Crypto weekly is co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($34,873): +1% / +111%

- ETH ($1,875): +4% / +57%

- SOL ($40.51): +23% / +315%

- UNI ($4.76): +14% / -8%

- MATIC ($0.69): +7% / -9%

MARKET CAP CHANGE: WTD/YTD

- Crypto Market Cap ($1.4T): +4% / +65%

- BTC Dominance: 50%

- ETH Dominance: 17%

- Tether ($85B): +1% / +29%

- USDC ($25B): -2% / -45%

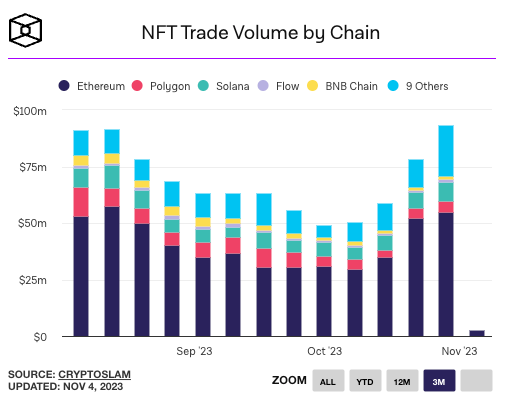

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Sam Bankman-Fried, founder of the failed FTX exchange which declared bankruptcy last November after losing billions in customer deposits, was found guilty on 7 counts of fraud and conspiracy. The jury convicted SBF within hours of beginning deliberations. SBF is facing decades in prison and will be sentenced at the end of March. Link. Link. Link. Link.

- WalletConnect is restricting use of its product in Russia due to OFAC sanctions. Link. Tweet.

- Coinbase revenue increased 14% in Q3 to $674 million, despite trading volumes falling to $76 billion from $92 million the prior quarter. The exchange’s USDC stablecoin reserves earned higher interest than forecasted, thanks to rising interest rates. Link. Link. Q3 Report.

- Daily NFT volumes have risen for 4 consecutive weeks, a first in over six months, but are still down 80% from earlier in the year ($405 million in October vs. $2 billion in March). Link. Link.

- NFT marketplace OpenSea laid off 50% of employees and will reorient the company around “OpenSea 2.0”. Link. Tweet.

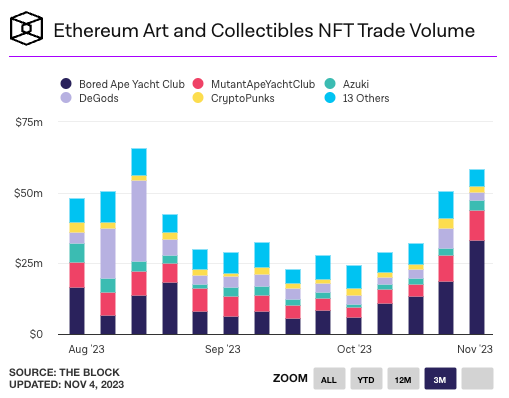

- Yuga Labs is collaborating with Magic Eden to build an Ethereum NFT marketplace that contractually enforces royalties, just months after the Bored Ape Yacht Club creator had announced they were sunsetting smart contract support for Opensea. Magic Eden did not elaborate on their technical approach to enforcing royalties. Link.

- Professional firms involved in 9 crypto bankruptcies have earned roughly $770 million in fees. FTX has paid $317 million in fees, Celsius $176M, Voyager $100M, BlockFi $72M, and Genesis $43M among others. Link.

- Solana’s SOL token is one of the best performing cryptocurrencies of the year, benefiting from the broader crypto market rally and the launch of a scaling solution called Firedancer. Solana fell 94% last year after the collapse of 2 of its major backers – FTX and Alameda Research. Link.

- PayPal received a subpoena from the SEC related to its PayPal stablecoin. PYUSD is pegged to the dollar and fully backed by US dollar deposits. Link.

- Almost 86% of Tether’s USDT stablecoin reserves were held in cash in Q3. Link.

- Coinbase now supports bitcoin and ethereum futures for its US retail users. Link.

- A judge dismissed Coin Center’s lawsuit against OFAC over its Tornado Cash sanctions. Link.

- Bitcoin’s Wikipedia page had 13,500 visits on October 24, the highest interest the page has seen since June 2022. Link.

- PayPal received a crypto license to operate in the United Kingdom. Link.

- The CFTC has paid out a total of $16 million to crypto whistleblowers. Link. Report.

- Microstrategy chairman Michael Saylor argued in an interview that his company is an attractive alternative to future Spot Bitcoin ETFs because they do not charge a fee. Microstrategy holds over 150,000 BTC ($5.25 billion). Link.

- The US Supreme Court agreed to hear a case involving Coinbase and its right to arbitration in a dispute with its users over a 2021 Dogecoin sweepstakes. Link.

- Retail crypto users will no longer be able to directly mint USDC – instead retail users will have to access the stablecoin via brokerages, crypto exchanges, and digital wallet services. Link.

- Indian banks are offering customers incentives for transacting with the e-rupee, India’s central bank digital currency. Link.

- The market cap of USDC and USDT has flattened and started to increase for the first time in two years, indicating there may be net inflows into the ecosystem. Link.

- The founders of Safemoon, a meme coin launched in 2021, were arrested this week by the DOJ on fraud charges for deceiving token holders by withdrawing $200 million from supposedly locked liquidity pools. Link.