This week's crypto weekly was co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($22,869): +1% / +38%

- ETH ($1,619): -1% / +35%

- SOL ($23.43): -5% / +140%

- UNI ($6.84): -1% / +33%

- MATIC ($1.20): +19% / +59%

MARKET CAP CHANGE: WTD/YTD

- Crypto Market Cap ($1.06B): +1% / +34%

- BTC Dominance: 42%

- ETH Dominance: 19%

- Tether ($68B): +2% / +3%

- USDC ($42B): -3% / -6%

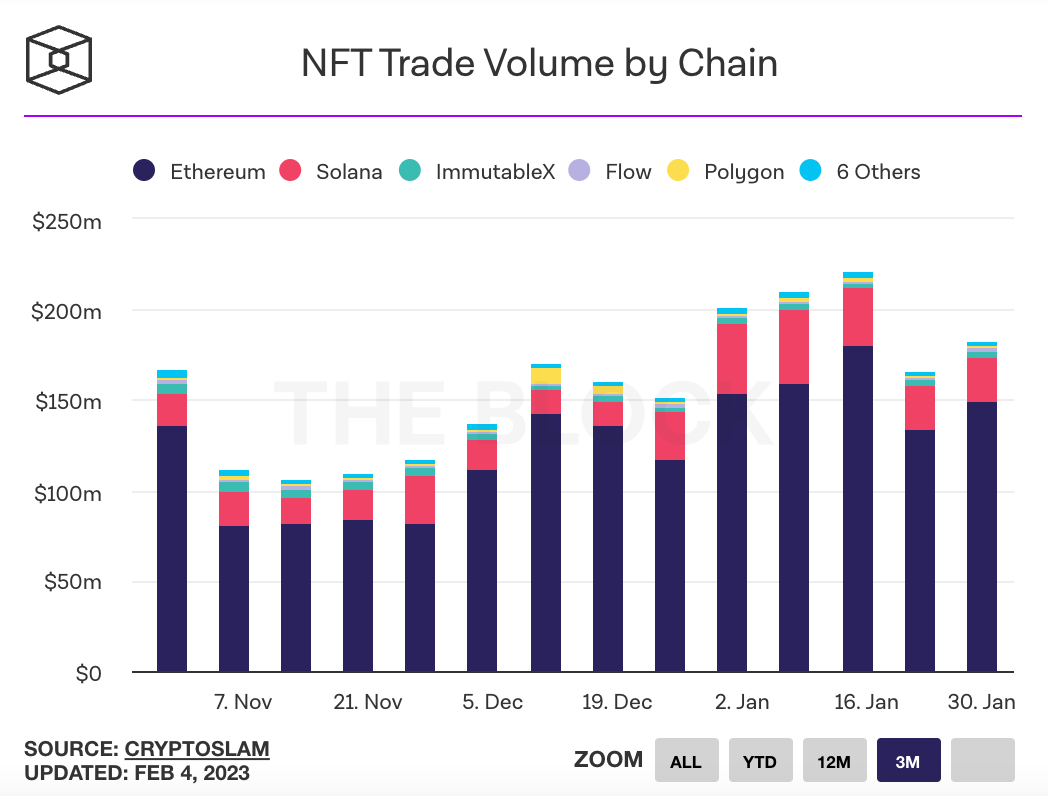

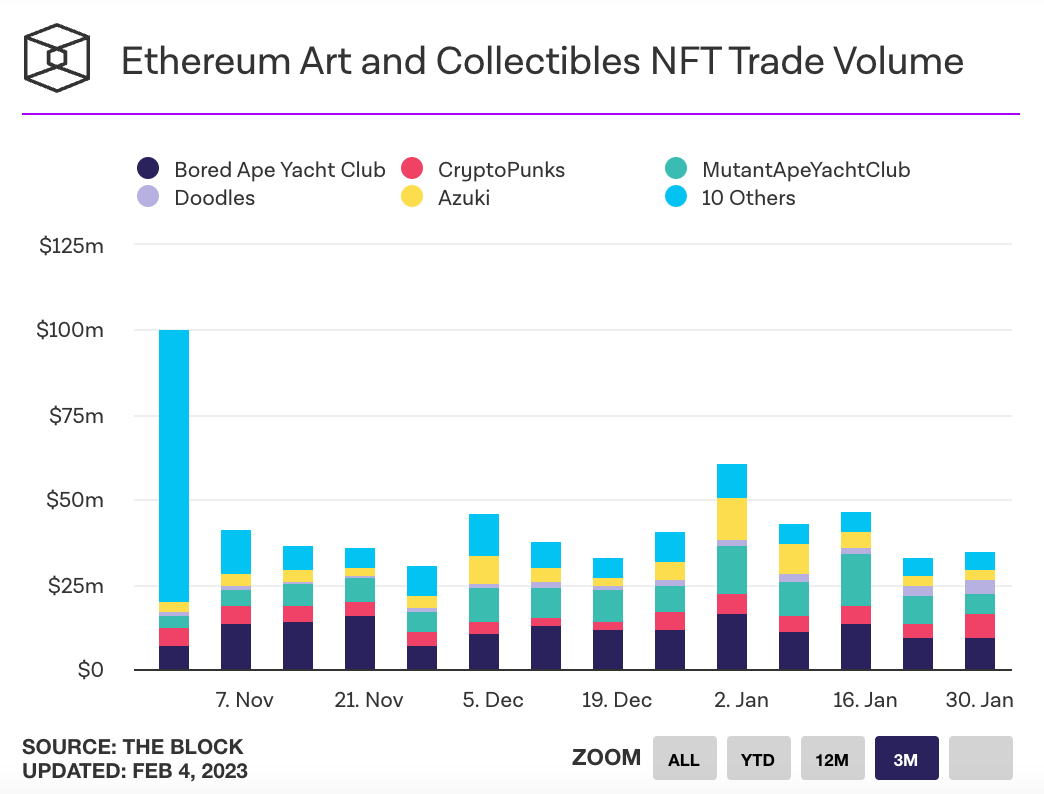

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Ethereum is launching a public testnet of its Shanghai upgrade to simulate the process of withdrawing staked ETH. The effort will allow developers to resolve any potential issues before the full release in April. Link.

- Ethereum's total circulating supply reached a post-Merge low of approximately 120.5 million tokens. Link.

- The Federal Reserve hiked interest rates by 25 basis points, causing Bitcoin and other digital assets to move positively. Link.

- Coinbase share price jumped 24% to its highest point in nearly three months, after a lawsuit alleging it sold unregistered securities was dismissed. Coinbase is also expected to benefit from Ethereum's upcoming Shanghai fork -- liquid staking could yield the exchange between $225 million and $545 million in revenue per year. Link. Link. Link.

- A governance vote to deploy Unsiwap V3 on the BNB chain using the Wormhole bridge has VC funds A16z and Jump Crypto at odds. A16z backs LayerZero as a bridge while Jump is invested in Wormhole. Link. Link. Proposal.

- NFT sales in January rose to $947 million, a 38% increase from $684 million in December. $772 million of volume in January happened on the Ethereum network, and $495 million was traded on the OpenSea marketplace. Link. Link.

- Social token platform Rally said it was shutting down its creator NFT side chain. The shut down will effectively destroy all the digital assets it contains. Link.

- Delegate Cash, a protocol that allows users to delegate NFT rights to a separate wallet for security purposes, is being used to secure more than $400 million worth of NFTs across 4,300 wallets. Link.

- Berkshire Hathaway’s Charlie Munger called for a ban on cryptocurrencies in the US, labeling them a gambling contract with a nearly 100% edge for the house. Link.

- CeFi platform Celsius Network has been accused of being a Ponzi scheme and misleading investors. The company is alleged to have used customer deposits to fund operations, and also used new customer funds to pay for other customers’ withdrawals. Celsius executives also sold millions of its native token CEL while internally claiming its true value was zero. Link.

- Reliance Retail, India's largest retail chain, will begin accepting payments in the newly launched CBDC digital rupee. The Reserve Bank of India hopes to lower the economy's reliance on cash and make cheaper and smoother international settlements. Link.

