PRICE CHANGE: WTD/YTD

- BTC ($37,774): +7% / -20%

- ETH ($2,561): +4% / -31%

- XRP ($0.60): -1% / -28%

- UNI ($11): -1% / -38%

- Crypto Market Cap ($1.7T): +8% / -23%

- BTC Dominance: 42%

- ETH Dominance: 18%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($78B): +0% / +0%

- USDC ($50B): +4% / +17%

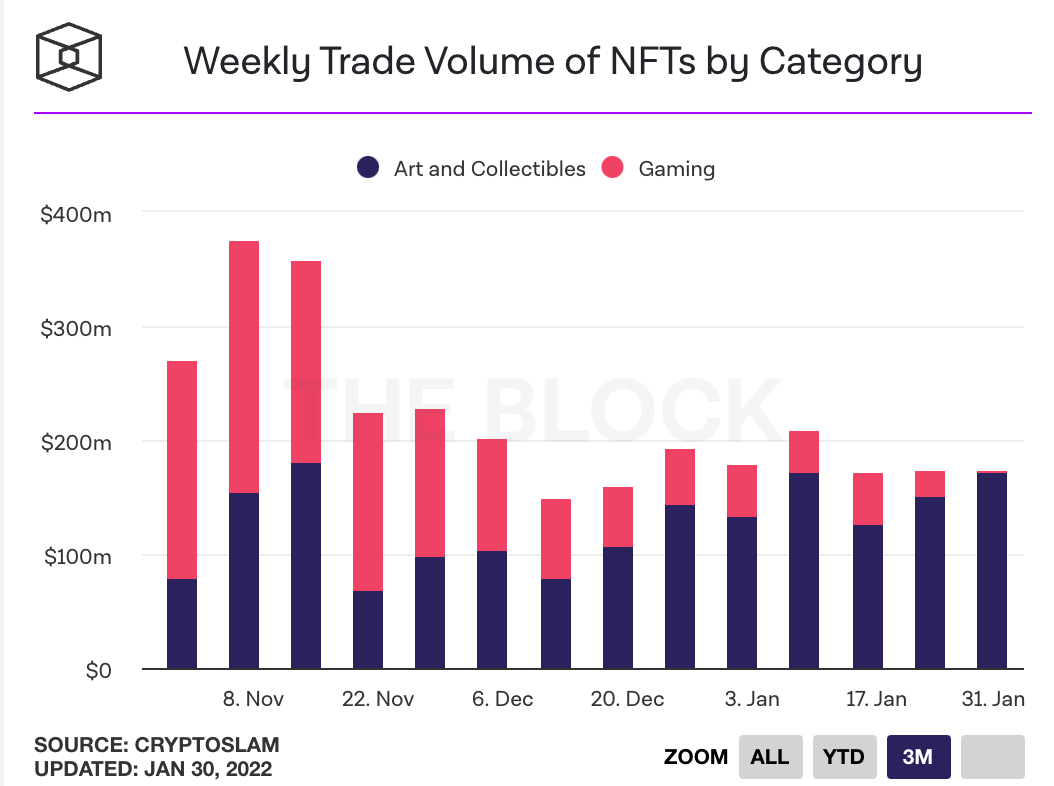

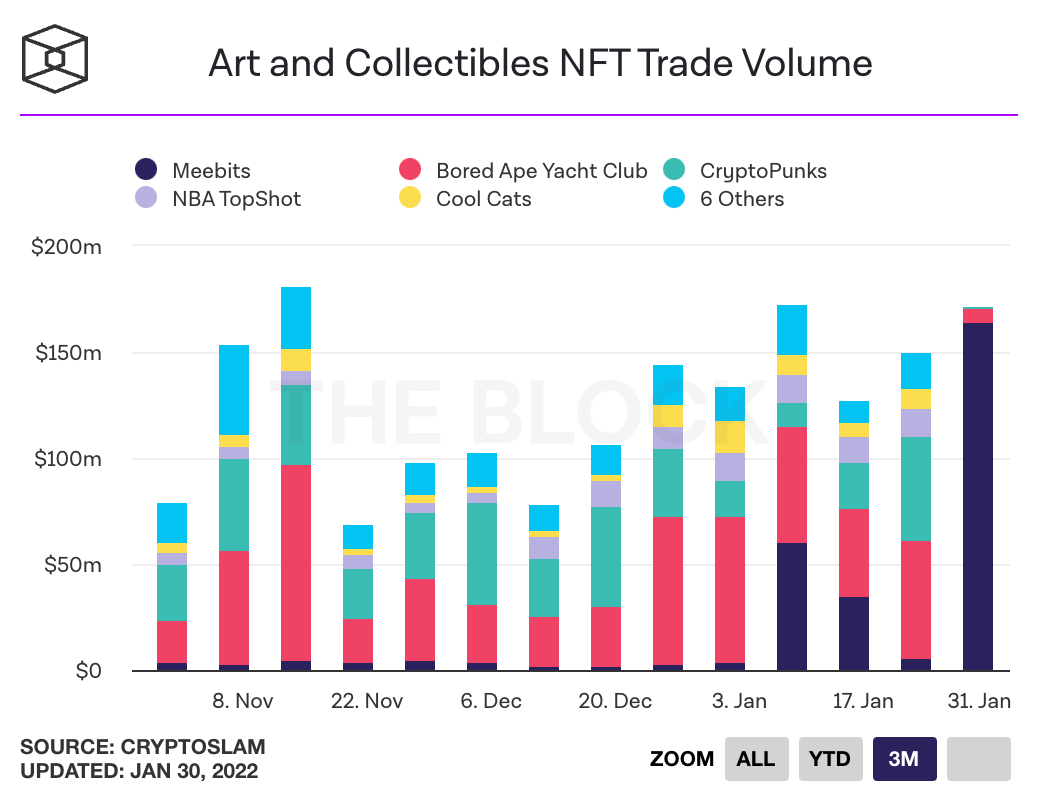

NFT 3M TRADING VOLUMES

Note: this week's charts are adjusted for the wash trading on LooksRare.

THIS WEEK IN CRYPTO

- Meta (fka Facebook) is winding down its never-launched stablecoin project, Diem (fka Libra) and selling the assets to Silvergate Capital for $200 million. Link.

- YouTube CEO Susan Wojcicki said the company was exploring helping its content creators capitalize on NFTs. Link.

- The team behind Etherscan released a beta of Blockscan Chat, a messaging platform for users to message each other wallet-to-wallet. The service isn't decentralized though, and messages will run through Etherscan's servers. Link.

- Leaked screenshots show OpenSea supporting Solana NFTs and the popular Solana wallet, Phantom. Link.

- A new Chainalysis report shows that $8.6 billion worth of crypto was laundered in 2021, a 30% increase over 2020 but still less than 2019's $10.9 billion. Money laundering accounted for just 0.05% of all crypto transaction volume in 2021. And by comparison there are estimates that between $800 billion and $2 trillion of fiat currency is laundered each year. Link.

