PRICE CHANGE: WTD/YTD

- BTC ($38,055): -2% / -19%

- ETH ($2,525): -4% / -32%

- XRP ($0.76): +3% / -9%

- UNI ($8.26): -5% / -52%

- Crypto Market Cap ($1.7T): -3% / -23%

- BTC Dominance: 42%

- ETH Dominance: 18%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($80B): 0% / +2%

- USDC ($52B): -1% / +24%

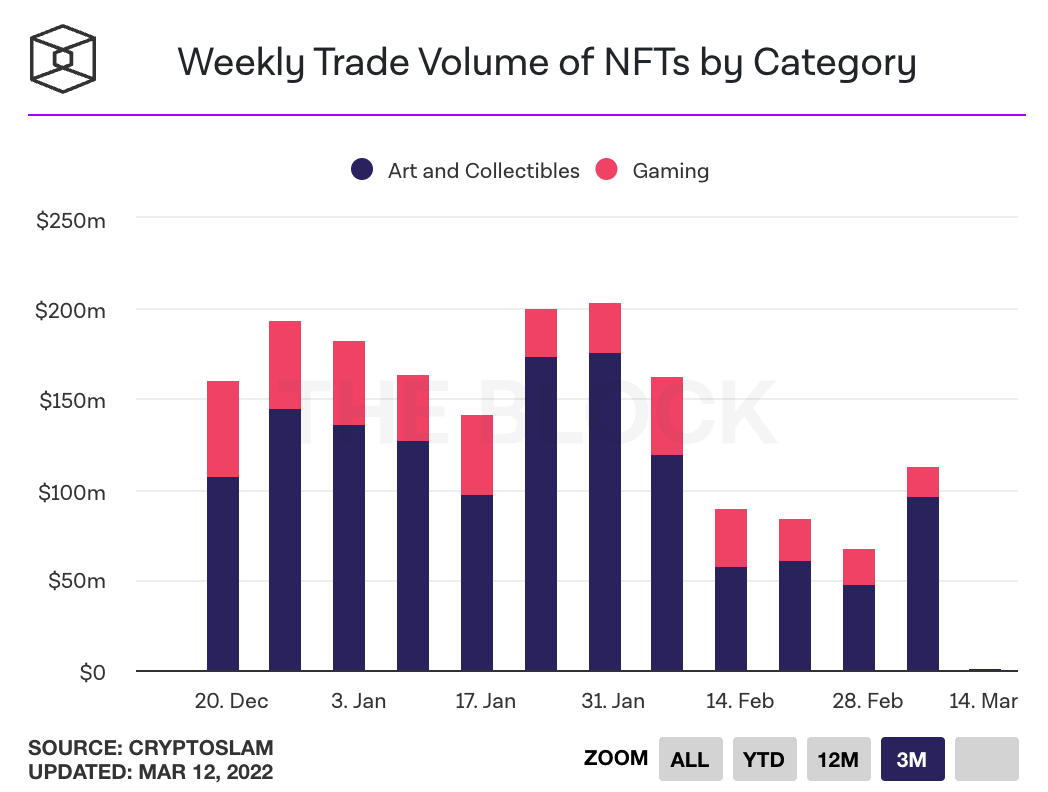

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

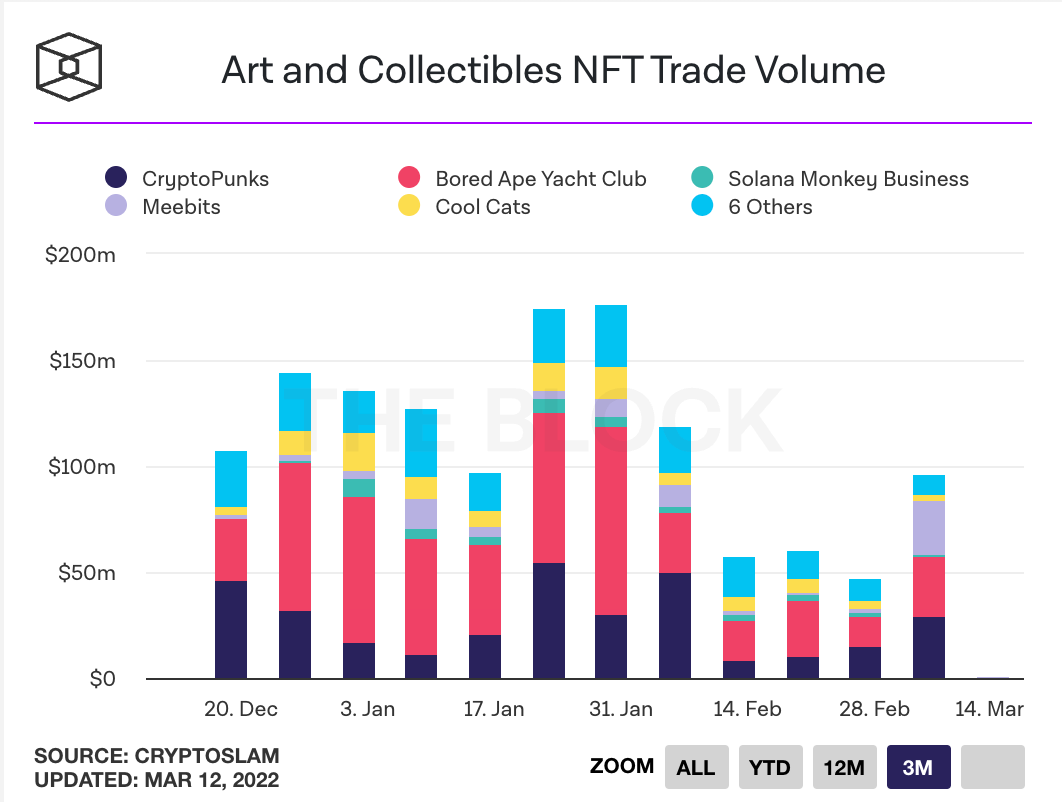

- Yuga Labs, the creators of the Bored Ape Yacht Club NFT collection, acquired the IP of the CryptoPunks and Meebits NFT collections from Larva Labs and gave commercial rights to holders. Bored Apes and CryptoPunks are the two most valuable NFT collections by market cap, valued around $3.6 billion. Mirror Post. Link.

