PRICE CHANGE: WTD/YTD

- BTC ($20,025): -15% / -58%

- ETH ($1,099): -13% / -70%

- XRP ($0.32): -3% / -62%

- UNI ($4.16): +10% / -76%

- Crypto Market Cap ($890B): -10% / -60%

- BTC Dominance: 43%

- ETH Dominance: 14%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($68B): -6% / -13%

- USDC ($56B): +3% / +32%

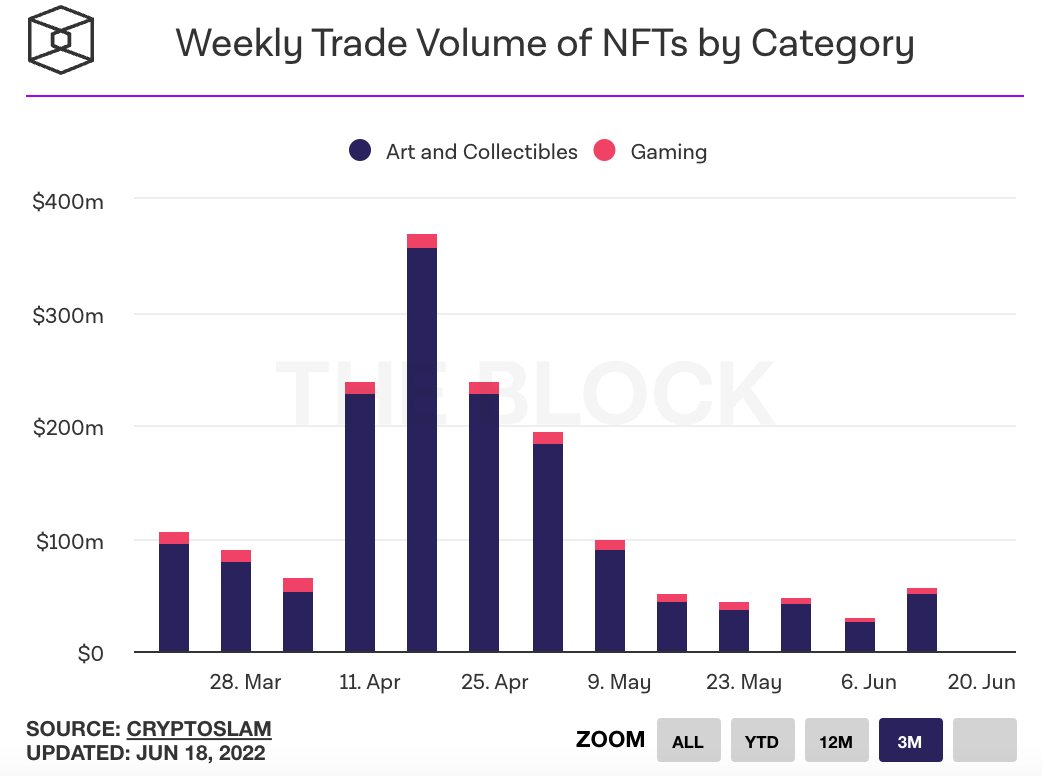

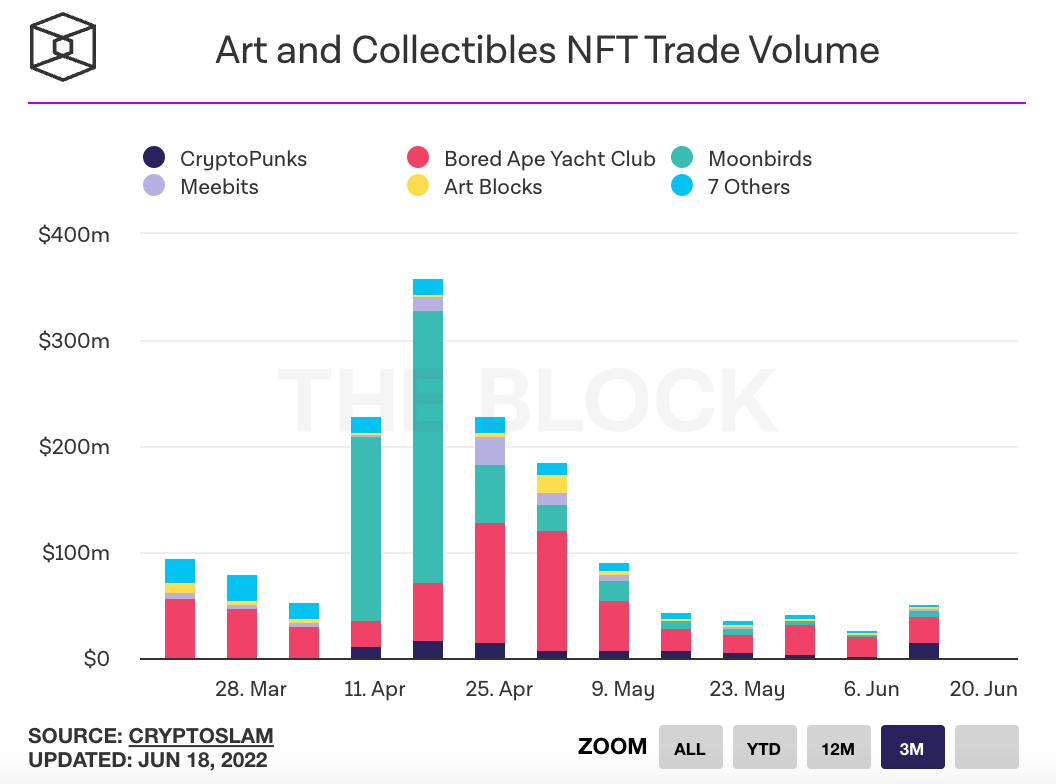

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- The price of Bitcoin fell below $20,000 for the first time since December 2020, following the collapse of Terra and Celsius. Ethereum fell below $1,000 for the first time since January 2020. Link. Link. Link.

- Celsius Network, which amassed more than $20 billion in assets by promising interest rates as high as 18% on crypto deposits, paused withdrawals this week citing marketing conditions. Celsius had invested users' funds in Terra, where it was hoping to earn more than the rates it was paying. Celsius isn't regulated as a bank and deposits aren't FDIC insured. Link. Link. Link. Link.

- FTX, Deribit and BitMEX liquidated positions held by Three Arrows Capital (3AC) after the crypto hedge fund failed to meet margin calls. Link.

- Play-to-earn platform Merit Circle will pay $1.75 million to Yield Guild Games (YGG) as a settlement after Merit Circle's DAO voted to remove YGG as an investor. The DAO originally voted to return YGG's cost basis, but instead Merit Circle made the decision to return ten times YGG's initial investment in order to protect both sides from future litigation. Link.

- Users of Solend, a decentralized lending protocol on Solana, granted emergency powers to the protocol to take over a whale's account, which was at risk of liquidation putting the protocol at risk. The proposal would have allowed Solend to liquidate the whale's assets via “over-the-counter” transactions, as opposed to on-exchange trades. The account concerned had deposited 5.7 million SOL tokens into Solend, accounting for more than 95% of deposits. Against that, it was borrowing $108 million in the stablecoins USDC and ether. By Monday users overturned the initial vote. Link. Link.

- Staked ether (stETH) is trading at almost a 7% discount to the price of ETH after a large holder unloaded 56,000 stETH in the market. Staking platform Lido created stETH ahead of ethereum's expected move to Proof of Stake. Staked ethereum is locked on the beacon chain until "the merge" (when ethereum mainnet moves from proof of work to proof of stake), which is expected to occur sometime in September. Testing issues could delay the merge. Link. Link.

- Christie's NFT head, Noah Davis, is joining Yuga Labs as brand leader for the CryptoPunks NFT collection. Yuga Labs also said it would be rolling out formal IP rights for CryptoPunks owners in the coming weeks. Link.

