Crypto weekly is authored by maaria and david blumenfeld

PRICE CHANGE: WTD/YTD

- Crypto Market Cap ($3.25T): -13% / -4%

- BTC ($95,173): -9% / +2%

- ETH ($2,787): -16% / -16%

- SOL ($194): -22% / +2%

- UNI ($8.70): -26% / -34%

- OP ($1.04): -35% / -41%

- Tether Mkt Cap ($139B): 0% / 0%

- USDC Mkt Cap ($53B): +2% / +22%

- BTC / ETH Dominance: 58% / 10%

THIS WEEK IN CRYPTO

- The Fed maintained rates at 4.25% after three consecutive cuts since September, signaling no immediate plans for further reductions as inflation has risen in recent months. In his news conference, Fed Chairman Powell called on Congress to pass comprehensive crypto regulations and stated banks are "perfectly equipped" to handle crypto customers. Link. Link.

- USDT issuer Tether reported $13 billion in 2024 profits, nearly matching Goldman Sachs’ $14 billion with a fraction of the employees. Link.

- Crypto political action committee Fairshake has raised $116 million for the 2026 midterm elections. Fairshake spent $170 million in the 2024 election and saw its candidates win 91% of the time. Link.

- The number of active addresses on Ethereum has increased 37% over the past three months, up to 575,000 from a 3 month low of 425,000. Link.

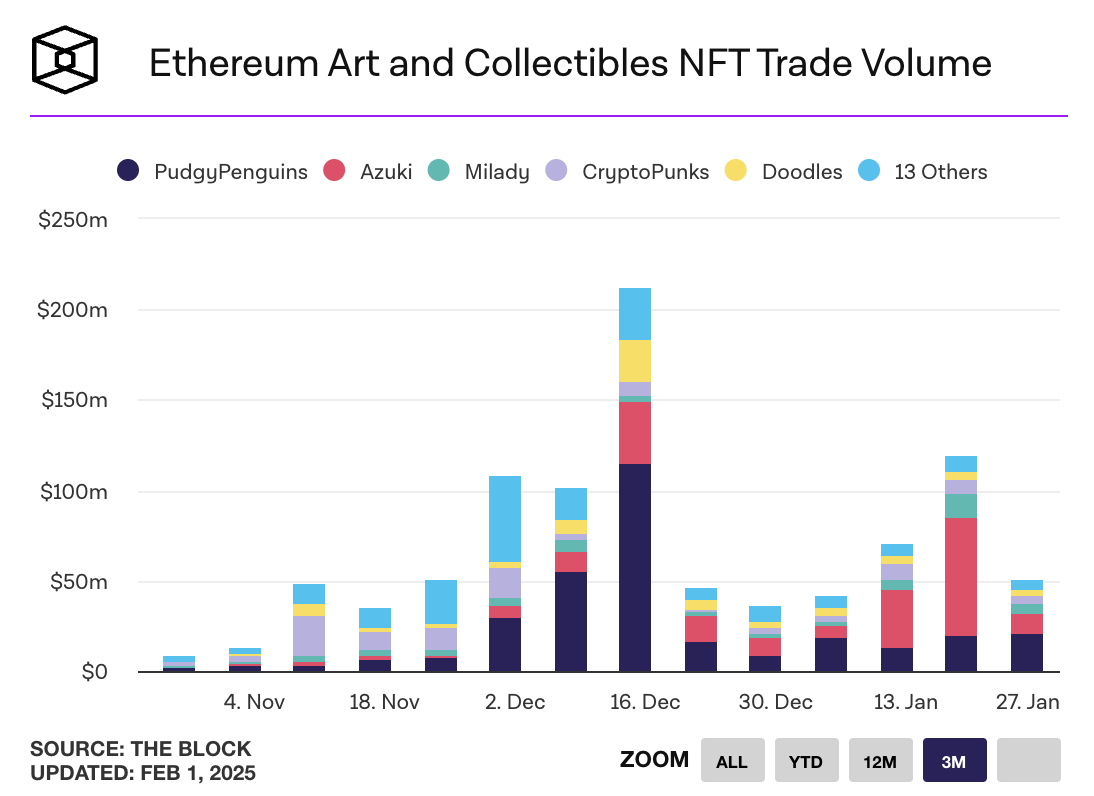

- NFT marketplace Opensea rolled out a private beta of its Opensea 2.0 platform, featuring a points system akin to competitor Blur. Link.

- A third class action lawsuit has been filed against Solana meme coin platform Pump.fun, alleging tokens created on Pump.fun are unregistered securities. Link.

- Venture investors invested $1.2 billion into crypto startups in January, up 63% from last January. Crypto startup investments are expected to double to $18 billion this year due to a more favorable US regulatory environment. Link.

- European Central Bank (ECB) president Christine Lagarde said bitcoin is not an option for the eurozone’s central bank reserves, citing concerns over liquidity, security and regulatory scrutiny. Link.

- Tether announced it will integrate its USDT stablecoin with Bitcoin's Lightning Network. Link.

- Kraken is launching a new staking product in the US nearly two years after the SEC forced it to halt a similar service. Link.

- Decentralized exchange Uniswap rolled out its V4 protocol this week, which introduces “hooks”, smart contracts that allow developers to build custom mechanisms for liquidity pools. Link. Announcement.

- The parents of FTX founder Sam Bankman-Fried have met with President Trump affiliates to make the case for their son to be pardoned. SBF was sentenced to 25 years in prison last year for fraud related to the 2022 collapse of FTX. Link.

- The SEC gave initial approval for a combined BTC/ETH ETF offered by Bitwise. The regulator still needs to approve Bitwise’s S-1 application in order for trading to go live. Link.

- During his Senate confirmation hearing, Commerce Secretary nominee Howard Lutnick supported mandatory stablecoin audits with 100% Treasury backing. Lutnick is the CEO of Cantor Fitzgerald, which custodies hundreds of billions of US treasuries that back USDT. Link.

- Former SEC chairman Gary Gensler is returning to MIT Sloan School of Management to focus on AI research and policy. Link.

- Ethereum NFT project Doodles replaced CEO Julian Holgiun with founder Scott Martin aka Burnt Toast. Holgiun, a former Billboard executive, led Doodles for 2 years. Link.

- SoFi CEO Anthony Noto said the company would offer crypto services pending regulatory clarity by the Trump administration. SoFi offered crypto products from 2018-2023. Link.

- Pudgy Penguins parent company Igloo launched its ethereum Layer 2 called Abstract. The blockchain was built with ZKSync’s ZKStack. Link.

- Coinbase acquired on-chain advertising platform Spindl for an undisclosed amount. Link.

- Blackrock is partnering with asset manager Apollo Global Management to tokenize their Diversified Credit Fund on Aptos, Avalanche, Ethereum, Ink, Polygon, and Solana. Link.

- Investment manager D.E. Shaw took a large stake in Bitcoin mining company Riot Platforms. Hedge fund Starboard Value took a stake in the company last year as an activist investor, pushing the company to convert some of its mining facilities to support AI customers. Link.