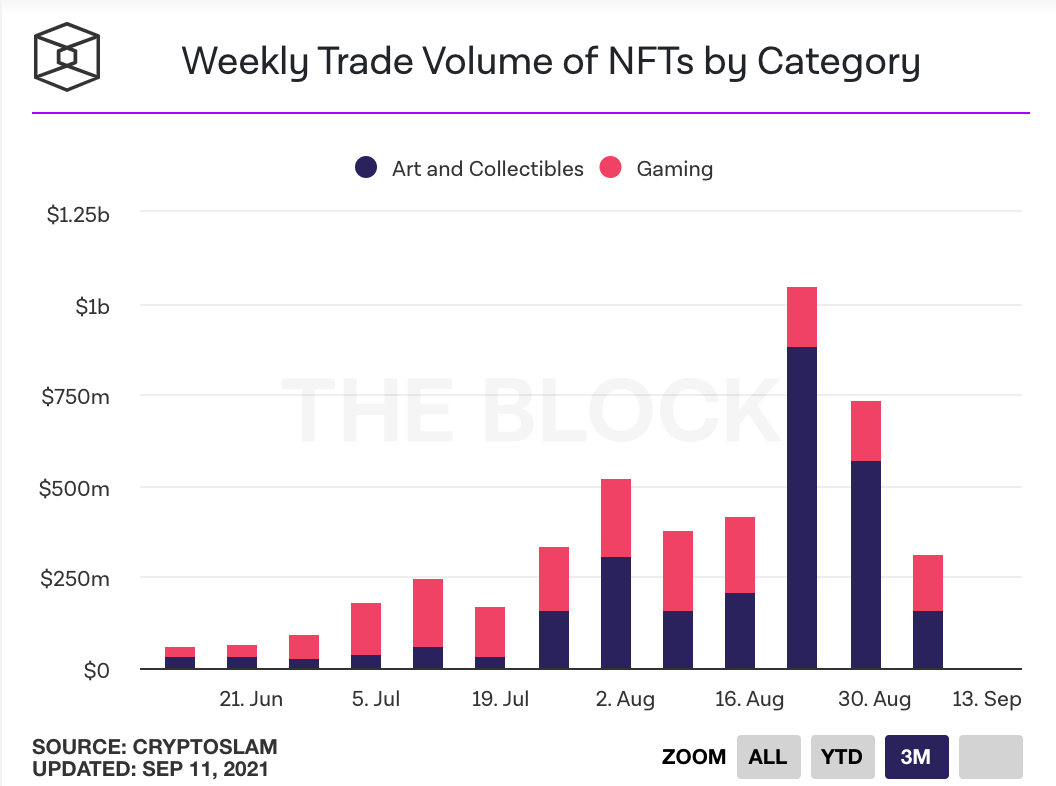

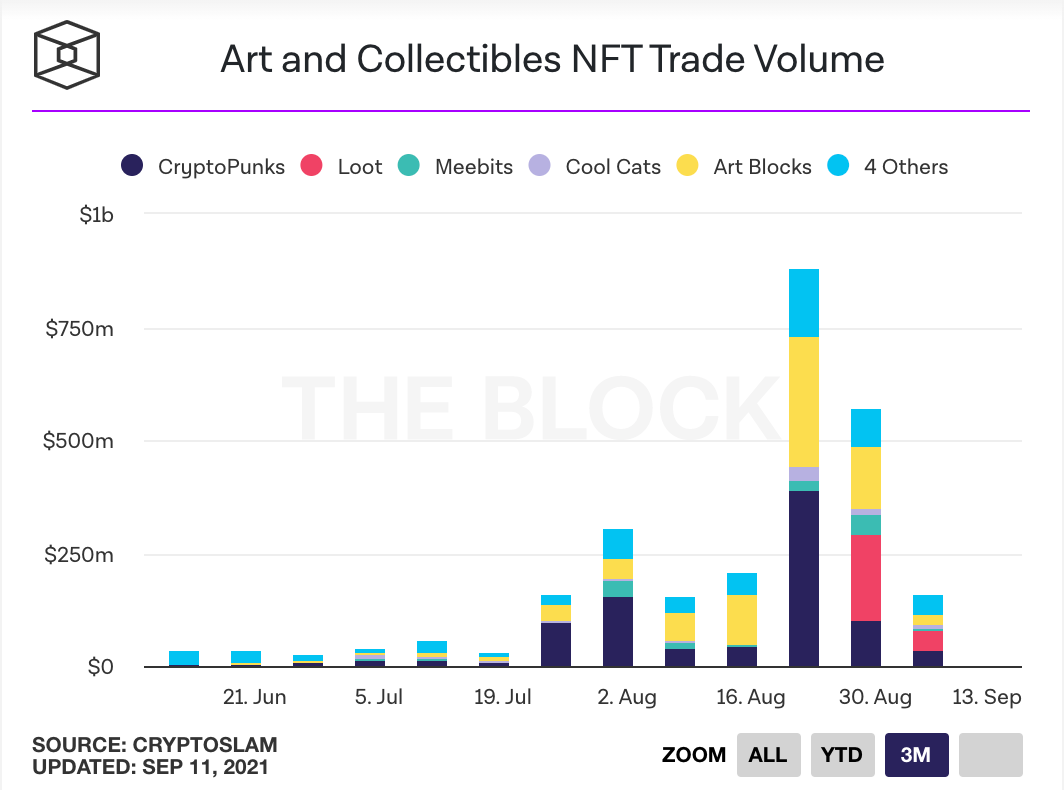

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Coinbase CEO Brian Armstrong tweeted that the SEC threatened to sue the company for securities violations if it launched its Lend product, which allows users to earn yield on USDC deposits. Armstrong said the SEC would not provide any guidance as to why they though the product was a security despite Coinbase's many efforts to work with the regulators. Link.

- Weekly sales volumes of NFT collectibles fell from a peak of $882 million at the end of August to $129 million last week. Prices also fell. Bored Ape Yacht Club NFT prices fell from an average of $200k to $133k and CryptoPunks fell from $400k to $330k. Link.

- Bitcoin and Ethereum prices crashed in a two hour window this week, falling from $51k to $45k and $3.8k to $3.1k respectively, before recovering slightly. The crash occurred after the rocky rollout of El Salvador's bitcoin digital wallet Chivo, which faced technical challenges. The government wants 2.5 million Salvadorans (39% of the population) to download Chivo and use bitcoin, believing it could save $400 million each year in commission for remittances. Link.

- US crypto exchanges Coinbase, Kraken and Gemini faced outages on Tuesday as crypto prices fell sharply and network traffic increased. Link.

- The US Treasury Department met with industry leaders this week to discuss stablecoins. Topics covered included regulation, structure, and key risks. The group plans to release a series of reports on the topic in the coming months. Link.

- The Sotheby's auction of 101 Bored Ape Yacht Club NFTs closed at $24.4 million, $6 million above the originally anticipated price. The 101 Bored Ape Kennel Club NFTs sold for $1.8 million. Link. Link.

- Eden Network, a priority transaction network for Ethereum, raised $17.4 million in seed funding led by Multicoin Capital. Eden Network rewards block producers and miners with EDEN tokens for prioritizing its transactions. Eden Network says it already represents more than 50% of the Ethereum hashrate though those claims aren't publicly verifiable. Link.

