PRICE CHANGE: WTD/YTD

- BTC ($22,468): 0% / +36%

- ETH ($1,614): +3% / +35%

- SOL ($20.22): -4% / +107%

- UNI ($6.11): -4% / +18%

- MATIC ($1.16): +2% / +54%

MARKET CAP CHANGE: WTD/YTD

- Crypto Market Cap ($1.0T): 0% / +30%

- BTC Dominance: 42%

- ETH Dominance: 19%

- Tether ($73B): +2% / +10%

- USDC ($40B): -8% / -9%

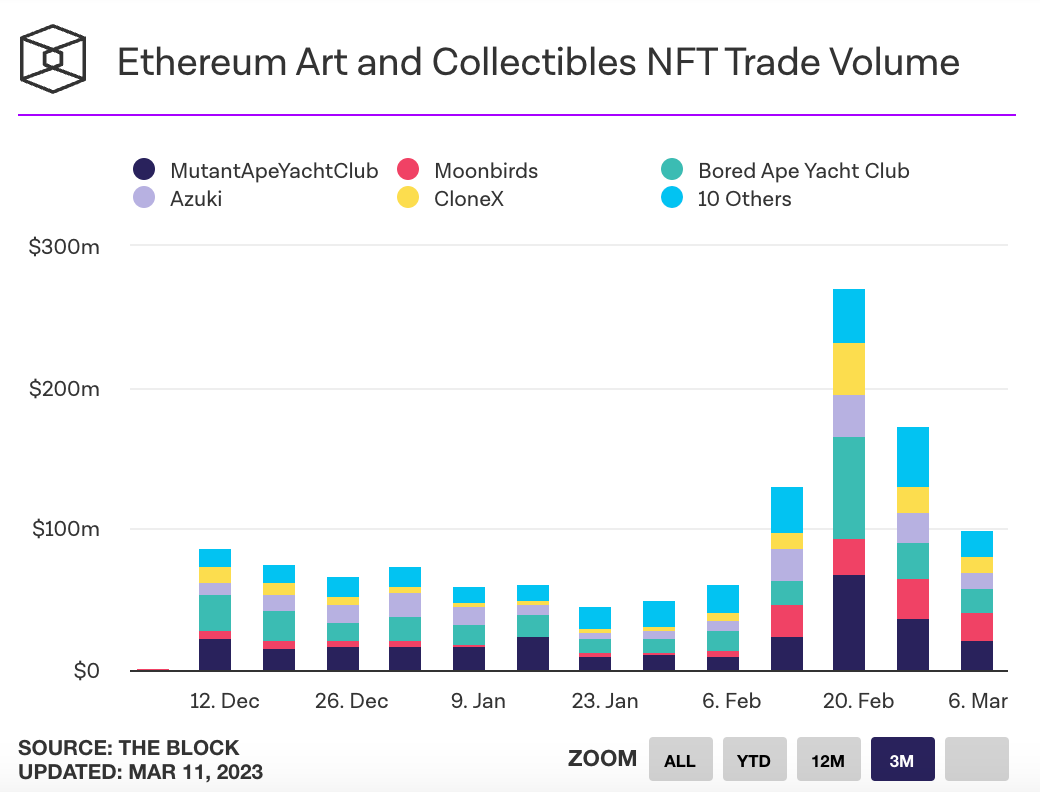

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Silicon Valley Bank (SVB), the preferred banking partner for many US start-ups and tech companies, had its operations taken over by the FDIC this week after experiencing a significant bank run. Circle, the issuer of the USDC stablecoin, disclosed it had 8% of its reserves at SVB. News of the $3.3 billion exposure sent the price of USDC to below $0.90 as panic selling put pressure on the stablecoin. On Sunday, the Fed announced that SVB deposits would be honored and USDC rebounded to its $1 peg. Link. Link. Link. Link. Link.

- Coinbase paused its 1 to 1 conversion of USDC to USD over the weekend, as it relies on clearing from traditional banking partners to fulfill the redemptions. Coinbase plans to reopen conversions when banks open on Monday. Link. Link. Tweet.

- The state of New York has sued KuCoin for violating laws governing the trading of securities and commodities, naming ETH, among other tokens, as unregistered securities the exchange has listed in the state. Link.

- CFTC Chairman Rostin Behnam stated that Ethereum is a commodity, directly contradicting SEC Chairman Gary Gensler, who has implied the token falls under securities laws. Link.

