This week's newsletter co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($21,636): +8% / -54%

- ETH ($1,750): +11% / -53%

- XRP ($0.36): +7% / -58%

- UNI ($6.45): +0% / -63%

- Crypto Market Cap ($1.05T): +7% / -52%

- BTC Dominance: 39%

- ETH Dominance:** 20%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($68B): 0% / -14%

- USDC ($52B): -1% / +22%

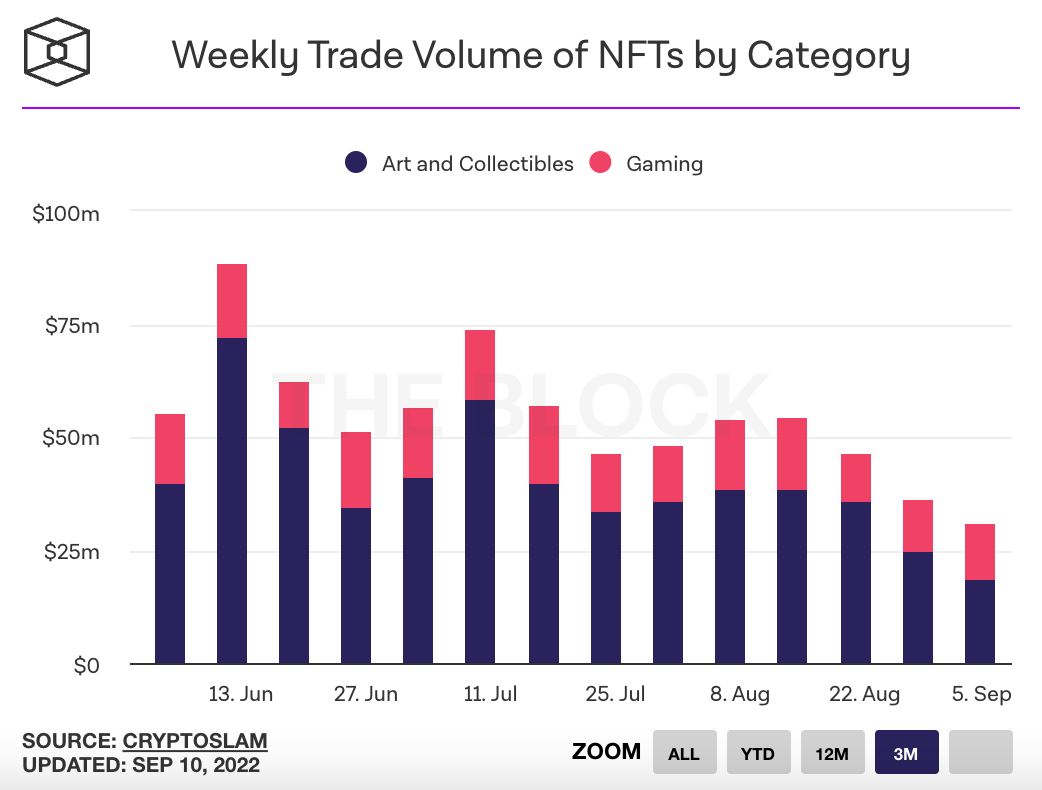

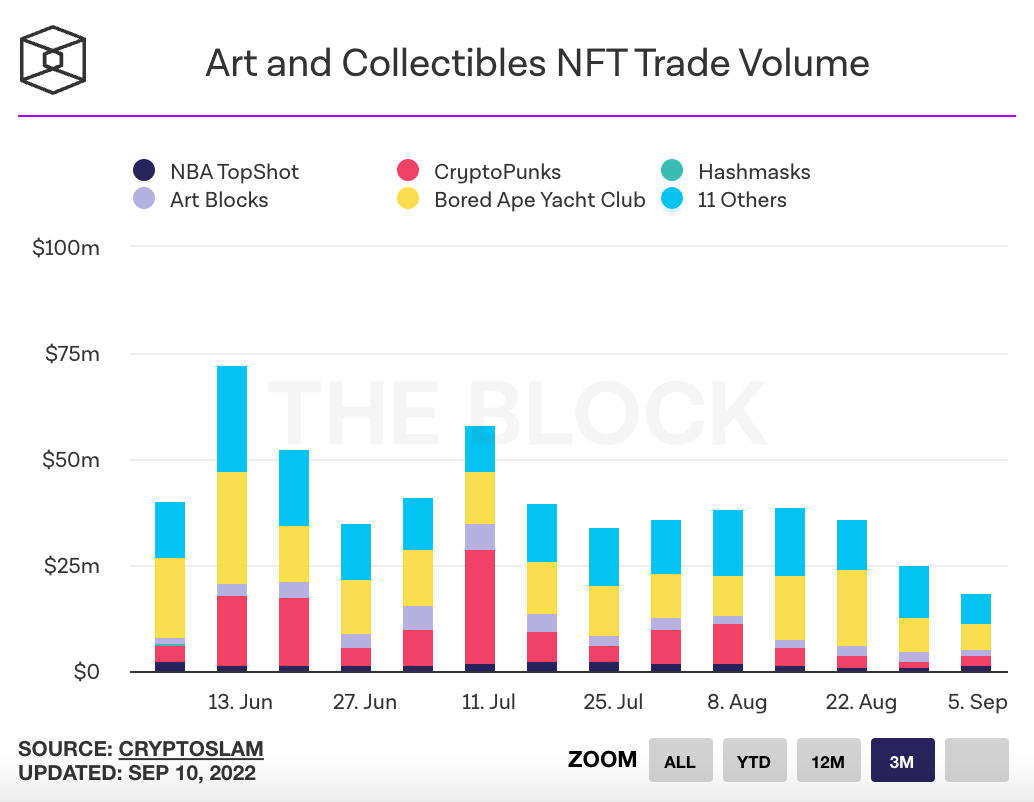

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Ethereum completed its 13th and final shadow fork in preparation for the proof-of-stake merge, which is now set to happen sometime between September 13th and 15th. Link. EF Blog Post.

- Crypto lender Celsius may have operated like a ponzi scheme using new investors to pay old investors, according to the Vermont Dept of Financial Regulation. Celsius was unable to repay investors as far back as July 2021, when crypto staking platform Stakehound lost 35,000 ETH and when a lender could not return collateral. Link.

- SEC chair Gary Gensler said he supports making the CFTC the agency that regulates crypto non-security tokens like bitcoin. The SEC would continue regulating security tokens. Link.

- At a conference this week, SEC chair Gary Gensler said “Of the nearly 10,000 tokens in the crypto market, I believe the vast majority are securities”. Link. Later that week, the SEC announced it was forming a new office to specialize in “unique and evolving” filings around crypto assets. Link.

- Fed Chair Jerome Powell said that the Fed would not issue a CBDC without clear support from the executive and legislative branches during a conference interview this week. He also suggested that privacy protection would be paramount for any CBDC issued by the government. The Fed Chair also called for legislation of stablecoins, elaborating that stablecoins should provide consumers with clarity, transparency and “full reserves of very liquid high-quality assets.” Link. Video interview (32:00).

- A White House report proposes legal limitations on proof of work crypto mining in the US to mitigate its environmental impact. Link. Report (PDF).

- ENS domains were the #1 collection on NFT marketplace OpenSea earlier this week. Nearly 9,000 ENS domains were traded, totalling $3.76 million in trading volume. Link.

- House Republicans sent a letter to the Federal Reserve asking for clarification on the Fed’s thinking around the potential for a digital dollar, including whether curtailing the use of digital assets is part of the Fed’s motivation. Link. Letter (PDF).

- One click checkout company Bolt backed out of a $1.5b acquisition of crypto payment provider Wyre. The deal was going to be the largest non-SPAC crypto acquisition to date. Link. Link.

