Crypto weekly is authored by maaria and david blumenfeld

PRICE CHANGE: WTD/YTD

- Crypto Market Cap ($3.84T): -6% / +13%

- BTC ($109,101): -5% / +17%

- ETH ($4,311): -12% / +29%

- SOL ($198): -5% / +5%

- UNI ($9.34): -17% / -29%

- OP ($0.675): -15% / -61%

- COIN ($305): -5% / +23%

- Tether Mkt Cap ($168B): +1% / +21%

- USDC Mkt Cap ($71.5B): +6% / +63%

- BTC / ETH Dominance: 57% / 14%

THIS WEEK IN CRYPTO

- Crypto markets experienced significant volatility with over $800 million in liquidations as bitcoin fell below $110,000 and ethereum dropped over 7% from recent all-time highs, driven by overleveraged positioning and inflation concerns. Link. Link.

- Decentralized derivatives platform Hyperliquid has outpaced Robinhood in monthly trading volume for three consecutive months, handling $330 billion compared to Robinhood's $238 billion in July 2025, despite having only 520,000 users versus Robinhood's 26.5 million funded accounts. Link.

- The Commerce Department will begin publishing economic statistics, starting with GDP figures, on the blockchain as part of the Trump administration's broader push to integrate cryptocurrency and blockchain technology into government operations. Link. Link. Link. Link.

- Spot Ethereum ETFs are on track for $4 billion in net inflows for August, significantly outperforming spot Bitcoin ETFs which face $623 million in net outflows for the month. Link.

- Decentralized lending protocol Aave launched Horizon, a new institutional platform that allows institutions to borrow stablecoins against tokenized real-world assets like Treasuries. Link. Link.

- Ethereum's onchain volume surged to over $320 billion in August 2025, the highest since mid-2021, driven by increased corporate treasury adoption, ETF inflows, record-low transaction fees, and enhanced network activity following recent upgrades. Link.

- The CFTC released regulatory guidance for foreign crypto exchanges to legally offer derivatives to US traders, potentially allowing firms like Binance to re-enter the American market and increase competition with domestic players like Coinbase. Link. Link.

- Google Cloud is developing its own blockchain called Google Cloud Universal Ledger (GCUL) for payments and financial products with Python-based smart contracts. Link.

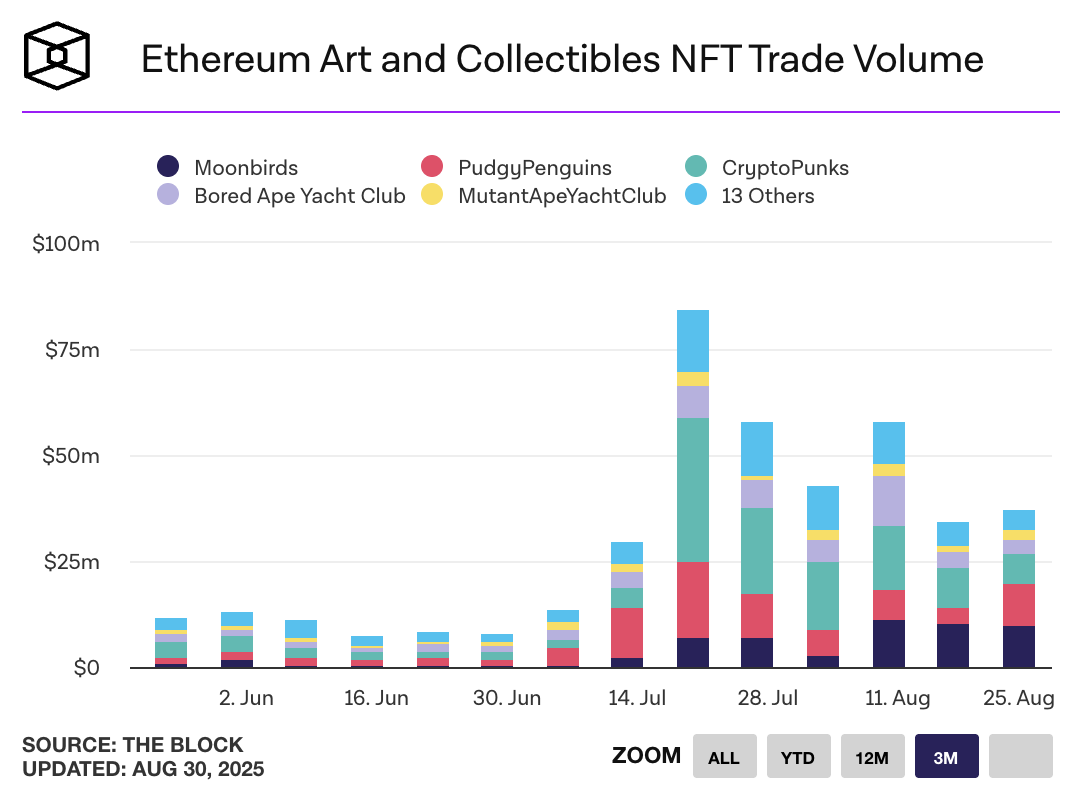

- Chinese property developer Seazen Group plans to issue tokenized private debt and launch NFT products related to its shopping centers by the end of 2025, making it the first major Chinese developer to enter the digital assets space amid Hong Kong's push for blockchain innovation. Link.

- Pete Davidson and Casey Affleck will star in "Killing Satoshi," a fictional thriller directed by Doug Liman about the mysterious Bitcoin creator Satoshi Nakamoto, slated for release in 2026. Link.

- MetaMask introduced a social login feature allowing users to create and manage self-custodial crypto wallets using their Google or Apple accounts while bmaintaining security through a user-created password that protects their Secret Recovery Phrase. Link. Link. Link.

- El Salvador split its 6,300 BTC worth over $682 million across 14 separate addresses to enhance security against potential quantum computing threats. Link.

- Decentralized derivatives platform Hyperliquid has approximately 80% of perpetual market share, and has grown its trading volume ratio against Binance from 8% to almost 14% this year, processing over $200 billion in recent months. Link.

- The Ethereum Foundation is pausing its $3 million open grants program launched in 2018 due to high application volume consuming resources, as part of efforts to reduce spending and operate more strategically with a target burn rate of 5% per year. Link.

- Rain, a startup that issues Visa debit and credit cards powered by stablecoins, raised $58 million in Series B funding led by Sapphire Ventures. Link.

- Decentralized prediction marketplace Polymarket added Donald Trump Jr. to its advisory board following a strategic investment from his venture capital firm 1789 Capital. Link.

- Metaverse game Sandbox is undergoing a major restructuring by parent company Animoca Brands that includes laying off over half of its 250 employees, removing co-founders from executive roles, closing multiple global offices, and reportedly pivoting toward building a memecoin launchpad. Link.

- Publicly traded BitMine (BMNR) added $2.2 billion in ETH and cash to its treasury last week, bringing its total crypto holdings to 1.71 million ETH worth nearly $8 billion. Link.