- Bitcoin mining difficulty has reached a new all-time high despite its lower price, making mining less profitable. Link.

- Coinbase NFT is pausing future NFT drops to focus on creator tools. The marketplace has struggled to gain traction, seeing just $106 in 24 hour trading volume on 2/1 compared to rival OpenSea’s $11.3 million in the same timeframe. Link. Link.

- No-fee NFT marketplace Blur created a new marketplace contract on OpenSea’s protocol, allowing it to circumvent OpenSea’s policy of block-listing platforms that do not enforce creator royalties. Link.

- Bitcoin-based payment network Strike is expanding its remittance services to the Philippines. About $12.7 billion in cash remittances was sent from the US to the Philippines in 2021. Link.

- The UK plans to regulate digital asset activities including trading, lending, and custody under the same rules as traditional financial services. Link. Link.

- Tesla recorded a $204 million impairment loss in 2022 related to its bitcoin holdings. The loss was offset by $64 million in profits from trading, leading to a net loss of $140 million. Tesla had invested $1.5 billion in bitcoin in Q1 2021. Link.

- Twitter could add crypto as a payment option for its new payment tools that include services like tipping and shopping. Link.

- YouTube star Logan Paul has been named in a proposed class-action lawsuit over NFT sales for a project called CryptoZoo. The suit alleges that Paul and his associates promoted the project as a game with future utility but neither materialized. Link. Link.

- Silvergate Capital is being investigated for fraud over its ties to FTX and Alameda Research. The bank hosted accounts for FTX and Alameda starting in 2018. Silvergate shares plummeted 20% in extended trading following the news. Link.

- The US Senate Banking Committee will hold a hearing on February 14 to examine financial system protections from the dangers seen in digital assets, dubbed "Crypto Crash: Why Financial System Safeguards are Needed for Digital Assets." Link. Link.

- MakerDAO, which governs the DAI stablecoin, saw a 40% decrease in revenue and 80% decline in operating earnings in 2022, due to crypto lending markets contracting in the wake of a broader market sell off. Link.

- Protocol Labs, the group behind Filecoin and IPFS, laid off 21% of its workforce. Link. Blog Post.

- OpenSea launches a new suite of tools for creators, including smart contract deployment, configurable drop mechanics, and personalized landing pages. The features aren’t available to the public yet. Link. Post.

- A large image of a wizard promoting "magic internet JPEGs" was mined on the Bitcoin blockchain using the Ordinals protocol, prompting a heated debate over whether the Bitcoin network should be used for more than traditional payment transactions. Link.

- Bridgewater founder Ray Dalio spoke out against Bitcoin and stablecoins, but showed interest in an inflation-linked coin. Link. Video.

- The price of LBRY Credits (LBC) rose 67% after the district judge overseeing its case against the SEC said that his ruling would not take into account the nature of secondary market sales. The SEC is claiming that LBC was an unregistered security. Link.

- Meta shares rose 18% after a positive quarterly earnings report, but the company's metaverse initiative, Reality Labs, lost $4.28 billion in Q4 2022 and pulled in only $727 million of revenue, down 17% from the previous year. Link.

- StarkWare is making its STARK Prover software open-source. The ZK rollup codebase has processed 327 million transactions and settled around $824 billion for popular DApps like Immutable X and Dydx. Link.

- NounsDAO is creating an NFT-based comic book series that will be redeemable for physical copies. Nouns has done multiple partnerships over the past year with brands such as the Australian Open, the Rose Parade and Budweiser. Link.

- Pantera co-CIO is leaving the firm after 6 years of managing its Liquid Token Fund. The Fund lost 80% in 2022. Link.

- Crypto marketing startup Addressable raised $7.5 million in seed funding to build digital fingerprinting technology that matches anonymous crypto wallets social media accounts. Link.

- Mastercard's former NFT product lead resigned after two years, noting mismanaged processes and internal inefficiencies. Link. Tweets.

- Hollywood agency UTA signed Bobby Kim, co-creator of the NFT collection Adam Bomb Squad. Link.