Crypto weekly is co-authored by @serdave

PRICE CHANGE: WTD/YTD

- Crypto Market Cap ($2.2T): -14% / +23%

- BTC ($58,892): -13% / +39%

- ETH ($2,742): -16% / +20%

- SOL ($141): -23% / +38%

- UNI ($6.26): -17% / -14%

- MATIC ($0.43): -16% / -56%

- Tether Mkt Cap ($114B): 0% / +25%

- USDC Mkt Cap ($33.2B): -3% / +36%

- BTC / ETH Dominance: 54% / 15%

THIS WEEK IN CRYPTO

- The price of bitcoin and ethereum fell below $60,000 and $3,000 respectively, amidst a poor US jobs report that also caused the S&P 500 to have its worst day since 2022. Link.

- Nine spot ethereum ETFs began trading this week. The ETFs witnessed net outflows of over $400 million, driven by the Grayscale Ethereum Trust which saw $1.5 billion in outflows. Link. Link.

- Senator Cynthia Lummis unveiled a bill to make bitcoin a strategic part of the US Treasury, for the purpose of reducing debt. The bill proposes a reserve of 1,000,000 bitcoin, to be held for a minimum of 20 years. Link.

- Donald Trump vowed to fire SEC Chairman Gary Gensler on his first day in office and make bitcoin a part of his Treasury policy. Trump also vowed to turn the US into a “bitcoin superpower” and commute the sentence of Silk Road founder Ross Ulbricht. Link. Link. Link. Link.

- The FBI arrested BitClout founder Nader Al-Naji for wire fraud related to the $257 million he raised for the decentralized social network. Allegations include spending investor funds for personal use. The SEC also filed civil charges against Al-Naji for securities violations related to BitClout. Link. Link. Link.

- Avalanche partnered with the state of California to tokenize all 42 million car titles in the state. The project allows residents to claim their vehicle titles through a mobile app, which will reduce the need for in person DMV visits. Link.

- In response to economic sanctions against the country, Russian lawmakers passed a bill allowing Russian companies to settle international transactions using cryptocurrency. Link.

- Coinbase beat earnings estimates in Q2, posting $1.4 billion revenue and $36 million net income. Though transaction revenue was down almost 30%, the company’s USDC interest program grew its balance sheet by over $730 million. It also saw significant increase in usage of its Layer 2 blockchain Base, which grew 300% over the quarter. Link. Shareholder Letter.

- USDT issuer Tether posted record profits of $5.2 billion for the first half of 2024. Tether holds $97 billion in US Treasury bills and 75,000 bitcoin in its reserves. Link. Link.

- NFT artists Brian Frye and Johnathan Mann filed a lawsuit against the SEC to get a declaratory judgment that their upcoming NFT project is not at risk of SEC suits. Link. Lawsuit.

- Circle, the issuer of the USDC stablecoin, is valued at $5 billion in the secondary market ahead of its upcoming IPO. The company tried to go public through a SPAC at a $9 billion valuation in 2022, but the deal was unsuccessful due to a lack of SEC approval. Link.

- Solana’s DEX ecosystem now has a higher trading volume than Ethereum’s, driven by 2 million weekly active addresses and $24 billion in trading volume from leading DEX Raydium. Link.

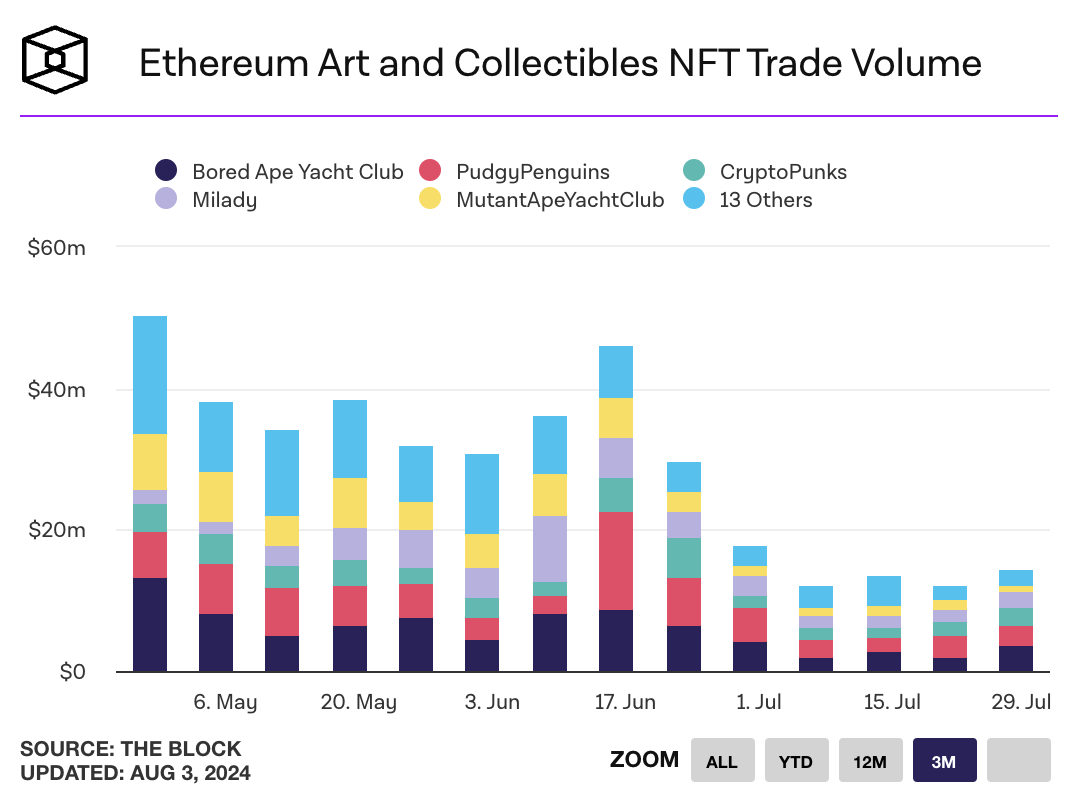

- DraftKings announced it is shutting down its NFT business, effective immediately. The company is embroiled in multiple class action lawsuits alleging its NFT sales violated securities laws. Link.

- Hamilton Lane, the investment firm with over $920 billion in AUM, launched its private credit fund on the Solana blockchain. Investors can purchase tokens that represent ownership in its Senior Credit Opportunities Fund (“Scope”). Link.

- Morgan Stanley will allow its 15,000 financial advisers to purchase spot bitcoin ETFs for their clients. Link.

- Montenegro courts ruled that Terra founder Do Kwon would be extradited to his native South Korea, rather than the United States. Do Kwon faces criminal charges in both countries related to the failed UST/Luna algorithmic stablecoin. Link. Link.

- Bitcoin’s hashrate, the amount of computational power needed to mine a block, is nearing all-time highs. Link.

- The SEC amended its complaint against Binance to drop unregistered securities charges related to third-party tokens including Solana and Polygon. Experts say the decision may have been a litigation tactic, and not a change in policy. Link. Tweet.**