PRICE CHANGE: WTD/YTD

- BTC ($43,290): -7% / -8%

- ETH ($3,290): -6% / -12%

- XRP ($0.77): -8% / -9%

- UNI ($10.26): -13% / -41%

- Crypto Market Cap ($2.0T): -7% / -10%

- BTC Dominance: 41%

- ETH Dominance: 20%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($82.6B): 0% / +5%

- USDC ($51B): -1% / +20%

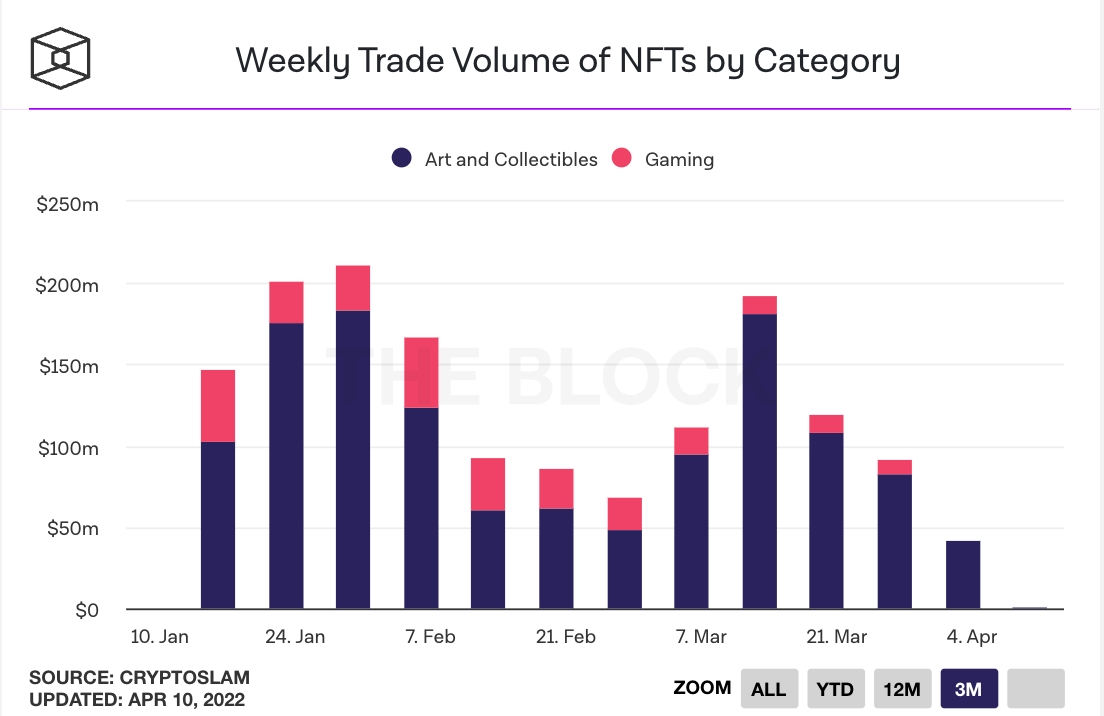

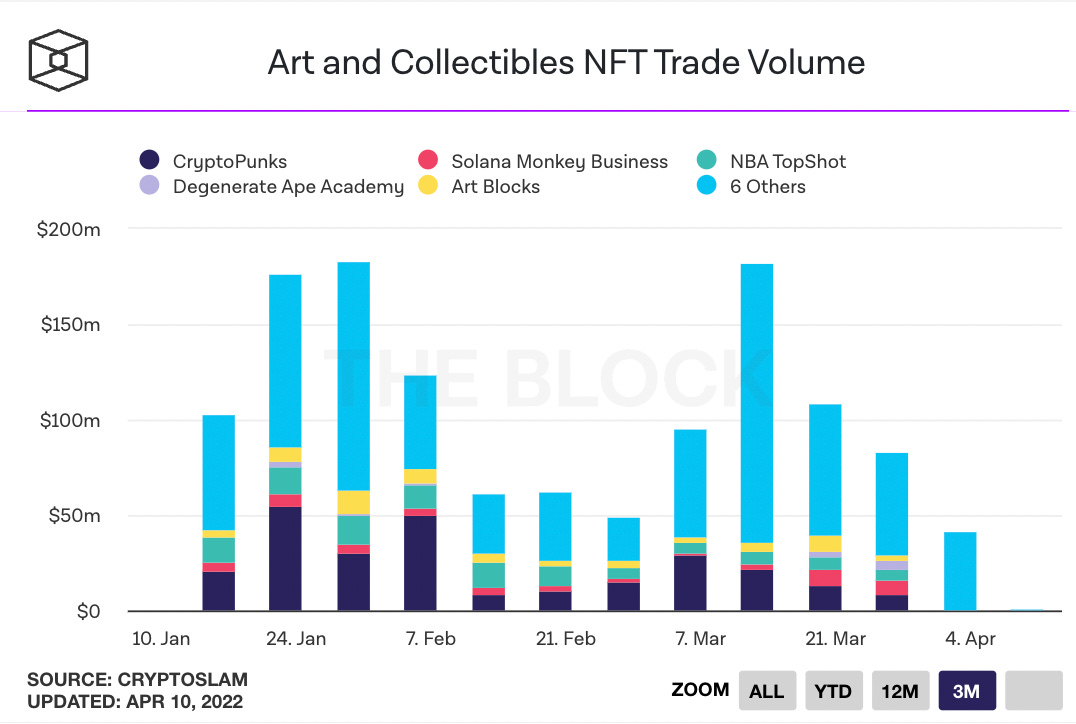

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- The Federal Reserve reiterated its commitment to tightening monetary policy, leading to a 6% decline in the crypto markets. The Fed plans to get inflation down through interest-rate increases. Link.

- At least 153 pieces of crypto-related legislation were pending this year in 40 states and Puerto Rico. State proposals include bills to exempt crypto from securities laws intended to protect investors from fraud. Other legislation would exclude certain crypto transactions from money-transmission laws enacted to curb money laundering. A bill in North Carolina introduced a bill to create a regulatory "sandbox" for financial technology projects in crypto. Link.

- Ledger unveils Ledger Nano S Plus, its newest wallet that offer clear signing features to prevent collectors from falling for NFT scams. Link.

- Payments infrastructure service Worldpay will now allow merchants the ability to settle directly in USDC. Link.

- Crypto exchange traffic increased 6.1% mom to 360 million visits in March, with Binance (32%) and Coinbase (16%) as the leading exchanges. Link.

- Yearn Finance became the first major protocol to publicly support the adoption of ERC-4626, a new token standard aimed at streamlining yield-bearing tokens. Link.

