Crypto weekly is co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($41,711): +11% / +152%

- ETH ($2,228): +8% / +86%

- SOL ($60.16): +4% / +517%

- UNI ($6.18): -1% / +18%

- MATIC ($0.80): +5% / +6%

MARKET CAP CHANGE: WTD/YTD

- Crypto Market Cap ($1.5T): +1% / +79%

- BTC Dominance: 51%

- ETH Dominance: 17%

- Tether ($90B): +1% / +35%

- USDC ($24B): -1% / -45%

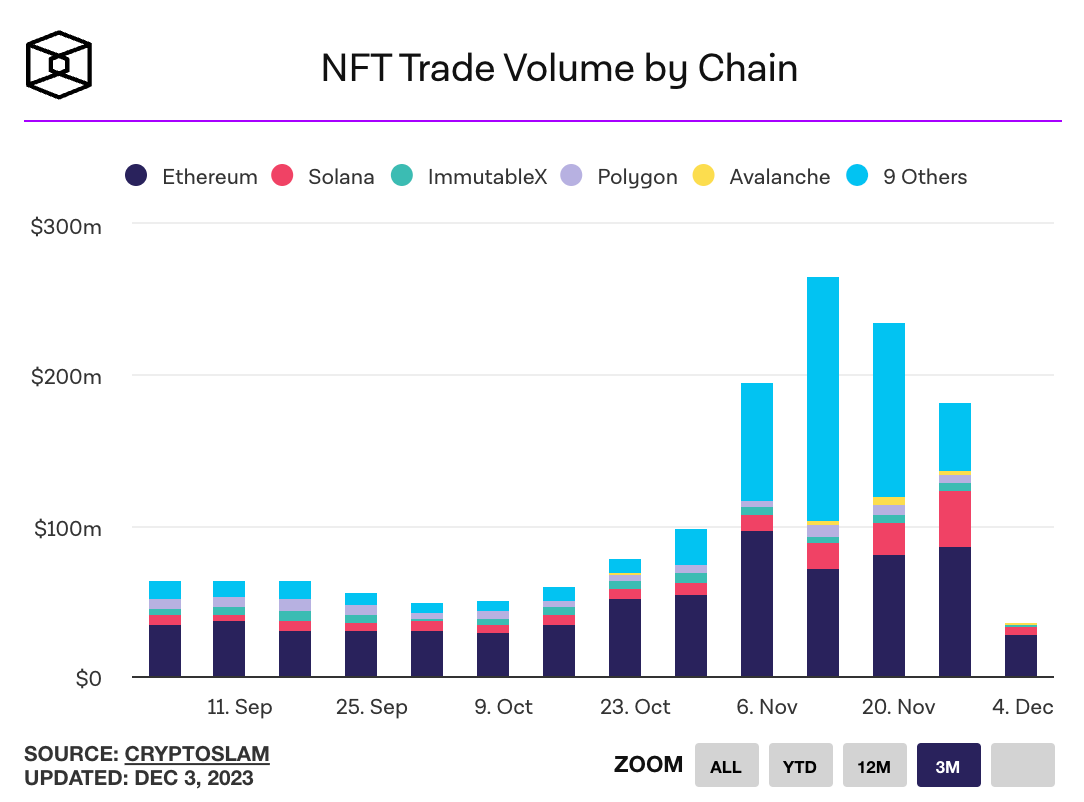

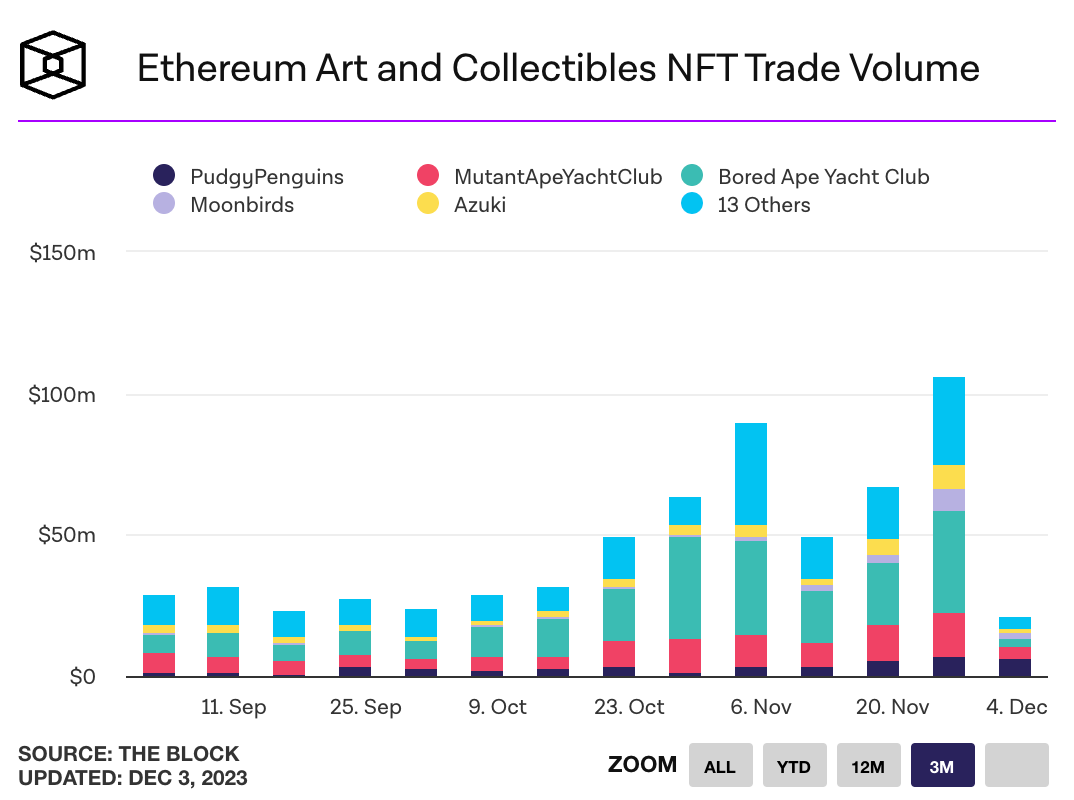

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Bitcoin prices surged past $42,000 for the first time in 19 months, with ongoing speculation around SEC approval of a spot ETF. The cryptocurrency is on track for its biggest annual gain since 2020. Link.

- The US treasury department asked congress to expand OFAC sanctions jurisdiction to crypto firms outside the US who help facilitate illicit finance. The proposal noted the department's concerns over stablecoin issuers outside the US, including USDT issuer Tether. Link.

- Base, the Ethereum Layer 2 launched by Coinbase, will not have a native token according to Coinbase CEO Brian Armstrong. Base is the third largest Layer 2 by total volume locked and uses ETH as its native token for paying transaction fees. Link.

- November saw $605 million in NFT trading on Ethereum, up from $306 million in October. December NFT trading volume has already reached $90 million month-to-date, with nearly $70 million of that volume coming from transactions on the Blur NFT marketplace. Link.

- Fintech startup SoFi is exiting the crypto space due to increased scrutiny of the space from banking regulators. Link.

- A federal judge warned SEC lawyers they may be sanctioned for misrepresenting evidence about crypto project Debt Box’s alleged efforts to transfer its assets oversees, which led to a court freezing the project’s bank accounts. The judge said “misrepresentations… undermined the integrity of the case’s proceedings,” in addition to causing the company irreparable harm. The SEC has two weeks to respond. Link. Court Order.