- JPMorgan Chase closed Uniswap founder's bank accounts without notice. The move comes a few months after the SEC reportedly started investigating Uniswap Labs, the main developer behind Uniswap. Link.

- 0xSifu, a co-founder and CFO of Avalanche-based fork of OlympusDAO called Wonderland, was outed as the co-founder of the notorious Canadian crypto exchange QuadrigaCX, which has been labeled as a ponzi scheme by officials. The community voted to remove Sifu as the protocol's treasury manager and is now voting on whether to wind down Wonderland. Link. Link. Link. Quadriga Story.

- Popular algorithmic stablecoins including Terra's $UST and Abracadabra's $MIM risked depegging from their dollar pegs, as users fled Frog Nation projects. Frog Nation is a series of DeFi protocols founded by Daniele Sestagalli and includes Wonderland, Abracadabra, and Popsicle Finance. Confidence in Daniele fell after it was revealed he knew Wonderland's treasury manager 0xSifu had been been involved in past frauds. Users pulled over $2 billion of liquidity from the MIM-3CRV pool on Curve, leading to a severe pool imbalance that was 95% $MIM and 5% 3CRV and an almost 2% decoupling from the dollar. This in turn effected Terra's UST stablecoin which is often used as collateral for leveraged $MIM yield farming. Link. Link. Link.

- Data analytics firm CryptoSlam estimates that $8.3 billion of NFT marketplace LooksRare's $9.5 billion of sales volume to date have been wash trades. Meebits was over half of that volume. Users are washtrading to capitalize on LooksRare's token incentive model, where users are given $LOOKS rewards for buying and selling NFTs on the site. Link. Link.