- Sky Mavis, the firm behind play-to-earn game Axie Infinity, raised $150 million from Binance, a16z, Paradigm, Accel and others to reimburse user funds lost in the $625 million Ronin attack. Link. Axie founder said it may take up to two years for the full funds to be recovered, and that the company would take a $450 million balance sheet hit in the near-term to reimburse users. Blockchain data shows that some of the stole Ether was moved to Tornado Cash to mask the stolen money. Link.

- Adam Back's Blockstream and Jack Dorsey's Block (fka Square) are building a crypto mine in Texas that will be powered by a Tesla solar installation and batteries. The development will cost $12 million, and plans to make energy consumption and hashrate data publicly available. The facility will be complete by the end of 2022. Link. Link.

- The SEC approved a Bitcoin futures ETF under the Securities Act of 1993, the first indication that the SEC could approve a spot Bitcoin ETF soon. Link.

- Lightning Labs raises $70 million Series B led by Valor Equity. It also announced a new protocol called Taro that will enable the use of stablecoins in Lightning Network apps such as Strike. Link.

- An owner of 104 CryptoPunks took out an $8.3 million loan at a 10% APR on the collection, the largest NFT loan to date. The loan occurred on NFTFi with a liquidity-DAO called MetaStreet providing the capital. Link.

- The Pudgy Penguins NFT collection was sold for 750 ETH, or roughly $2.5 million, to Luca Netz. The sale comes just a few months after the project voted out controversial founder ColeThereum. Link.

