PRICE CHANGE: WTD/YTD

- BTC ($49,637): +4% / +70%

- ETH ($3,229): -3% / +338%

- XRP ($1.22): -4% / +453%

- UNI ($28): -8% / +468%

- Crypto Market Cap ($2.1T): +3% / +175%

- BTC Dominance: 44%

- ETH Dominance: 18%

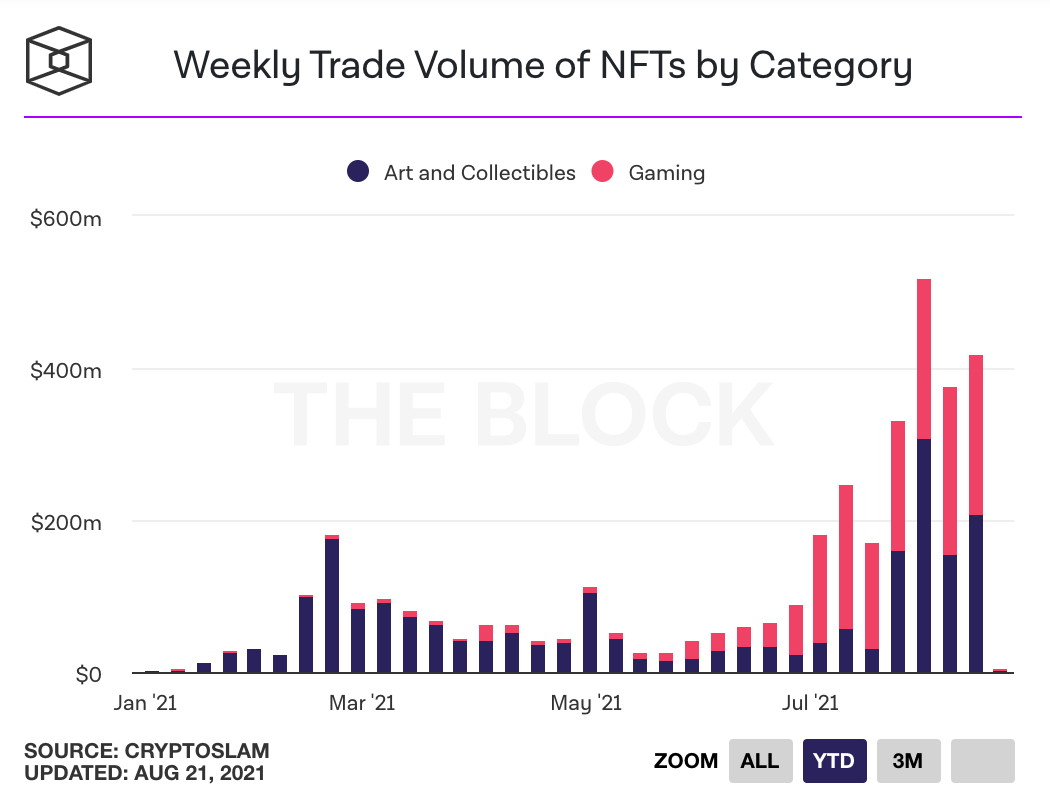

NFT 3M TRADING VOLUMES

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($65B): +2% / +209%

- USDC ($27B): -2% / +595%

THIS WEEK IN CRYPTO

- NFT marketplace SuperRare launched its native RARE token, and airdropped 15% of the total supply to past users of the platform, including artists and collectors. SuperRare has done over $90 million in NFT art sales since 2018. Link.

- OpenSea became the first NFT platform to pass $1 billion in monthly trading volume. The platform makes up most trading volumes, making up $1.23 billion in volume this month while the entire marketplace saw $1.27 billion of total volume. Link.

- ConsenSys is working on MetaMask Institutional (MMI), a new initiative that will serve as the gateway for major financial groups to enter DeFi. Link.

- Galaxy Digital launched a DeFi index fund, a passively managed vehicle that tracks the performance of the newly launched Bloomberg Galaxy DeFi index. The index fund provides institutional investors access to returns based on the performance of DeFi tokens, offering exposure to major DeFi platforms like Uniswap, Aave, Maker, Yearn and others. Link.

- 5 months after raising a $100 million Series A, crypto tax compliance startup TaxBit announced a $130 million Series B fundraise at a $1.3 billion valuation. The round was led by IVP and Insight Partners. Link.

- Avalanche is putting up $180 million in incentives to lure DeFi assets to its protocol. AVAX - Avalanche's native currency - will be used as a liquidity mining incentive for Aave and Curve users. Avalanche has set aside $20 million for Aave users and $7 million for Curve users. Link.

- Binance, the world's largest crypto exchange, is enforcing KYC on all new users including ID and facial recognition. It is also reducing withdrawal limit for non-verified accounts from a maximum of 2 BTC to 0.06 BTC. Link.

- 41% of Robinhood's revenue came from crypto trading in Q2. 62% of its crypto revenues came from trading of DOGE. Link.

- Andreessen Horowitz led a $4.6 million investment in the tokens of Yield Guild Games (YGG), a decentralized gaming studio built in the Philippines that lets players share in the company's revenue by playing games like "Axie Infinity". YGG lends players the money to buy Axies and other digital assets so they can start earning money. Link.

- Fractional.art raised $7.9 million in seed funding from investors including Paradigm, Flamingo DAO, and Delphi Ventures. Fractional allows users to fractionalize NFTs into fungible ERC-20 tokens that can be transacted tor traded on DEX"s or marketplaces. Fractional currently has 200 curators and 2,500 NFT fraction owners. Link.

- DEX aggregator 1Inch expanded to Optimism Ethereum, a Layer-2 scaling solution that is expected to lower gas fees and increase transaction speeds. Last month Uniswap also expanded to Optimism Ethereum. Link.

- Coinbase plans to purchase more than $500 million worth of crypto on its balance sheet. It will also be investing 10% of all future profits in crypto. Link.

- MobileCoin, a crypto startup working with messaging app Signal, raised a $66 million Series B at a valuation north of $1 billion from investors including BlockTower Capital, Coinbase Ventures, Marc Benioff, and Vy Capital. MobileCoin enables privacy-protected p2p payments, including over Signal which rolled out support in the UK a few months ago. Link.

- 1confirmation led a $2.2 million round into crypto music marketplace Catalog. Catalog has over 100 independent artists on its platform who have earned over $200,000 selling on the Catalog platform. The marketplace is powered by Zora. Link.

- Chainflip, a decentralized automated market maker-based protocol, closed a $6 million round led by Framework Ventures with participation from ParaFi Capital, Distributed Global, Coinbase Ventures, and DeFi alliance. Link.

- Blockchain payments firm Wyre has joined Visa's Fintech Fast Track program, allowing Wyre to integrate with Visa and offer added fiat and crypto functionality for its users, including the ability for instant payouts of crypto holdings to users' bank accounts using Visa debit cards. Link.

- Ethereum scaling solution Polygon said it would build a DAO for the DeFi sector. Link.