- DeFi platform dYdX distributed its governance token $DYDX. Users who used the platform in the past 3 years were eligible for an airdrop of tokens, though users based in the US were restricted from receiving the airdrop due to SEC regulations. Link.

- Mastercard acquired blockchain analytics firm CipherTrace for an undisclosed amount, continuing to grow its digital assets strategy. Other blockchain programs Mastercard is testing include crypto cards, supporting central bank digital currencies, and integrating stablecoins directly into its payments network. Link.

- Crypto derivatives exchange FTX launched an NFT minting platform. The NFTs will be built cross-chain on Solana and Ethereum. Link.

- A bug on OpenSea accidentally burned 42 NFTs, including the first ENS name ever registered. Users were trying to transfer the NFTs which were then accidentally sent to a burn address. The NFTs are permanently gone. OpenSea says it has fixed the bug. Link.

- Solana experienced its first million-dollar NFT sale for Degen Ape #7225, purchased by Moonrock Capital for 5,980 SOL worth $1.1 million. Link.

- El Salvador's largest bank, Bancoagricola, is allowing clients to pay their loans and credit card bills in bitcoin via the Lightning Network. Clients can also use bitcoin to purchase goods and services from merchants who use the bank. Link.

- Coinbase Pro added memecoin shiba inu (SHIB) to its Pro exchange. Link.

- Doja Cat released her first NFT collection, "Planet Doja" in partnership with OneOf, the music-focused NFT platform built on Tezos. The release includes 26,000 collectibles starting at $5. Every NFT unlocks access to the "Planet Doja" Discord channel and some include tour tickets and in-person VIP tickets. Link.

- A16z Crypto hired Jane Lippencott as a partner. Lippencott was previously at Distributed Global and Winklevoss Capital. A16z raised $2.2 billion for its second crypto fund in June. Link.

- Aave founder Stani Kulechov sold an NFT called "Yield" for 350 ETH ($1.15 million). The buyer has the option to return the NFT to Stani and receive their funds back along with 10% of the value of the NFT or 10 ETH, whichever is cheaper. Or they can hodl. Link.