- Payments network Strike is partnering with Shopify to allow all of its merchants to accept bitcoin payments via Lightning Network. Strike will instantly convert those payments into dollars on behalf of the merchants. Link.

- One-click checkout platform Bolt is acquiring Wyre Payments for $1.5 billion. Wyre's platform allows users to move money between crypto and fiat. The acquisition will allow Bolt's retailers to accept crypto as payment for goods and services, and will allow for the purchase of NFTs through Bolt using Wyre's APIs. It is one of the sectors largest non-SPAC acquisitions to date. Link.

- Robinhood's crypto wallet is now available to 2 million customers, meaning users can move crypto in and out of the app. Robinhood also announced support for bitcoin transactions on the Lightning Network. Link.

- Improbable raises $150 million led by a16z and SoftBank Vision Fund 2 to build an interoperable metaverse network, where thousands of users can participate in a virtual world simultaneously. Link.

- Bitstamp will offer a white-label version of its crypto trading services to banks and fintechs in the US. It can also provide AML/KYC features as well as custodial services. Link.

- Layer 1 NEAR Protocol raised $350 million in a round led by Tiger Global. Link. It's also expected to launch its own stablecoin called USN which could offer up to 20% yields. Link.

- Crypto data firm Coin Metrics raised $35 million in funding. Link.

- Pantera Capital is raising a $200 million Select Fund to invest in growth stage deals. Link.

- Cash App users can now invest direct deposits directly in bitcoin. In a few weeks users will also be able to invest change from debit transactions directly in bitcoin. Link.

- Samson Mow, previously Chief Strategy Officer at Blockstream, raised $21 million at a $100 million valuation for his latest startup called JAN3. JAN3 will focus on building infrastructure like lightning payments, and has signed an MOU with El Salvador to supply digital infrastructure for the country and Bitcoin City. Link.

- Kevin Smith is launching his latest movie "KillRoy Was Here" as a collection of 5,555 NFTs on the Cosmos-based Secret Network, which also released Quentin Tarantino's "Pulp Fiction" NFTs earlier this year. Only tokenholders will be able to view the film. Link.

- Influencer Logan Paul raised $8 million for a marketplace that will tokenize high-end collectibles and make them accessible for anyone. Link.

- Scammers are hijacking the accounts of verified Twitter users and sending phishing links for a fake Azuki NFT airdrop. Link.

- Shares of Robinhood and Coinbase slipped 5% and 2.5% respectively after Goldman Sachs downgraded the stocks from neutral to sell. Link.

- A new IMF report shows that crypto is more popular in countries perceived as corrupt or with strict capital controls. Link.

- Algorithmic stablecoin Neutrino was depegged from the dollar after Waves, the token backing the stablecoin, fell more than 26% in 24 hours. Link.

- Mexican billionaire Ricardo Salinas says his liquid portfolio is 60% bitcoin, up from 10% bitcoin in 2020. Link.

- Meta, the parent company of Facebook, is reportedly interested in creating tokens for use within its metaverse. Facebook is reportedly building a closed metaverse where it controls and owns the data on its platform. Link.

- Popular Solana collections like Solana Monkey Business, DeGods, and DeGenerate Ape Academy are now available on OpenSea. Link.

- FTX said it would hold back on token listings due to regulatory uncertainty. Link.

- Terra added $230 million to its Bitcoin reserves, bringing its total bitcoin reserves to $1.6 billion. Link.

- Ocean's Eleven director Steven Soderberg is launching a $300k grant on Roman Coppola's blockchain film financing project, Decentralized Pictures. Link.

- Ledger is acquiring 36 tracts of land in The Sandbox. Link.

- SEC chairman Gensler wants the SEC and CFTC to regulate crypto exchanges together, eliminating confusion by giving exchanges a single regulatory authority to turn to. Link.

- Celo announced plans to launch a $20 million incentive fund. Link.

- Binance US raised $200 million in its seed funding, at a pre-money valuation of $4.5 billion. Link.