This week's crypto weekly was authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($28,772): -2% / +74%

- ETH ($1,913): +1% / +60%

- SOL ($22.20): -4% / +128%

- UNI ($5.32): -3% / +3%

- MATIC ($0.98): -1% / +29%

MARKET CAP CHANGE: WTD/YTD

- Crypto Market Cap ($1.2T): -2% / +55%

- BTC Dominance: 45%

- ETH Dominance: 19%

- Tether ($82B): 0% / +24%

- USDC ($31B): 0% / -32%

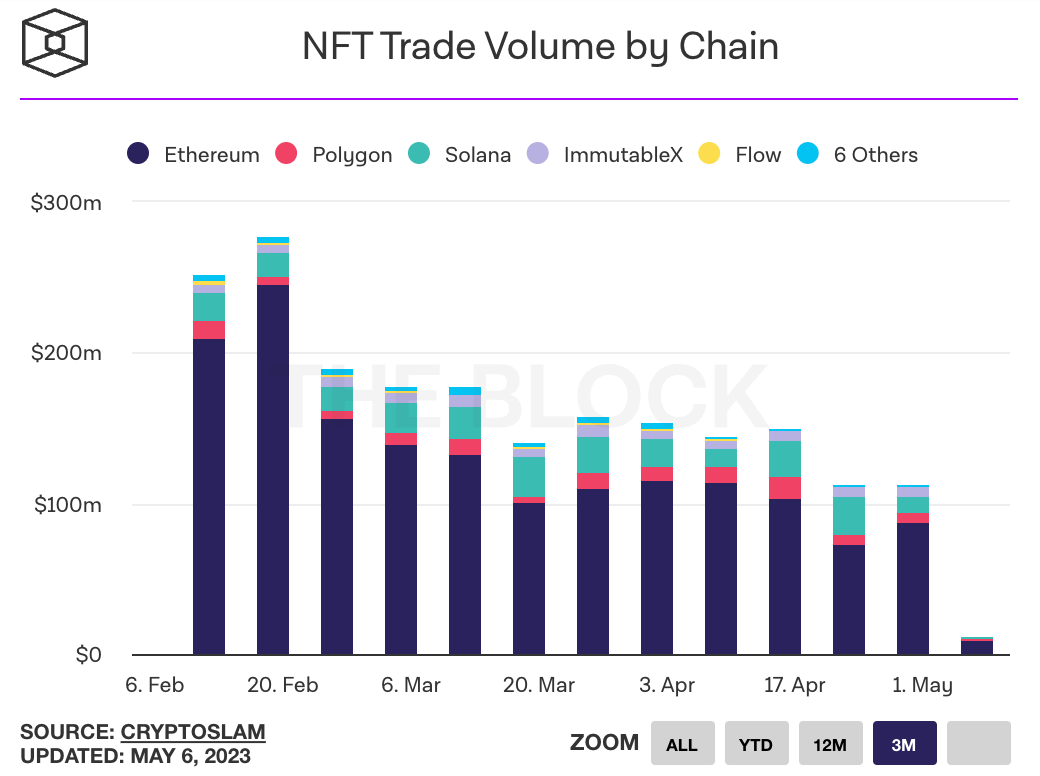

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- The US Justice Department is investigating whether crypto exchange Binance was used by Russians to skirt US economic sanctions. Link.

- U.S. congressman Patrick McHenry, chair of the House Financial Services Committee, said his committee will put together legislation to oversee the crypto sector in the next two months. Link.

- Coinbase CEO Brian Armstrong announced in Q1 earnings that the company is ‘100% committed’ to the US market, after reports that the firm is interested in moving overseas amidst US regulatory scrutiny. Link.

- A US court ordered the SEC to respond to Coinbase's complaint over how it applies securities laws to digital assets. The SEC must file its response within 10 days. Link.