- Paradigm is working on a new NFT pricing mechanism called CRISP (Constant Rate Issuance Sales Protocol) which aims to sell NFTs at a targeted rate over time. Prices will dynamically adjust based on demand. Link. Tweet.

- Visa customers made $2.5 billion in payments using its crypto-linked cards during the first fiscal quarter of 2022, 70% of what it did in all of fiscal 2021. Link. Link.

- Ripple announced a $200 million Series C share buyback, implying a $15 billion valuation. The news comes as Ripple is battling the SEC. Link.

- The head of YouTube Gaming, Ryan Wyatt, is joining Polygon as CEO of Polygon Studios to focus on growing the developer ecosystem across gaming, entertainment, fashion and sports. Link.

- A DAI vaultholder named "7 Siblings" narrowly avoided having $600 million of Ethereum collateral liquidated during the ETH crash, which would have caused even more downward pressure on the currency. 7 Siblings was able to add collateral to their vault after just $65 million of liquidations, to the relief of Twitter. Link. Twitter.

- Syndicate launched the public beta of its Web3 Investment Clubs platform, which allows small groups of individuals to pool money and resources to invest in assets or buy property. The DAOs run natively on Ethereum using an ERC-20 infrastructure. Link. Link.

- MoonPay launches NFT Checkout, which allows anyone to use fiat to purchase NFTs on Ethereum, Flow, Solana and Polygon. Customers can use debit and credit cards, Apple Pay, Google Pay, wire transfers, and ACH transfers. Link.

- OpenSea reimbursed 750 Ethereum, roughly $1.8 million, to users who accidentally sold valuable NFTs well below their going market rate through an exploit involving "inactive listings". Several BAYC NFTs were purchased off the marketplace using old, cheap listing prices that were never canceled on the blockchain. Link. To avoid the exploit users must cancel inactive listings in their wallet, if they plan to re-purchase or transfer an NFT back into the wallet. Learn how to cancel any inactive listings here. (Note: feel free to reach out if you have any questions on how to do this).

- Fidelity Investments is working with the SEC to launch two ETFs to track companies operating in crypto and the metaverse. The SEC recently rejected Fidelity's application for a spot bitcoin ETF. Link.

- FTX US raised a $400 million Series A at an $8 billion valuation. The exchange launched in the US in 2021 and has 1.2 million users and $350 million in daily trading volume. Link.

- CoinTracker, a crypto startup that helps users report and file taxes, raised $100 million Series A at a valuation of $1.3 billion. Link.

- DeFi stablecoin project OlympusDAO is soft-launching an NFT marketplace called Olympus Odyssey on 3/3 to generate revenue for OlympusDAO members and show that its stablecoin OHM can be used as a medium of exchange. Link.

- Crypto custodian Fireblocks raised a $550 million Series E at an $8 billion valuation. Fireblocks has $45 billion in assets under custody. Link.

- Users of El Salvador's Chivo wallet are reporting significant issues, including blocked accounts, unauthorized charges, and failed transactions. Link.

- Superdao, which is building Shopify for DAOs, raised a $10.5 million seed at a $160 million valuation led by SignalFire. Link.

- Brevan Howard hired Jump Capital partner Peter Johnson to invest $250 million it has earmarked for crypto investing. Brevan manages $18.4 billion and is beginning to explore crypto. Link.

- Warner Music Group is planning virtual concerts in Sandbox's metaverse. Link.

- Lebron James and his foundation are partnering with Crypto.com to provide crypto and blockchain-related education and resources to underserved communities. Link.

- The Sandbox launched a $50 million accelerator program with Animoca Brands and Brinc to invest in up to 100 metaverse startups. Link.

- Reddit is testing a feature that would allow users to use an NFT as a verified profile pic. Twitter recently added this feature. Link.

- PleasrDAO is raising $69 million at a $1 billion valuation. Link.

- Coinbase Ventures made almost 150 new investments in 2021, and now has almost 250 companies in its portfolio. DeFi and CeFi accounted for 23% of new investments, followed by protocols/web3 infra at 20% and NFTs/metaverse at 17%. Link.

Thanks for reading! Subscribe for free to receive Crypto Weekly every Sunday.