PRICE CHANGE: WTD/YTD

- BTC ($36,023): +1% / +24%

- ETH ($2,436): +11% / +230%

- XRP ($0.92): +13% / +318%

- UNI ($26): +51% / +435%

- Crypto Market Cap ($1.5T): +8% / +105%

- BTC Dominance: 43%

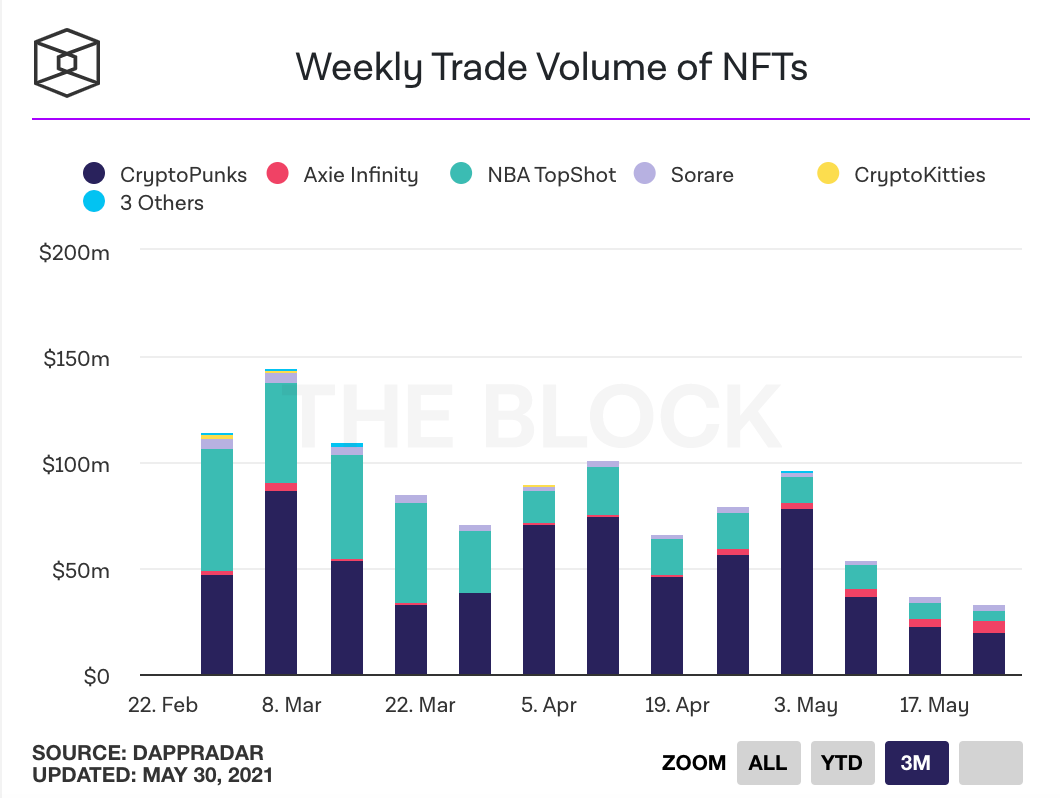

NFT 3M TRADING VOLUMES

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($62B): +3% / +195%

- USDC ($22B): +56% / +477%

THIS WEEK IN CRYPTO

- Uniswap, the largest DEX on Ethereum and second largest across all blockchains, is considering using Arbitrum as a second layer scaling solution. Arbitrum uses optimistic rollups and processes transactions on a sidechain that is then settled in batches on the Ethereum mainnet. Arbitrum is launching on Friday and voting for the UNI deployment is taking place through an off-chain snapshot poll where anyone can vote with UNI tokens. Voting is done through signing on MetaMask rather than directly on the blockchain. Uniswap was expected to launch on Optimism, a rival scaling solution, but Optimism delayed its mainnet launch until July. So far, 41 million UNI tokens have voted in favor of the proposal. Link.

- PayPal and Venmo will soon allow users to send their cryptocurrencies to third-party wallets. Currently users can buy/sell on the platforms but can't transfer. Link.

- Andreessen Horowitz is reportedly doubling the size of its third crypto fund to $2 billion. In April the firm had reportedly been looking to raise between $800 million and $1 billion. Link.

- The IRS is being sued by 2 Tezos users who paid thousands of dollars in taxes as a result of Tezos mining. The couple sought a refund for their tax payment, claiming that crypto earned through staking should not be taxed until it is sold or exchanged. The lawsuit is backed by an org called the Proof of Stake Alliance, whose board includes execs from Tezos, Polychain Capital, and Bison Trails. Link.

- Uniswap may run a liquidity mining program again soon according to its founder Hayden Adams. Liquidity mining is a kind of yield farming in which users of a DeFi product earn an additional token on top of the regularly expected yield just for putting assets into a liquidity pool. Link.

- A Chainalysis report indicated that investor whales bought the bitcoin dip this week, buying over 77k bitcoin, representing over $2.5 billion Link.

- Hasbro CEO Brian Goldner announced the company was pursuing NFT opportunities, particularly in digital gaming, during their Q1 2021 earnings call. Hasbro has already seen success with collectible cards through its fantasy game called Magic: The Gathering. Link.

- Canadian crypto lender Ledn raised $30 million in Series A at a $230 million valuation from investors like Alan Howard, Alexis Ohanian, and ParaFi Capital. Ledn provides Bitcoin-backed loans, bitcoin and USDC savings accounts. It manages more than $1 billion of assets and originated over $120 million in bitcoin-backed loans in Q1. Link.

- Apple posted a job listing for a BD Manager for its alternative payments group, which includes digital wallets and cryptocurrencies. Apple has yet to accept crypto in its App Store. Link.

- Infinite Objects, a startup turning NFTs into physical collectibles through a video display, raised $6 million in seed funding from investors including Courtside VC, Dapper Labs, and Sound Ventures. The company had partnered with artist Beeple in December to release physical tokens of NFTs he was selling on Nifty Gateway. Link.

- UC Berkeley is selling NFTs of the digital data related to Nobel Prize-winning inventions for gene editing and cancer immunotherapy on NFT platform Foundation. Berkeley will keep 85% of primary proceeds and 10% of secondaries. Link.

- Coinbase is expanding its prime brokerage services for institutional customers, adding pricing on 12 different regulated exchanges, smart-order routing, and concierge support for trading teams. Coinbase has more than 8,000 institutional clients with $122 billion in assets on the platform. Link.

- Recently launched Meme.com, which is bringing together memes and NFTs, has raised $5 million from Outlier Ventures, Morningstar and Spark Digital Capital. Link.

- Middleware crypto startup QuickNode raised a $5.3 million seed round led by Seven Seven Six, a venture fund founded by Alexis Ohanian. The company provides APIs to query blockchain data and support dApps across Bitcoin, Ethereum, Binance Smart Chain, Polygon, and Optimistic Ethereum. QuickNode clients include CoinGecko, DappRadar and Dune Analytics. Link.

- Users buying WAX tokens on the MoonPay app did not receive their tokens in their wallets for several days due to problems with its liquidity partner Bittrex Global. The price of WAX fell from $0.18 to $0.11. Link.

- Ripple CEO Brad Garlinghouse said the crypto company wanted to go public once its legal battle with the SEC was resolved. Link.

- Cops in the UK stumbled upon an illegal bitcoin mining farm. Cops had thought they were going after an illegal cannabis farm because of the heat emanating and high power consumption. Link.