This week's crypto weekly was co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($26,109): -4% / +58%

- ETH ($1,750): -8% / +46%

- SOL ($15.46): -30% / +59%

- UNI ($4.31): -15% / -16%

- MATIC ($0.65): -28% / -14%

MARKET CAP CHANGE: WTD/YTD

- Crypto Market Cap ($1.1T): -8% / +34%

- BTC Dominance: 48%

- ETH Dominance: 20%

- Tether ($83B): 0% / +26%

- USDC ($28B): -2% / -36%

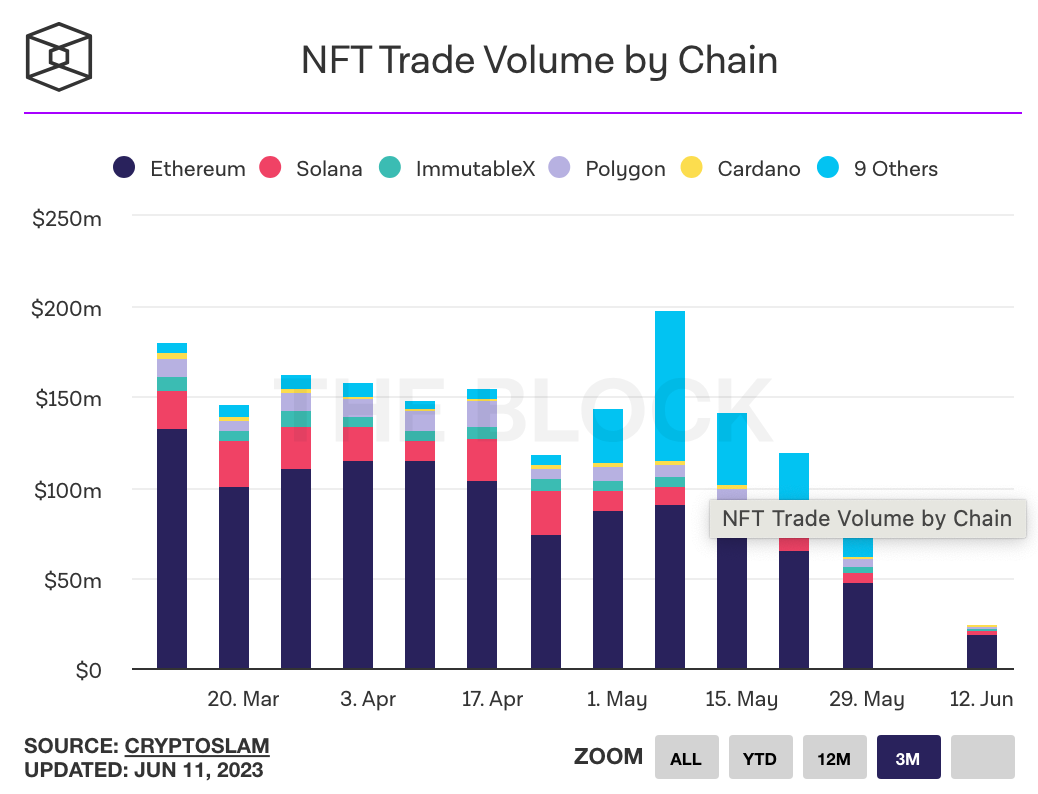

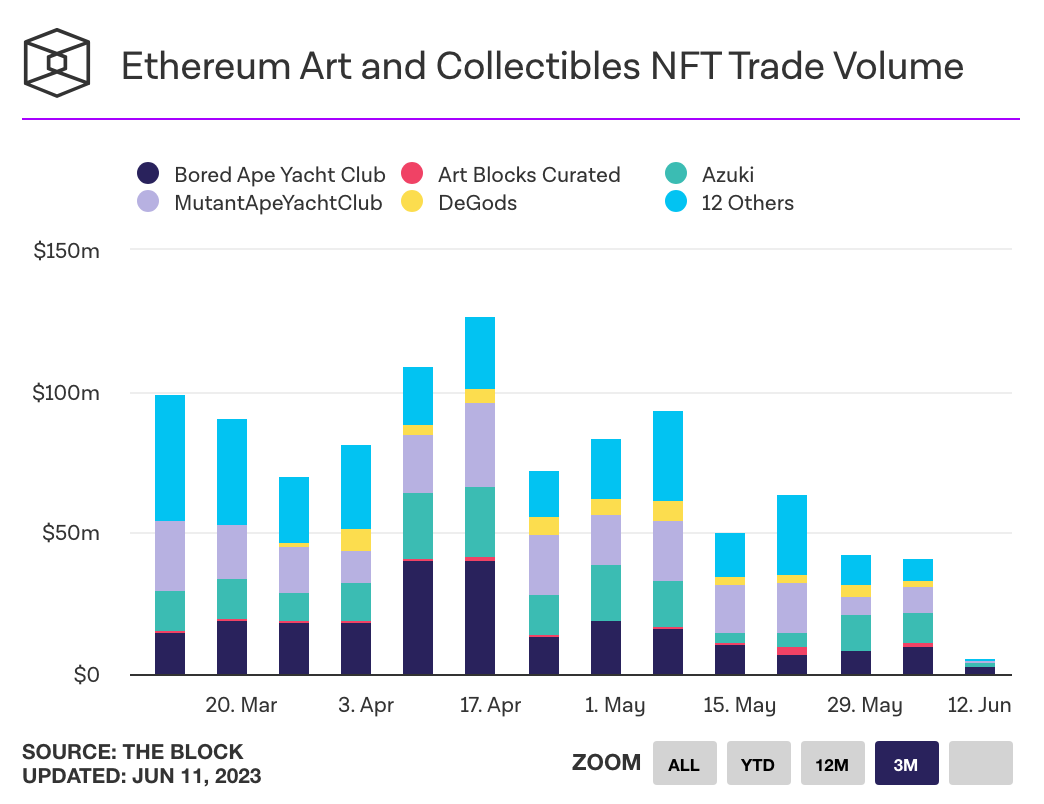

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

[Maaria & Dave Note] This week included a myriad of regulatory and legislative events that will influence the future of crypto in the United States. Given the breadth of the events, crypto weekly has a different format than usual.

*TL;DR: The SEC brought charges against two of the largest crypto exchanges, Binance and Coinbase, for violating securities laws and operating as unregistered exchanges by selling tokens such as Solana (SOL), Polygon (MATIC), Sandbox (SAND), Axie Infinity (AXIE). The SEC has yet to bring lawsuits against the protocols themselves.

In addition to securities violations, the SEC also brought fraud charges against Binance and its CEO CZ, alleging misappropriation of customer funds as well as non-compliance with banking rules. Most notably, the lawsuit against Coinbase does not include allegations of fraud and does not name Coinbase CEO Brian Armstrong personally.

