PRICE CHANGE: WTD/YTD

- BTC ($43,095): +3% / -9%

- ETH ($3,335): +5% / -10%

- XRP ($0.77): +3% / -8%

- UNI ($18): +13% / +4%

- Crypto Market Cap ($2.1T): +5% / -7%

- BTC Dominance: 39%

- ETH Dominance: 19%

STABLECOIN MARKET CAP CHANGE: WTD/YTD

- Tether ($78B): +0% / +0%

- USDC ($45B): +4% / +7%

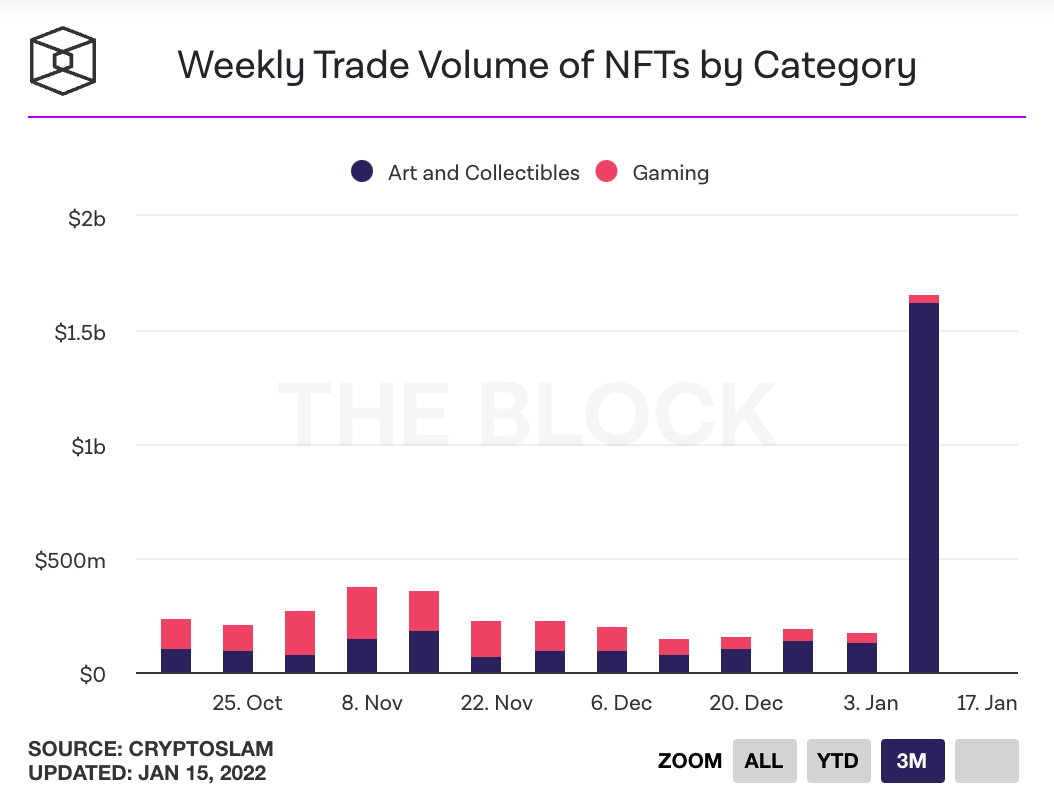

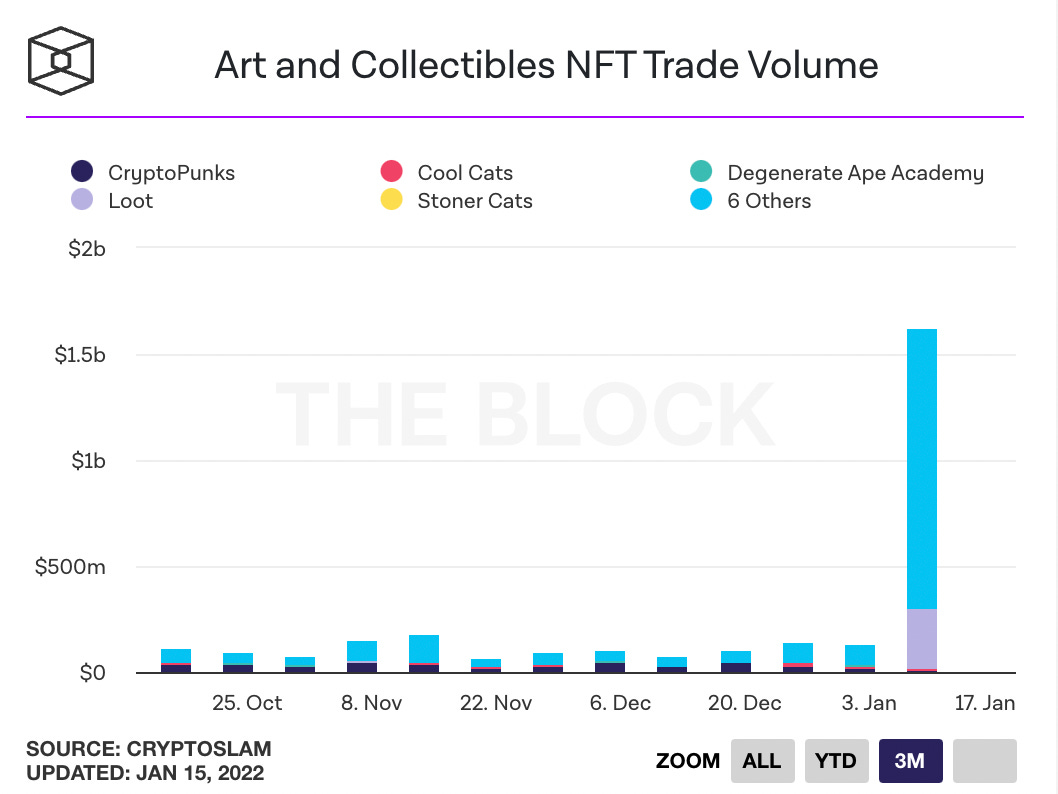

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- NFT collection World of Women signed with investor and music exec Guy Oseary to represent the project across TV, film, music, video games, and consumer projects. Oseary already manages Bored Ape Yacht Club's Yuga Labs. World of Women NFTs saw almost $10 million of trading volume on the news, up more than 1,100%. The floor price of the collection has risen from 5 ETH a week ago to almost 8 ETH today. Link. Link.

- NFT volumes soared to over $1.5 billion for the week according to data analytics site CryptoSlam, driven largely by Meebits NFTs which saw $1.3B of volumes in the last 7 days. Trading volume may be artificially inflated due to the launch of an NFT platform called LooksRare, which wants to take on market leader OpenSea. CryptoSlam data. Blog Post. LooksRare launched its LOOKS token, a token that was claimable by users who listed an NFT for sale on the marketplace. LooksRare charges a 2% fee on all trades (lower than OpenSea's 2.5%) which it then distributes to users who stake their LOOKs tokens. Volumes on LooksRare skyrocketed as users artificially pumped up volumes to increase their rewards for staking; many of the trades were suspected to be 'wash trading' or users selling between wallets at artificially inflated prices. Staking rewards on LooksRare are currently at 805% APR. Link.

- DeFi governance platform Bribe announced a $4 million seed round to build what it refers to as a Voter Extractable Value (VEV) protocol. Bribe plans to route value to governance token holders by enabling "bribes" -- payments in exchange for voting on proposals in a certain way. VEV emerged during the "Curve Wars" which represented an escalating battle for other protocols to accumulate and control Curve's CRV governance tokens, which can incentivize user deposits into specific trading pools. Link.

