Crypto weekly is authored by maaria and david blumenfeld

PRICE CHANGE: WTD/YTD

- Crypto Market Cap ($3.97T): -8% / +17%

- BTC ($114,073): -8% / +22%

- ETH ($4,125): -9% / +24%

- SOL ($194): -15% / +2%

- UNI ($6.62): -18% / -50%

- OP ($0.49): -33% / -72%

- COIN ($357): -6% / +44%

- Tether Mkt Cap ($180B): +1% / +30%

- USDC Mkt Cap ($76B): 0% / +73%

- BTC / ETH Dominance: 57% / 13%

THIS WEEK IN CRYPTO

- Crypto markets experienced their most severe liquidation event after President Trump announced a 100% tariff on China, with over $19 billion in positions wiped out and bitcoin plummeting to $104,00 before recovering to $112,000. The severity of the drop was amplified by excessive leverage in DeFi. Perpetual swaps platform Hyperliquid saw $10 billion in liquidations and decentralized exchange Uniswap saw $9 billion in trading volumes. Link. Tweet.

- Binance, the largest crypto exchange in the world, briefly experienced technical glitches with certain assets de-pegging due to sharp market fluctuations during the crypto market crash. Link.

- Grayscale became the first spot ethereum ETF to include staking rewards. Link.

- The SEC is developing a formal "innovation exemption" framework that could be finalized by year-end to allow crypto and fintech startups to experiment under regulatory supervision instead of facing enforcement actions. Link.

- Intercontinental Exchange, the owner of the New York Stock Exchange, will invest up to $2 billion in crypto-based prediction marketplace Polymarket at an $8 billion valuation. Link.

- Senate Democrats proposed new DeFi regulations that would designate Treasury and financial regulators to determine protocol control and decentralization. The proposal, which stalls the crypto market structure CLARITY Act, has drawn sharp criticism from crypto industry leaders and Republican committee members who say it is overly broad and impossible to comply with. Link.

- Block launched Square Bitcoin, a fully integrated bitcoin payments offering that allows merchants to accept bitcoin payments with zero fees and automatically convert card sales into bitcoin. Link.

- Polymarket is planning to launch a native crypto token but will likely wait until 2026 as it prioritizes its re-entry into the US after being banned by the CFTC in 2022. Link. Link.

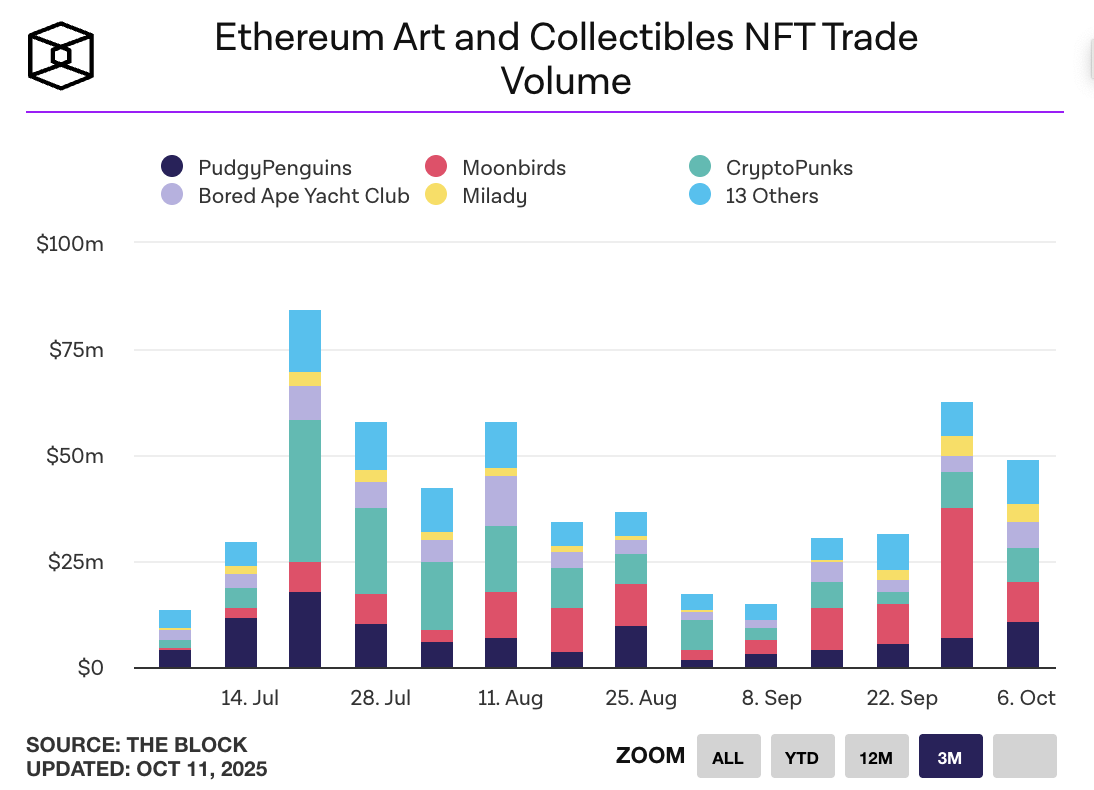

- Larva Labs’ latest generative art collection called Quine sold for nearly $15 million on Art Blocks. Link.

- Morgan Stanley is removing restrictions on crypto fund access for its wealth management clients. Link.

- Coinbase and Mastercard are reportedly competing to acquire London-based stablecoin infrastructure firm BVNK for up to $2.5 billion. Link.

- Citigroup's venture arm invested in stablecoin payments startup BVNK to expand cross-border payment infrastructure. Link. Link.

- A consortium of major international banks including Goldman Sachs, Deutsche Bank, Bank of America, and Banco Santander are collaborating to explore creating stablecoin-like digital money backed 1:1 by reserves, focusing on G7 currencies. Link.

- The Bank of France is urging the EU to centralize crypto oversight under the European Securities and Markets Authority and restrict multi-jurisdictional stablecoin issuance. Link.

- The Ethereum Foundation has formalized privacy as a key pillar of its roadmap by creating a dedicated research cluster that consolidates existing privacy experiments and pursues new initiatives. Link.

- North Korean hackers have stolen a record-breaking $2 billion in cryptocurrency in 2025, nearly triple last year's total. Link. Link.

- EthanaUSD, the 3rd largest stablecoin with a $12.6 billion market cap, briefly lost its dollar peg on Binance and fell to $0.65 before recovering. Link.

- President Trump is considering pardoning former Binance CEO Changpeng "CZ" Zhao, who served four months in prison for anti-money laundering violations, and remains Binance’s largest shareholder. Link.

- Norwegian officials are investigating potential information leaks after at least three Polymarket traders made approximately $90,000 in profits by betting on Venezuelan opposition leader Maria Machado winning the 2025 Nobel Peace Prize shortly before the official announcement. Link.

- India plans to launch a digital currency backed by the Reserve Bank of India while discouraging the use of unbacked cryptocurrencies through heavy taxation. Link.