- NFT platform Sorare is launching an officially-licensed NBA fantasy basketball game. Users will be able to create fantasy lineups using NFT cards based on pro players from the league. Sorare will launch the offering for the 2022-2023 NBA season. Link.

- Coinbase has said it would offer MakerDAO 1.5% interest if it deposited $1.6 billion USDC on Coinbase Institutional. MakerDAO would earn $24 million annually if the proposal passes. Link. Proposal.

- Binance US is offering 6% APY staking ahead of the upcoming Merge. Link.

- Coinbase is backing a lawsuit against the US Treasury Department claiming that its sanctions of Tornado Cash are illegal. The lawsuit questions whether the OFAC can target recurring code for national security purposes. Link. Brian Armstrong Tweets. Blog Post.

- Quentin Tarantino settled with Miramax over his ‘Pulp Fiction’ NFT sale. Link.

- LG Electronics launches its own NFT Marketplace called ‘LG Art Labs’ that will allow users to buy, sell, and trade NFTs directly from their LG TV. The program will be available for all US LG TV owners running webOS 5.0. Link.

- Crypto lender Voyager will auction the remainder of its assets on Sept 13, as part of its Chapter 11 bankruptcy process. Link.

- FTX Ventures is buying 30% of SkyBridge Capital for an undisclosed amount. $40 million of the funding will be used to purchase cryptocurrencies. Link.

- SEC enforcement chair Gurbir Grewal said that the SEC does not plan to slow down its legal actions against crypto companies. Link

- Crypto exchange Enclave launched a confidential trading platform for institutional investors called Enclave Cross. Users will be able to trade blocks of digital assets at the market price without any information leakage. The product was developed to be an OTC digital asset dark pool, where traders execute trades in private using smart contracts. Link.

- In an SEC filing this week, Microstrategy announced it is selling $500 million in common stock, and will potentially use the proceeds to buy more Bitcoin. The company already holds $4 billion of BTC on its balance sheet, making it the largest corporate holder of the cryptocurrency. CEO Michael Baylor stepped down recently, after the company reported $900 million in impairment charges in its quarterly earnings from the decline in bitcoin prices. Link.

- Chainalysis and US law enforcement recovered $30 million of the $600 million stolen by North Korean hackers in the Ronin exploit earlier this year. Link.

- Puma is launching a metaverse space called “Black Station” to showcase its sneaker NFT collection called Futrograde. The NFT’s are redeemable for physical sneakers, and will be showcased at New York Fashion Week. Link.

- Several US Senators issued a letter to Meta, asking for information on its efforts to prevent cryptocurrency-related scams on platforms like Facebook, Instagram, and WhatsApp. Link. Letter (PDF).

- Mysten Labs, the startup led by Meta veterans that is aiming to build infrastructure to accelerate Web3 adoption, raised $300 million at a $2 billion valuation. Link.

- The judge in the Tether class action lawsuit is set to hear arguments for removing law firm Roche Freedman as the lead plaintiff attorneys. The hearing comes after an undercover video accused Kyle Roche of bringing class actions against various crypto projects to benefit Avalanche developer Ava Labs. Link.

- A wallet responsible for the DAO Maker hack of August 2021 used Tornado Cash this week to launder $500k DAI of the $7 million in stablecoins stolen last year. Link.

- Joshua Nicholas, the founder of EmpireX, pleaded guilty to securities fraud charges for operating a $100 million crypto ponzi scheme and will face up to 5 years in prison. Link.

- JPMorgan hires Microsoft’s former CIO to lead JPMorgan Payments, its new division focused on digital payments and blockchain technology. Link.

- NFT influencer Cooper Turley launches Coop Records, a $10 million fund that will invest in music NFTs. The fund will act as a web3 venture fund, record label and incubator. Link. Blog Post.

- SEBA, a crypto-friendly Swiss bank, is launching Ethereum staking for its institutional investors ahead of the upcoming Merge. Link.