- Legislation for regulating stablecoins and the overall digital asset industry isn’t expected to come to a vote in the US House of Representatives until early 2024 at the earliest. Link.

- Polygon allegedly gave unusually favorable terms to DraftKings for running a validator, despite saying it was an ‘equal’ member of the community. On-chain data shows that DraftKings received millions in MATIC, more than any other validator, even though it failed to maintain its validator’s performance and was kicked off the network last month. Link.

- Crypto bridge Wormhole raised $225 million at a $2.5 billion valuation from investors including its incubator Jump Trading, Brevan Howard, Coinbase Ventures, and Multicoin Capital. Jump’s CEO and COO left Jump earlier this month to run the bridge as a separate entity. Link.

- Genesis Global and its parent co DCG have agreed to settle their ongoing lawsuit, with DCG agreeing to pay $502 million of the $620 million in loans Genesis is seeing repayment on. Link.

- Ethereum co-founder Vitalik Buterin released a blog post titled “My techno-optimism” in response to Marc Andreessen’s recent “techno-optimist manifesto”. Link.

- The Starknet Foundation confirmed an eligibility cutoff date for its airdrop has already been determined, and that no further user actions would affect eligibility. Link.

- November saw $343 million in hacks and fraud, with centralized platforms like Poloniex and Huobi accounting for over 53% of the losses. So far $1.75 billion has been lost to hacks and fraud year-to-date. Link. Report (PDF).

- Square Enix, the game studio behind AAA games Final Fantasy and Kingdom Hearts, announced their first Web3 game “Symbiogenesis” will launch on December 21. Link.

- Fortune released a profile on SEC chair Gary Gensler, which included stories on staff burnout, criticism from Congress, and reckoning from hostile federal courts. Link.