- Gas fees for trading tokens on Uniswap hit a 12-month high of roughly $30 due to increased trading activity of memecoins on the network, including $PEPE which passed $1 billion in market capitalization. Link. Binance announced it would list PEPE on the exchange, though it disclosed the memecoin offered no utility. Link.

- Binance US walked away from its deal to acquire bankrupt crypto lender Voyager, citing regulatory uncertainty in the US. Link. Voyager failed to find alternative buyers and will liquidate its assets and return proceeds to customers. Link.

- Coinbase and Gemini both launched crypto-derivatives exchanges available only to non-US customers this week. Link.

- The SEC removed digital assets from its 2022 proposal to overhaul disclosures for hedge funds. Link. Rules.

- Argentina’s central bank banned payment apps in the country from offering digital assets like crypto to their customers. Link. Link.

- The SEC awarded a whistleblower a record $279 million. Whistleblowers are typically awarded between 10-30% of monetary sanctions for infractions over $1 million. The whistleblower's identity was not made public, though it's suspected the reward may be related to the crypto sector. Link. Press Release.

- The White House released a report calling for a tax on digital asset mining based on their associated electricity costs. Link. Link.

- MicroStrategy, the largest public holder of Bitcoin, posted a profit on its investment for the first time in nine quarters. Link. Link.

- NY Attorney General Letitia James proposed tighter restrictions for crypto companies, including requiring independent public audits of crypto exchanges and barring people from owning both brokerages and tokens to prevent conflicts of interest. Link.

- Cash App sold $2.16 billion in Bitcoin to customers this year, a 25% year-over-year increase. Link.

- Ex-OpenSea product manager Nathaniel Chastain was convicted on Wednesday of fraud and money laundering for insider trading based on knowledge of collections that would be promoted the front page. Chastain profited $50,000 from trading NFTs and faces up to 10 years in prison. Link.

- Crypto lobbying group the Blockchain Association is closing its New York office and building out a full-time staff in Washington DC. Link.

