This week's crypto weekly was co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($21,580): -6% / +30%

- ETH ($1,488): -8% / +24%

- SOL ($20.37): -13% / +109%

- UNI ($6.20): -9% / +20%

- MATIC ($1.16): -3% / +54%

MARKET CAP CHANGE: WTD/YTD

- Crypto Market Cap ($998B): -6% / +26%

- BTC Dominance: 42%

- ETH Dominance: 18%

- Tether ($68B): +1% / +3%

- USDC ($41B): -3% / -8%

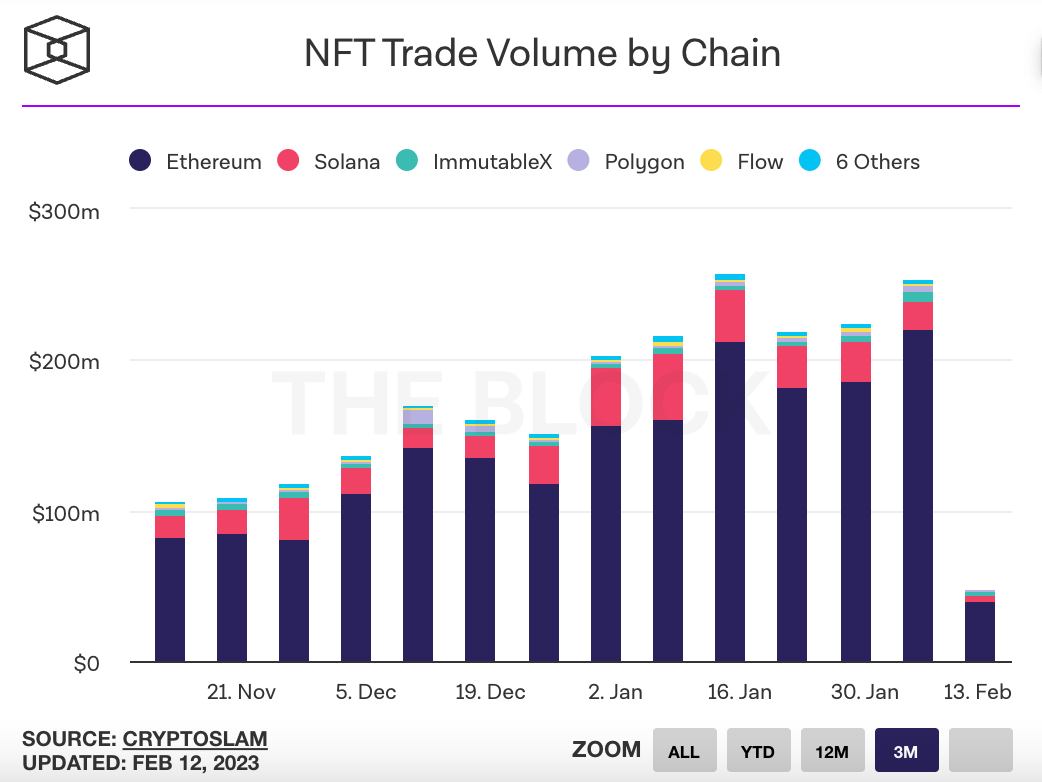

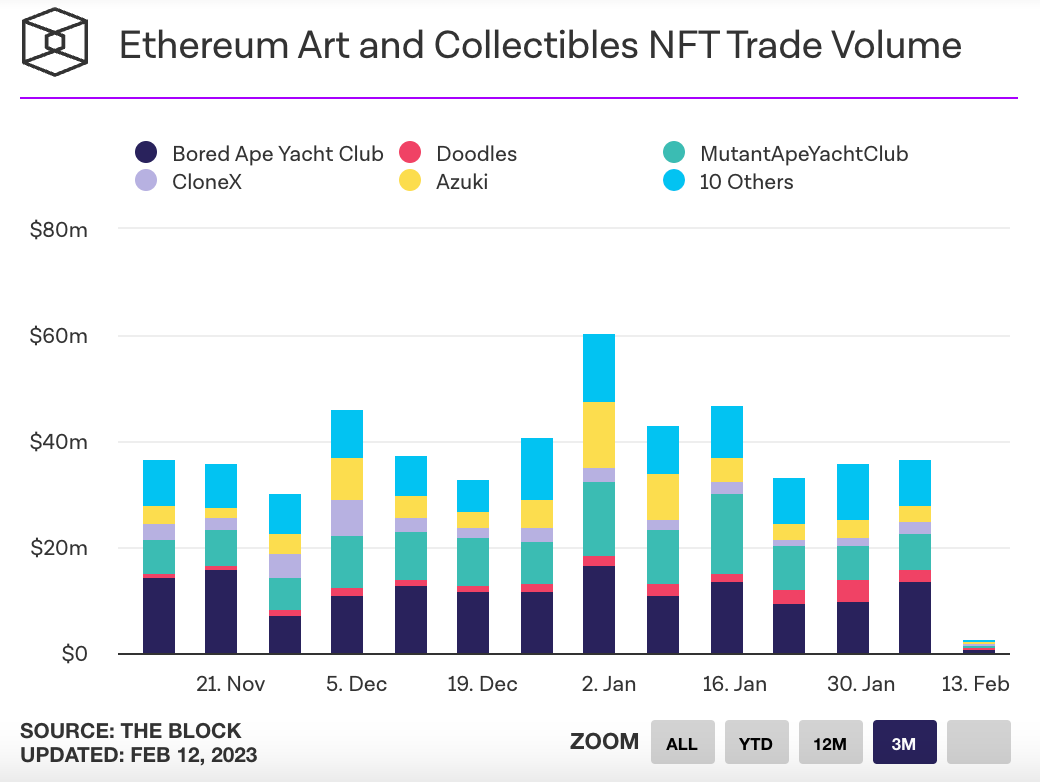

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- The number of transactions on the Bitcoin blockchain hit highs not seen since Q2 2021 due to the popularity of the Ordinals protocol, which allows NFTs to be stored on the bitcoin network. The launch of Ordinals has led to some of the largest block sizes in the history of Bitcoin and an increase in transaction fees, but has triggered a significant debate within the Bitcoin community on non-financial uses of the network. Link.

- On Feb 28 Ethereum developers will push a major test network upgrade for the upcoming Shanghai hard fork, which will allow withdrawals of staked ethereum from the network. Link.

- The SEC plans to sue crypto firm Paxos Trust for violating investor protection laws regarding its Binance USD stablecoin, the agency’s first enforcement action against a major stablecoin issuer. Link.

- Nexo will stop its Earn Interest Product for all U.S. clients on April 1 following a $45 million settlement with the SEC for failing to register the offer and sale of its crypto lending product in 2020. Link.

- The amount of ETH distributed via the maximal extracted value (MEV) tool from Flashbots, passed 100,000 ETH ($162 million) since the Ethereum Merge last September. Link.

- ConsenSys will financially support the ongoing lawsuit challenging the IRS' ability to tax staking rewards. The lawsuit argues that self-generated staking rewards should be considered "created property" under the federal tax code and not taxed until sale. Link.

- Kraken has agreed to pay $30 million to settle SEC charges that it offered unregistered securities through its staking-as-a-service platform, ending the program for US customers. SEC chair Gary Gensler warned other platforms taking custody of customer assets and advertising “earn” products to register with the SEC in order to comply with regulations. The settlement caused the tokens for decentralized competitors like Lido Finance, Rocket Pool, Persistence, and StaFi to rise on the news. Link. Link. Link.

- After Kraken announced its settlement with the SEC, Coinbase CEO Brian Armstrong tweeted that Coinbase's staking services are not securities and that he is willing to defend this in court. Link. Tweet.

- Gemini, Genesis Global Capital, and Digital Currency Group have reached an agreement that provides a path for Gemini Earn users to recover their assets. Genesis had served as the primary lending partner of Gemini, the New York-based crypto exchange, and owes users of the high-yield savings product Gemini Earn $900 million. Link. Link.