For those interested in crypto policy and legislation in the United States, tomorrow will be a big day to watch. The 'Hinman docs', internal emails from the SEC staff discussing crypto policy, will finally be made public. The SEC will respond to an order on Coinbase's petition for regulatory clarity. The SEC will also make its case on its motion to temporarily freeze Binance US assets.*

BINANCE LAWSUIT

Court Filing (PDF), Court Listener

- The SEC sued Binance for selling unregistered securities, mishandling customer funds, and allowing US-users to illegally access the international exchange, among other complaints. Binance is the world’s largest crypto exchange accounting for over 50% of centralized exchange trading volumes. Link. Link. Binance Response.

- The SEC alleges that Binance sold unregistered securities including: Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos (ATOM), Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity (AXS), Coti (COTI).

- Following its lawsuit against Binance, the SEC sought an emergency order to temporarily freeze the $2.2B assets of its US-based subsidiary, Binance US to “ensure that customers’ assets are protected and remain in the US”. Link. Link. Filing.

- The SEC suit also alleges that Binance moved $70 billion of potentially customer funds through US bank accounts via now-defunct Silvergate Bank and Signature Bank. The complaint alleges the accounts were non-compliant with banking regulations and were controlled by Binance CEO CZ. Link. Link. Link.

- Fraud charges against CZ include allegations that CZ-controlled entities received between $11-$22 billion from Binance-related entities and accounts in 2020 and 2021. Some of these funds were allegedly used for yacht and private plane services. Link.