- OpenSea moves to Seaport Protocol, a new smart contract that will allow its 1.8 million users to save money on Ethereum gas fees. NFT holders will be ale to list multiple NFTs for sale at once and only pay one gas fee for the batch of listings. Link.

- Tether shot back at rumors about its holdings of commercial paper as collateral against its US dollar stablecoin. Tether said it had already decreased its exposure to commercial paper by 17% from $24 billion to $19.9 billion. Link.

- Circle, the issuer of the popular USDC stablecoin, is launching a Euro-based stabled coin that will be backed by euro-denominated reserves. The euro has 32% share of global trading, but euro-based stablecoins haven't taken off to the same extend as those based on the dollar. Link. Link.

- Voyager Digital signed a non-binding term sheet with Alameda Research for a revolving line of credit to safeguard customer assets in light of market volatility. Voyager added more than $200 million on its balance sheet. Link.

- Samsung launched an Apple Wallet competitor called Samsung Wallet. Samsung Wallet helps users store their cards, digital keys, IDs and more, and users will also be able to easily monitor their digital asset portfolios through an integration with Samsung Blockchain Wallet. Link.

- A class action lawsuit has been brought against Do Kwon and Terraform Labs face a class action lawsuit for selling unregistered securities and making false statements about the stability of TerraUSD (UST) and the related LUNA token to induce investors to purchase them. Link.

- El Salvador's Finance Minster said the crypto market crash poses an "extremely minimal" fiscal risk to the country, which holds millions in BTC in its treasury. He said El Salvador hasn't suffered losses since it has yet to sell the cryptocurrency. Link.

- Coinbase is being sued in relation to its promotion of the TerraUSD (UST) stablecoin. The lawsuit claims Coinbase misled investors into believing they were purchasing a "reserve-backed stablecoin". TerraUSD is not backed by actual US dollars. Link.

- Meta partners with Balenciaga, Prada, and Thom Browne to launch a digital fashion marketplace where creators can design and sell fashion NFTs for Web3. Link.

- Immutable launches $500M developer and venture fund which will invest in web3 games and NFT-focused companies building on its layer-2 network, ImmutableX. Link.

- The SEC has reportedly launched a probe into how crypto exchanges are safeguarding against insider trading. Link.

- Three Arrows Capital (3AC) was pitching investors for an arbitrage opportunity involving Grayscale's bitcoin-linked fund GBTC just days before the firm was liquidated across several exchanges by several lenders. There is speculation this was a last-ditch effort by the firm to lock up BTC and borrow against it as collateral for its other loans. Link.

- Elon Musk told Twitter employees he wanted to integrate crypto payments into Twitter more broadly. Link.

- A Dogecoin investor is suing Elon Musk, Tesla, and SpaceX claiming their actions with DOGE constituted a Ponzi scheme. The complaint calls for triple the damages of $86 billion, which is how much the plaintiff alleges has been lost by Dogecoin investors since Musk first started tweeting about it. Link. Musk tweeted he would keep supporting DOGE despite the lawsuit. Link.

- Phantom and Metamask patched a major vulnerability that sometimes caused user seed phrases to be stored on their hard drive. Link.

- A new report from the Federal Reserve points to the recent collapse of TerraUSD and other algorithmic stablecoins as examples of financial stability risks in the crypto markets. Link. PDF Report.

- Crypto firms have laid off more than 1,500 people in the last 2 months, driven mostly by crypto exchanges. Coinbase laid off 18% of its workforce (roughly 1,100 people), Gemini 10%, and BlockFi 20%. Link. Link.

- Celsius hired Citigroup to assess its options after it abruptly halted withdrawals. Link.

- The FBI warns of an increase in LinkedIn cryptocurrency scams. Link.

- FTX is acquiring Canadian cryptocurrency trading platform Bitvo. Link.

- The team behind Words with Friends raised $46 million for a new gaming venture on Polyogn. Wildcard Alliance a "hybrid multiplayer online battle arena" and also a collectible card game where players compete live in front of fans. Link.