- The SEC plans to focus on registered investment advisers, including venture capital firms, for their compliance with fiduciary duty and custody of digital assets in the wake of the FTX fallout. There is speculation that venture capital funds investing in tokens themselves, rather than a company, will also face scrutiny. Link.

- Centre Pompidou in Paris will host an exhibition featuring NFTs for the first time in the museum’s history. The exhibition will feature NFTs from the CryptoPunks and Autoglyphs projects, both donated to the museum by Yuga Labs, and works by 12 other digital artists. Link.

- Yuga Labs co-founder Gordon Goner penned a letter this week addressing his resignation from the company due to health reasons and the allegations of racism surrounding Yuga Lab’s ongoing lawsuit with Ryder Ripps. Link.

- Music artist Rihanna's popular song “B**** Better Have My Money," was offered as a non-fungible token (NFT) through anotherblock, allowing holders to receive partial streaming royalties. Link.

- Zhu Su and Kyle Davies, the founders of failed crypto hedge fund 3AC, are launching Open Exchange, a public marketplace for crypto claims against bankrupt crypto firms, including those of 3AC. Link.

- MoonPay, a Web3 payments firm, is partnering with NFT marketplace LooksRare to enable easy purchase of NFTs using a debit or credit card. Link.

- MakerDAO integrated Chainlink's decentralized oracle into its Keeper Network framework for maintaining stability of its DAI stablecoin after a successful governance vote. Link.

- Aave has launched its native stablecoin, GHO, on the Goerli testnet network as part of its planned roll out on the Ethereum mainnet. Similar to MakerDAO’s DAI stablecoin, the GHO official launch will be approved by the Aave DAO community at a later date. Link.

- Several cryptocurrency companies, including Binance, Tether, Bitfinex, OKX and Kucoin, pledged over $9 million in donations to help the victims of the massive earthquakes in Turkey and Syria. The Avalanche Foundation donated $1 million in AVAX tokens to the cause. Link.

- MakerDAO is releasing Spark Protocol, a lending platform for the DAI stablecoin that aims to rival Aave, one of Ethereum's largest DeFi products. Link.

- Yuga Labs has settled a legal dispute with Thomas Lehman, who assisted Ryder Ripps and Jeremey Cahen in selling counterfeit versions of the company's NFT collections. The lawsuit between Yuga Labs and Ripps and Cahen is ongoing. Link.

- Binance US temporarily suspended USD bank transfers starting February 8th; all other methods of buying and selling crypto remain unaffected. The pause is likely due to issues with its bank partner Signature Bank who said they would stop processing crypto SWIFT transactions under $100,000. Link.