- Binance US suspended trading on its platform using US dollars and would transition to a “crypto-only exchange”. Link. Link. Link. Tweet.

COINBASE LAWSUIT

Court Filing (PDF), Court Listener

- The SEC sued Coinbase alleging the company was operating as an unregistered exchange by selling unregistered securities on its platform. Coinbase shares fell 12% on the news. Link. Link.

- 10 states simultaneously sued Coinbase for allegedly violating securities laws. Coinbase has 28 days to ‘show cause’ as to why they should not be directed to cease and desist from selling cryptocurrencies in those states. The states filing charges include: California, Illinois, Kentucky, Maryland, New Jersey, South Carolina, Vermont, Washington, Wisconsin, and Alabama. Link. [State specific actions linked above].

- Coinbase’s chief legal officer said the company would continue to operate as usual, as it fought the SEC’s enforcement action. Link. Tweet.

- A US judge ordered the SEC to clarify its position on Coinbase’s petition from July 2022 asking the Commission to clarify its regulations around digital assets. The SEC must specify whether it has decided to deny Coinbase’s petition, and if not, how much time it requires to determine whether to grant or deny the request. Link. Court Order.

CONGRESSIONAL EFFORTS

- Republican lawmakers proposed the “SEC Stabilization Act” which would restructure the SEC to add a sixth commissioner and remove Gary Gensler as Chair. Link. Statement.

- The US House Financial Services Committee released a draft stablecoin bill, that would allow the Fed to write requirements for issuing stablecoins while still allowing states to oversee the companies issuing the tokens. The draft includes inputs from both Democrats and Republicans. Link. Draft.

- Representatives Patrick McHenry and GT Thompson released draft legislation providing a statutory framework for digital asset regulation. Link. Link. Draft.

- Elizabeth Warren wrote a letter to US Attorney General Merrick Garland asking the DOJ to investigate Binance and its American affiliate Binance US. Link. Link.

MARKET RESPONSE

- Coinbase and Binance US saw $4 billion of deposit withdrawals. Link. Link.

- Tokens listed as securities by the SEC in its lawsuits against Coinbase and Binance tumbled over 28% during the week, losing around $23 billion in market capitalization. Link. Link.

- Moody’s changed its outlook on Coinbase (COIN) from stable to negative. Link. Report.

- Robinhood is cutting support for Cardano, Polygon and Solana. Link. Link. Link. Statement.

- Financial trading platform eToro announced that US customers would no longer be able to purchase Algorand (ALGO), Decentraland (MANA), Dash (DASH) and Polygon (MATIC). Link.

- Venture firm Andreessen Horowitz plans to open its first international office in the UK, which it says ‘sees the promise of web3’. Link. Link. Blog Post.

- Singapore-based exchange Crypto.com said it would wind down its US institutional practice. It plans to keep naming rights for the Los Angeles Crypto.com Arena, which was previously known as the Staples Center. Link.

OTHER NEWS

- The DOJ charged two Russian men with hacking Bitcoin exchange Mt. Gox and laundering roughly 647,000 (worth about $17 billions today) of the 850,000 stolen bitcoin through their crypto exchange BTC-e. Link. Link. DOJ Press Release.

- Ethereum founder Vitalik Buterin released a blog post outlining the protocol’s need for scaling solutions, secure wallets, and better privacy features. Link. Blog Post.

- Interbank messaging system Swift and decentralized oracle Chainlink will be collaborating with dozens of financial institutions to test the transfer of tokenized assets across blockchains. Link. Press Release.

- Decentralized social media platform Lens Protocol raised $15 million. Link.

- Crypto trading volume on Robinhood fell 68% in May as compared to May 2022. Link. Release.

- 3 venture firms are suing the CEO of DeFi platform Curve Finance alleging fraud. ParaFi Capital, Framework Ventures, and 1kx allege that Egorov misappropriated trade secrets and moved to Switzerland to avoid legal fallout. Link.

- Mike Novogratz’s Galaxy Digital won the dismissal of a BitGo lawsuit over its abandoned $1.2 billion acquisition of the crypto custodian. Link.