- Ukraine has received close to $100 million in crypto donations. Link.

- 40 million Americans, around 16% of the population, have invested in, traded, or used crypto. Link.

- President Biden's executive order on cryptocurrencies called for consumer protection while promoting innovation and access. The order also directed regulatory agencies to research the development of a US Central Bank Digital Currency. Link. Link. Link. Executive Order.

- The NFT market had $18 billion of trading volume and $5.5 billion of net profits in 2021. Link.

- Payments giant Stripe is launching a crypto offering. Web3 companies will be able to buy and store crypto tokens, offer fiat off-ramps, trade NFTs, and handle KYC and fraud prevention. Users will be able to purchase more than 135+ cryptocurrencies with fiat from 180 countries. Tweet. Link. Site.

- Terra's LUNA token rose 25% this week, making it the 6th largest currency by market cap. LUNA prices rose as demand for the algorithmic USD stablecoin TerraUSD (UST) grew. Link.

- $4 billion hedge fund Fir Tree is shorting the Tether stablecoin, USDT. Fir Tree doesn't believe Tether has the reserves to back its $80 billion in coins dollar for dollar, specifically its thesis centers around Tether's roughly $24 billion in high yield paper, which it believes is loosely tied to Chinese real estate developers. China's real estate sector is in crisis, and government intervention and restructuring is likely. Link.

- The Swiss government is freezing crypto assets owned by Russian citizens and businesses. 223 Russian, including close associates of Putin, had their accounts frozen. Link. As a result many Russians are looking to the UAE to sell their crypto assets. Link.

- The Sandbox is granting $25 million to World of Women to launch the WoW Foundation and bring more women into NFTs through education and mentorship. Link.

- OpenSea did $2.3 billion in transaction volume over the past 30-days, a 40% decrease over the previous 30-day period. Link.

- Ethereum fees hit their lowest rate since August 2021. The cost of a token swap is roughly $15, well below the $200 cost in fall. Link.

- Polychain and Arca proposed cutting Anchor Protocol's current 20% yield to by 2% to 9.5% for users with over $100k in deposits. Anchor currently has $12.7 billion in total value locked (TVL) making it the largest DeFi protocol in the Terra ecosystem, and the fourth largest across all blockchains. Link.

- Chainalysis launched an oracle for identifying sanctioned wallets on Ethereum and EVM-compatible chains like Polygon and Avalanche. Later this month it will release a free API that can identify sanctioned wallet addresses across all chains. Link.

- Ethereum's 2.0 staking contract holds over 10 million ETH (over $25 billion) ahead of the networks transition from proof-of-work to proof-of-stake. Stakers are earning 4.81% in ETH rewards, which is less than staking on Terra (6.07%) and Solana (5.72%). Link.

- Web traffic to crypto exchanges fell 20% m-o-m in February to 339 million. Binance made up 31% of traffic, followed by Coinbase at 18%. Monthly traffic peaked in Nov 2021 at 546 million. Link.

- StarkWare, an ETH Layer 2 developer that uses ZK-rollup tech, is rumored to be raising $100 million at a $6 billion valuation. Link.

- Creators using Adobe's Behance creator platform can now mint NFTs directly on Polygon. Link.

- Polygon was down for roughly eight hours this week due to a technical upgrade that caused the network to stop producing blocks. Link.

- FTX is launching services for institutional clients, including index products, analytical tools, and advisory services. Link.

- Blockchain infrastructure platform Blockdaemon purchased crypto on-ramp provider Gem for an undisclosed amount. Link.

- dYdX released a beta of its iOS mobile app to 10k users, making it one of the first DeFi platform to go mobile. Link.

- Warner Bros is creating over 6 million DC Comics-inspired physical trading cards packaged with redeemable NFTs featuring 165 different superheroes. The NFTs will be minted on Ethereum side chain ImmutableX and will be priced between $5 to $120. Link.

- WalletConnect, a web3 infrastructure startup that allows users to connect crypto wallets using QR codes, raised $11 million in a Series A round co-led by Union Square Ventures and 1kx. Link.

- Spanish bank Santander is working with Agrotoken to offer loans collateralized by tokenized commodities like soy and corn. Link.

- LimeWire, the early 2000s app for illegally downloading music, is re-launching under a new team as an NFT music marketplace with loyalty programs for fans. Link.

- The majority of ruble-denominated crypto trading volume appears to be conducted with Tether, the US dollar stablecoin. USDT/RUB volume on exchanges grew from $2.1M on 1/1 to $21.4M on 3/1. Link.

- The Bored Ape Yacht Club NFT collection donated $1 million to Ukraine. Link.

- Financial regulators are shutting down all 81 crypto ATMs in the UK. Link.

- Ethereum Layer2 protocol Immutable X raised a $200 million Series C at a $2.5 billion valuation. Link.

- Bain Capital Ventures launched a $560 million dedicated crypto fund. Link.

- Chapter One, an LA-based venture firm, launched Chapter One Studios, a six-month incubator program which will provide three crypto startups with million-dollar checks and hands-on support. Link.