Crypto weekly is co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($28,558): +3% / +73%

- ETH ($1,605): -1% / +34%

- SOL ($24.11): +4% / +147%

- UNI ($4.14): -4% / -20%

- MATIC ($0.54): -4% / -29%

MARKET CAP CHANGE: WTD/YTD

- Crypto Market Cap ($1.06T): -3% / +33%

- BTC Dominance: 51%

- ETH Dominance: 18%

- Tether ($83B): 0% / +26%

- USDC ($25B): +2% / -42%

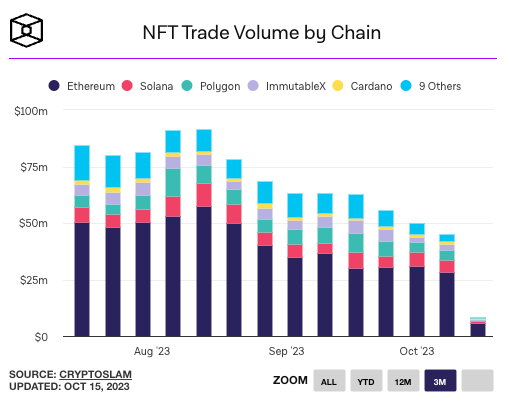

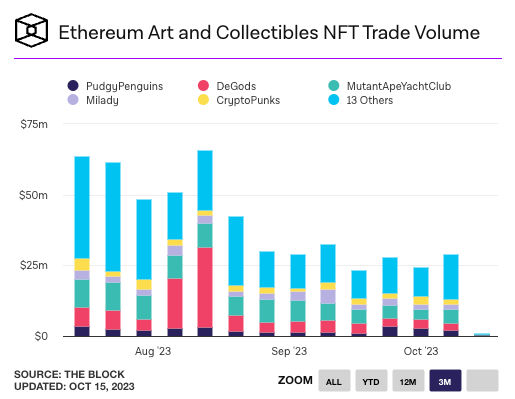

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Bitcoin’s market dominance approached multi-year high, eclipsing 51% for the second time in 2 years. Link.

- The SEC won’t appeal a court’s ruling that its rejection of Grayscale’s Bitcoin ETF application was invalid, boosting the chance of multiple Bitcoin spot ETFs getting approved. Link.

- Israeli authorities froze Hamas-linked crypto accounts on Binance. Hamas was accepting Bitcoin donations for years but stopped the practice in April 2023 due to donors being tracked by western governments. Link. Link.

- California governor Gavin Newsom signed a law requiring state lawmakers to create a regulatory framework for digital assets by 2025. Link.

- The average gas fee on Ethereum hit 8.8 gwei this week, a low not seen since October 2022, and has caused ETH to turn inflationary. The annual inflation rate is currently 0.44%. Link.

- The lightning network, Bitcoin’s layer 2 scaling solution, has seen a 1200% growth in transaction volume over the last two years. Link. Report.

- According to Messari’s latest “State of Ethereum'' report, Layer 2’s account for over 60% of Ethereum transaction volume. Link. Report.

- A group of Democratic senators sent a letter to the IRS urging them to speed up implementing crypto tax reporting rules. The IRS proposed rules in August to treat crypto brokers like traditional finance brokers. Link. Proposed Rules.

- Coinbase told the IRS it has ‘serious concerns’ about its proposed tax rules, which would effect decentralized protocols and wallets in addition to centralized exchanges. Link.

- Trezor unveiled a new crypto hardware wallet and a corrosion resistant stainless steel product for storing seed phrases. Link.

- Former Alameda CEO Caroline Ellison testified last week as a government witness in the SBF trial. A few notable moments from her testimony:

- FTX tried to use wallets attached to Thai sex workers to recover $1 billion in funds frozen by the Chinese government, and eventually bribed officials with $150 million. Link.

- Ellison sent a fake spreadsheet to Genesis that hid the over $10 billion Alameda had borrowed from FTX. Link.

- Ellison kept a list of things “Sam is freaking out about”, which included buying Snapchat, raising capital from Saudi Crown Prince Mohammed Bin Salman and convincing US regulators to investigate Binance. Link.

- Prosecutors in the SBF case filed to prevent any mention of AI-startup Anthropic, which is rumored to be raising at a $30 billion valuation. Prosecutors argue that Anthropic’s valuation, which may be used to return customer deposits, does not pertain to the question of SBF’s fraud or guilt. Link.

- A consultant used a personal Ledger hardware wallet to save $400 million from being stolen during the FTX hack in November. The hacker ultimately stole over $415 million. Link.

- Sam Altman said the US government is waging war on crypto in an interview with Joe Rogan. Link. Interview.

- JPMorgan’s went live with blockchain-based settlement, turning shares of its money market funds into digital tokens that it then used as collateral in an OTC trade with Barclays. Link.

- Polygon Labs proposed a Layer 2 ‘ApeChain’ to power the ApeCoin ecosystem, asking for $200,000/year to build and maintain the blockchain. Yuga Labs suggested a dedicated chain should be built in the aftermath of their Otherdeed NFT mint in 2022 that saw ETH gas prices skyrocket to all-time highs. Link. Proposal.

- Mastercard successfully completed a CBDC pilot with the Reserve Bank of Australia. Link.

- Layer 2 zkEVM Scroll had a stealth rollout to mainnet this week, with over $500,000 bridged so far. Scroll’s architecture was noted by Ethereum co-founder Vitalik Buterin as being “fully ethereum equivalent”, meaning smart contract execution is identical to mainnet, a key difference from other zkEVMs like Polygon and zkSync. Link. Link.

- The CFTC charged Voyager co-founder Stephen Ehrlich with fraud and registration failures. Voyager went bankrupt in 2022 due to unsecure loans the bank made to Three Arrows Capital. Link.

- Real USD (USDR) stablecoin depegged and dropped to 50 cents. The stablecoin’s reserves include tokenized real estate, which it used to offer higher yield. A house committee passed legislation in July that would require stablecoins to be backed solely with cash, cash equivalents, and Treasury bills. Link.

- Ferrari began accepting crypto as payment for cars in the US and is exploring doing the same in the EU. Link.

- The G20 adopted the crypto regulatory roadmap proposed by the IMF and Financial Stability Board. The roadmap advocates for oversight of crypto instead of a blanket ban. Link.

- USDT issuer Tether promoted CTO Paolo Ardoino to CEO. Former CEO Jean-Louis van der Velde will transition into an advisory role. Link.

- The Museum of Modern Art (MoMA) in New York acquired Refik Anadol’s “Unsupervised—Machine Hallucinations” for its permanent collection. The generative art piece has been on display in the MoMA lobby for the past year. Link.

- Grocery store chain Trader Joe’s sued Defi trading platform Trader Joe in US federal courts for trademark infringement. The chain previously filed a suit in the United Nations court but the case was thrown out. Link.

- Ripple CFO Kristina Campbell is leaving the company. Link.

- Binance has only spent $30 million of the $1 billion it had committed to financing promising crypto startups in the wake of the FTX collapse. Link.

- Perp trading protocol GMX received the largest share of Arbitrum’s $40 million grant program, while liquid staking platform Lido received no funding amidst concerns the platform controls too much staked ETH. Link.