- Crypto-friendly bank Silvergate is winding down operations, citing regulatory scrutiny as a key factor. The bank announced a voluntary liquidation, including full repayment of all deposits. Link. Link. Link.

- On Sunday, the NY Department of Financial Services announced it had taken possession of Signature Bank and its $88 billion deposits, citing systemic risk similar to SVB. Regulators said they would guarantee all deposits, with no losses incurred by taxpayers. The closure of Signature and Silvergate leaves many crypto companies unable to find banking services. Link. Link.

- Coinbase has launched Wallet as a Service, a set of developer tools designed to enable companies to embed custom digital wallets directly into their applications. Link. Link. Blog Post.

- Uniswap's v3 protocol will become fully open-source on April 1. Link.

- Meta is working on a decentralized text-based messaging app. Link.

- A bill in Illinois that requires exchanges and crypto businesses to obtain a license akin to the New York Bit License advanced in the state’s house. Link.

- Amazon is developing an NFT platform set to launch as early as April 24. US-based Prime customers will be able to purchase NFTs tied to real-world assets. Link.

- Starbucks launched its first paid NFT on Polygon as part of its Starbucks Odyssey rewards program. Up to 2,000 NFTs will be sold for $100 each. Each NFT is a unique piece of artworks inspired by the brand’s mermaid logo. Link.

- President Biden released his 2023 budget proposal to congress, which includes a 30% excise tax on crypto miners and closing the loophole crypto traders use for tax loss harvesting. Congress has to pass a budget that includes these tax rules before they can be implemented. Link. Link. Link.

- GitCoin launched an NFT collection in collaboration with Ethereum founder Vitalik Buterin. The open edition NFT saw trading volume reach 7,763 ETH. Link.

- Interbank messaging company SWIFT is moving into a second phase of testing a product for transferring and settling central bank digital currencies (CBDCs). France, Italy, the UK and Singapore are participating in the tests. Link.

- U.S. congressmen Patrick McHenry and Ritchie Torres reintroduced the Keep Innovation in America Act, a bill that will reform the way crypto is treated for tax purposes. The bill would narrow the definition of a crypto broker and allow miners, validators, and software developers to operate without onerous reporting requirements. Link.

- The auction for Yuga Labs' TwelveFold Bitcoin NFT collection concluded with 288 successful bidders spending $16.49 million worth of BTC. Link.

- JPMorgan is ending its banking relationship with crypto exchange Gemini, while Coinbase's banking relationship with JPMorgan remains intact. Link.

- Coinbase updated its terms and conditions for its staking service, stating that clients will earn rewards through protocols and not Coinbase itself, one month after Kraken was fined by the SEC for its staking product allegedly violating securities laws. Link.

- An NFT buyer purchased a CryptoPunk NFT using testnet ETH tokens, which are supposed to be worthless. The buyer swapped 527,281 Goerli testnet ETH for 72.72 ETH to purchase CryptoPunk #9682. Link.

- Crypto VC funding hit $91 million this week, down significantly from $254 million the prior week. Majority of this week’s funding went to DeFi companies. Link.

- The US Department of Justice has filed an appeal to block Binance.US' purchase of Voyager, shortly after a New York bankruptcy judge approved the acquisition. Link.

- BRC-20, an experiment that uses Ordinals to mint and transfer a form of fungible tokens on the Bitcoin blockchain, launched this week. The creator cautioned that the experiment should not be considered a standard for Bitcoin-based tokens. Link.

- GQ launched its Ethereum NFT collection this week. The collection did not sell out, but GQ the brand remained committed to the project long term. Link.

- Gitcoin is launching an ETH staking index token called gtcETH. The token is a blend of various liquid staking service tokens, with additional fees going towards funding of public goods. Link.

- BitMEX co-founder Arthur Hayes has proposed NakaDollar, a stablecoin backed by bitcoin and bitcoin derivatives, which would theoretically not rely on a traditional bank. Link.

- U.S. authorities transferred $1 billion worth of BTC recovered from a dark web hack to new wallet addresses on Wednesday, stoking fears they would sell BTC on the open market. Link.

- Blockchain.com is winding down its asset management arm, which launched last April. Link.

- Yuga Labs announced details for the second test of its Otherside metaverse, slated for 3/25 and including a two-hour narrative experience for up to 10,000 people with Otherdeed NFTs. Link.