Crypto weekly is co-authored by @serdave

PRICE CHANGE: WTD/YTD

- Crypto Market Cap ($2.1T): +10% / +17%

- BTC ($51,628): +7% / +22%

- ETH ($2,916): +17% / +28%

- SOL ($110): +4% / +8%

- UNI ($7.56): +14% / +3%

- MATIC ($0.98): +18% / +1%

- Tether Mkt Cap ($98B): +1% / +6%

- USDC Mkt Cap ($28B): 0% / +14%

- BTC / ETH Dominance: 49% / 17%

THIS WEEK IN CRYPTO

- The market cap of Bitcoin hit $1 trillion this week, a first since late 2021. Link.

- Bitcoin ETFs saw record cumulative net inflows of $2.5 billion last week. Link.

- Ethereum reached its final testnet for the upcoming Dencun upgrade, which will enable proto-danksharding. Proto-danksharding is a major network upgrade requiring a hard fork (est March 13) and should drive lower transaction costs on ethereum Layer 2s. Link.

- Ethereum traded over $2,800 for the first time since Terra/Luna’s crash in May 2022. Link.

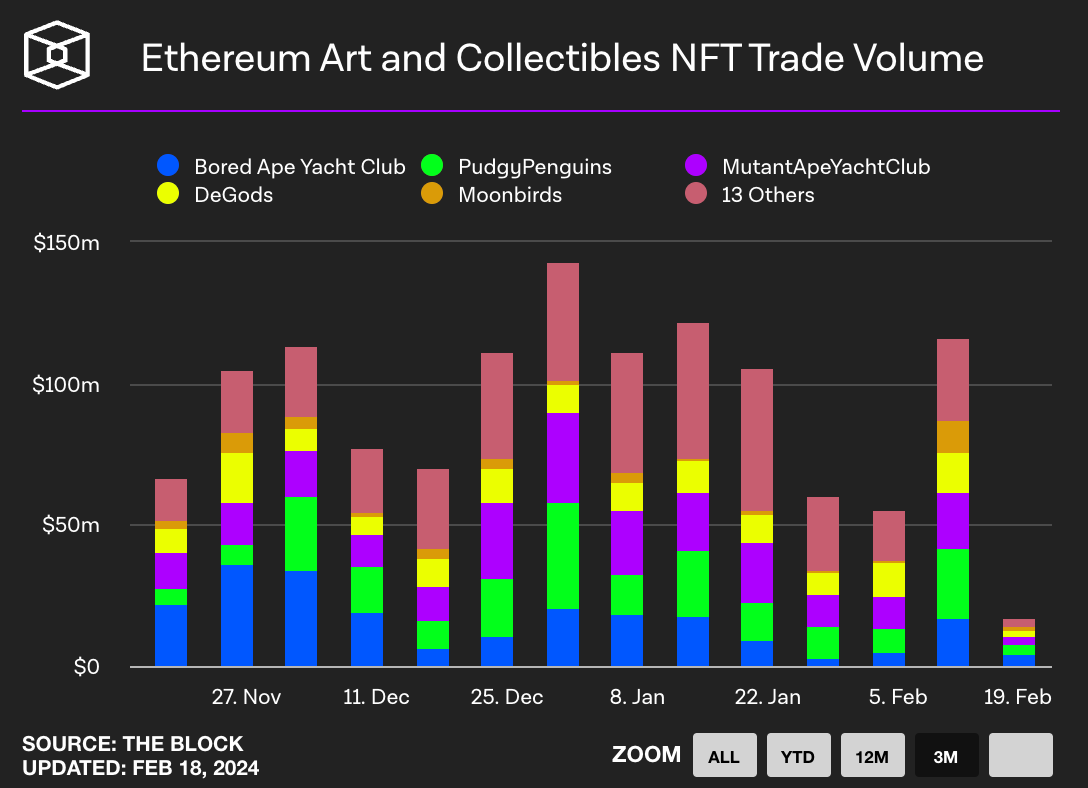

- Yuga Labs acquired Proof, the creator of Moonbirds, in an all equity deal for an undisclosed amount. Link. Link.

- Starknet, an ethereum layer 2 network powered by zero knowledge technology, announced the airdrop of its STRK token for February 20th. 1.3 million wallets are eligible for the airdrop, the largest in history, but US and UK residents are excluded. Link. Link.

- The Uniswap Foundation said the launch of the DEX’s V4 protocol is tentatively scheduled for Q3, dependent on the implementation of Ethereum’s Dencun upgrade. V4 introduces “hooks”, smart contracts that act as plugins to allow liquidity pools to add custom features such as dynamic fees and on-chain limit orders. Link. Original V4 Announcement.

- Franklin Templeton filed a spot Ethereum ETF application with the SEC. There are 8 active Ethereum ETF applications, all by institutions that launched a Bitcoin ETF last month. The SEC has delayed Ethereum ETF decisions in the past, but must approve or deny the earliest application, filed by Van Eck, by May 23rd. Link.

- Coinbase’s stock price increased 30% this week after reporting strong Q4 earnings. Coinbase reported $954 million of revenue, surpassing the $629 million generated in Q4 2022. Transaction revenue, the firm's core business, grew 83% in the fourth quarter from the previous quarter. Link.

- Coinbase has earned $6.2 million in revenue since July from transaction fees on its Layer 2 blockchain Base. Base ranks 4th amongst L2s for value of assets deposited on it, and 5th in terms of activity. 4 million wallets have interacted with the network, with daily active users of around 60,000. Link. Dune Dashboard. L2 Beat.

- Galaxy Digital projects 20% of mining hashpower will drop off after April’s bitcoin halvening. The halvening reduces per-block rewards for mining bitcoin from 6.25 BTC to 3.125 BTC. Link.

- Crypto media company CoinDesk saw it’s longtime chief, Kevin Worth, replaced by Sara Stratoberdha. The shift comes less than three months after the media company was acquired by Bullish, a subsidiary of Block.one. Link.

- Founders Fund invested $200 million in bitcoin and ethereum in the 2nd half of 2023. Link.

- MicroStrategy reported $4 billion of profit from its bitcoin holdings. Link.

- CitiBank used layer-1 blockchain Avalanche’s Spruce subnet to test tokenizing private equity funds. T. Rowe Price and WisdomTree tested tokenizing and trading assets on Spruce last year. Link.

- Indonesia elected former defense minister Prabowo Subianto and his pro-crypto running mate, Gibran Rakabuming Raka, to be the country’s next president and vice president. Indonesia has more registered crypto investors than stock traders. Link.

- Genesis won bankruptcy court permission to sell its $1.3 billion holding of Grayscale Bitcoin Trust shares as part of its plan to compensate clients who had assets deposited when the lender froze withdrawals in 2022. Link.