Crypto weekly is co-authored by @serdave

PRICE CHANGE: WTD/YTD

- Crypto Market Cap ($2.5T): +6% / +43%

- BTC ($66,718): +8% / +57%

- ETH ($3,069): +4% / +34%

- SOL ($170): +17% / +67%

- UNI ($7.70): +8% / +5%

- MATIC ($0.69): +1% / -27%

- Tether Mkt Cap ($111B): +1% / +21%

- USDC Mkt Cap ($33B): +1% / +37%

- BTC / ETH Dominance: 51% / 15%

THIS WEEK IN CRYPTO

- The House and Senate passed a bill to overturn an SEC accounting rule that requires custodians to account for digital assets as liabilities on their balance sheets, instead of accounting for them similar to stocks and bonds. Despite overwhelming support in favor of the bill, President Biden plans to veto the bill. Link. Bill. SEC Bulletin 121.

- Oklahoma became the first state to sign legislation into law protecting its citizens’ right to self-custody digital assets. The bill also legalizes mining, staking, and node operating without requiring a money transmitter license. The law takes effect November 1st. Link. OK-3594 (PDF).

- The price of bitcoin rose in response to better-than-expected inflation data and increased optimism that the Federal Reserve will begin lowering interest rates. Link.

- Ethereum co-founder Vitalik Buterin proposed EIP-7706, which would introduce a new type of fee for calldata. The costs of transmitting data in transactions would be distinct from the costs of executing transactions and storing data. Link. EIP-7706.

- The DOJ charged two MIT students with wire fraud, accusing them of stealing $25 million in cryptocurrency by exploiting a vulnerability in the MEV (“Maximal Extractable Value”) open source software used to optimize ethereum block-building. Link. Link. DOJ Indictment.

- President Joe Biden ordered a Chinese-owned bitcoin miner in Wyoming to shut down, citing national security concerns related to its proximity to a nuclear missile base. Link. Link. Order.

- Bankrupt crypto lender Genesis Global received court approval to begin distributing $3 billion in cash and assets to creditors. Creditors include users of crypto exchange Gemini who had participated in its Earn program. Link. Link.

- Tornado Cash developer Alexey Pertsev was sentenced to 64 months in prison after being convicted on money laundering charges related to the Tornado Cash software. Pertsev is appealing the conviction. Link. Link.

- Morgan Stanley disclosed spot bitcoin ETF holdings worth over $270 million, making it one of the largest institutional holders of spot bitcoin ETFs. Link.

- House lawmakers are expected to vote next week on FIT21, a Republican-led bill aimed at digital asset regulations that shifts more regulatory responsibility to the CFTC. If the bill passes the House, it will go to the Senate where it is expected to face an uphill climb. 60 crypto firms signed a letter supporting the bill. Link. Link.

- Crypto prime brokerage firm Falcon Labs agreed to pay $1.7 million in fines for failing to register with the CFTC as a futures commission merchant. Link.

- The State of Wisconsin’s pension fund holds over $163 million in spot bitcoin ETFs. It also holds crypto-related stocks such as Coinbase and Cipher Mining. Link. Link.

- Circle filed paperwork to move its legal base from Ireland to the US ahead of a possible IPO. Link.

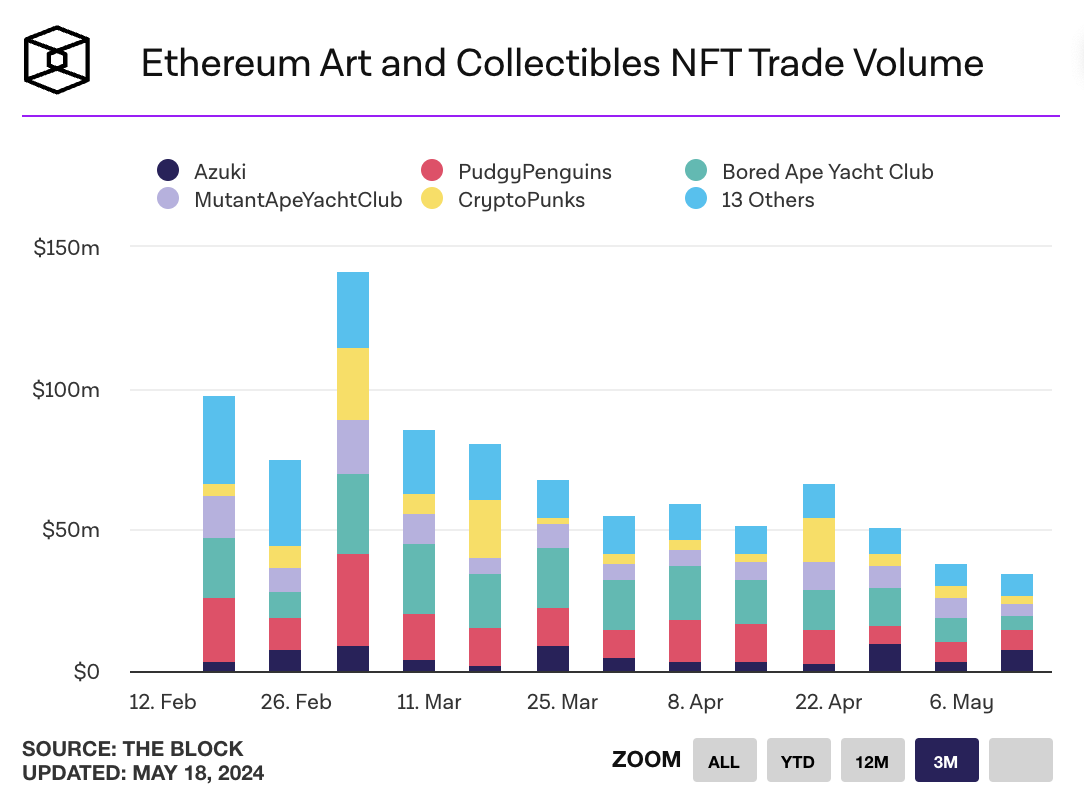

- NFT marketplace OpenSea is third behind Blur and Magic Eden in terms of trading volumes, but leads in number of users. Link. DappRadar.

- NFT collection Pudgy Penguins said it sold over 1 million plushies in just under a year. Link.