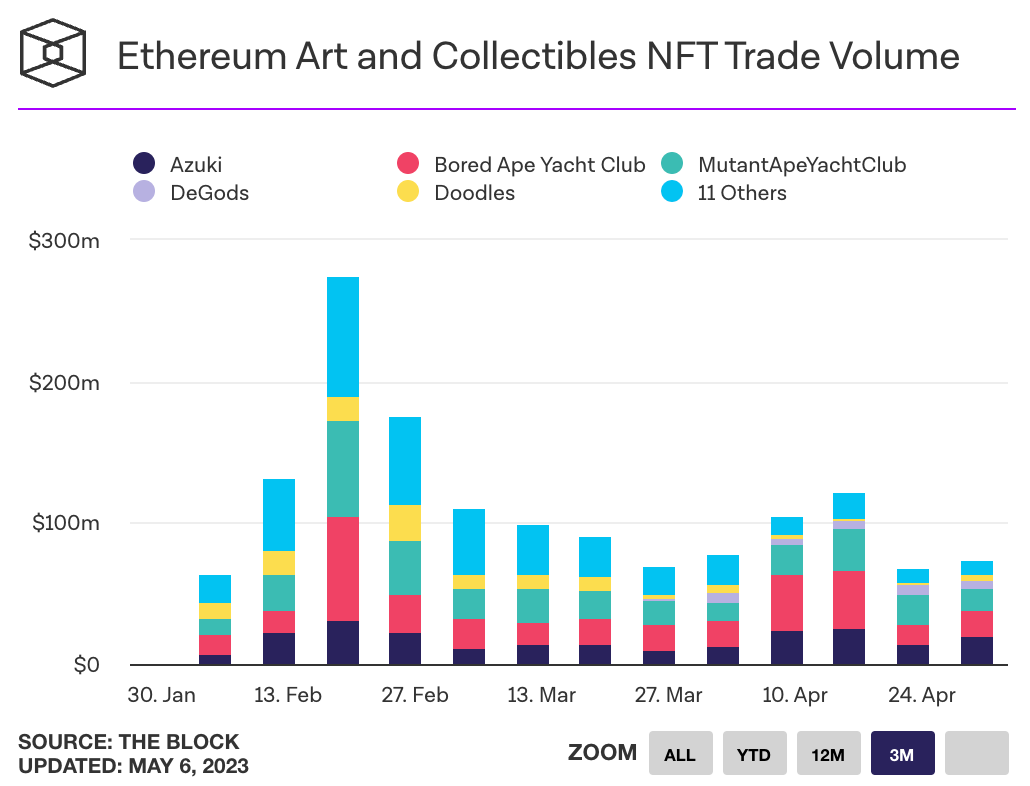

- NFT marketplace Blur has seen a significant drop in trading volume since its token launch but is still leading all Ethereum NFT marketplaces including OpenSea. Link.

- French lawmakers are considering a bill that would allow social media influencers to promote products of registered crypto companies. Link.

- NFT marketplace Blur announced a new lending protocol called Blend, developed in conjunction with Paradigm. So far 2300 loans worth 22,000 ETH have been taken. Link. Link. White Paper.

- Los Angeles County Museum of Art partnered with NFT studio Cactoid Labs and famed cryptoartist Deafbeef to release the “Noumenon + Chronophotograph” NFT collection. Link.

- Ex-Coinbase CTO Balaji Srinivasan settled his $1 million bet that Bitcoin would reach $1 million in 90 days, releasing a video reiterating his belief that the US economy is on path to hyperinflation. Link. Link.

- Digital Currency Group announced that CFO Michael Kraines stepped down in April and the company has fully repaid a $350 million senior secured term loan during the first quarter. Link.

- Decentralized exchange Sushiswap adopted rival Uniswap’s V3 liquidity pool code across 13 networks this week. Link. Link.

- PayPal will allow users to transfer crypto from Venmo to external wallets. Link.

- Mastercard is rolling out a service that allows cross-border transactions to be compliant with international finance and commerce regulations. Link.

- The Kenyan government proposed a 3% tax on digital asset transfers and a 15% tax on income generated from content creators in the crypto space. Link.

- A US judge approved the sale of FTX owned trading platform LedgerX. Link.

- North Carolina's House of Representatives unanimously passed a bill prohibiting the state from accepting payments in central bank digital currencies (CBDC). Link.

- Crypto payments firm Moonpay is launching a consumer facing app that allows users to manage multiple wallets and tokens. Link.

- The Dubai government reprimanded 3AC founders Kyle Davies and Su Zhu over their new venture OPNX, claiming the company is an unregistered exchange. Link.

- Sotheby’s added support for secondary NFT artwork sales to its NFT marketplace. Artwork available for sale will be curated by Sothebys and they will honor artist royalties. Link.

- Bitcoin kiosk company Coinme agreed to pay $4 million to settle charges by the SEC alleging it was party to an unregistered security offering. Link.

- According to a JP Morgan report, investors currently prefer Gold over Bitcoin as a hedge against more banking collapses due to regulatory uncertainty for crypto in the US. Link.

- Liquid staking protocol Lido Finance surpassed 6m ETH deposits this week. The protocol has 79% market share for staked ETH and is enabling withdrawals later this month. Link.

- Coinbase Borrow, which allowed users to take out loans against Bitcoin, is shutting down next week. Coinbase said the announcement is unrelated to its legal battles with the SEC. Link.

- U.S. sports publication Sports Illustrated partnered with Consensys to launch an NFT ticketing platform on Polygon. Link.

- Binance refunded Tron founder Justin Sun’s $56 million transfer after a warning from CZ that Sun was not allowed to buy the newly launched SUI token from Binance’s launchpool. Link. Link.

- A class action lawsuit was filed against Coinbase, alleging the company failed to disclose negative information about the company prior to going public in April 2021. Link.