- Transactions on emerging layer 1 blockchain Fantom passed those on Avalanche. Fantom is currently offering DeFi users ~30-60% APR on stablecoins. Link.

- $DOGE soared 16% after Elon Musk tweeted that Tesla merch could be purchased with the memecoin. Link.

- SEC chairman Gary Gensler wouldn't respond to an interviewers question about whether Ethereum was a security. The SEC had previously said that it didn't consider Bitcoin to be a security, and in June 2018 former director of the SEC William Hinman had said that Ethereum had become "sufficiently decentralized" since its launch and therefore was not a security. Link.

- The House Energy and Commerce Oversight Subcommittee is holding a hearing on the environmental impact of blockchains and proof-of-work networks like Bitcoin on January 20. There are growing concerns over the rise of crypto mining in the US, which has become the largest source of Bitcoin's hash rate over the last year after China banned mining. Link.

- A new LinkedIn report shows that postings related to "bitcoin," "blockchain", and "Ethereum" grew 395% between 2020 and 2021. Most common roles were for blockchain developers and engineers. Link.

- Bitcoin payment processor Strike launched in Argentina. Users can only send and receive money on Strike via USDT for the time being, but Strike plans to add support for Bitcoin soon. Link.

- The total supply of USDC on Ethereum passed rival's USDT (Tether) for the first time ever. USDC supply hit 39.92 billion, while USDT supply was at 39.82 billion. Total supply of USDT is higher than USDC across all blockchains though. USDC's recent growth has come from increased usage in DeFi on Ethereum. Link.

- Visa and ConsenSys are partnering together to build new infrastructure to support the rollout of central bank digital currencies (CBDCs). Their new tech will be able to plug into existing payment modules, meaning companies will be able to integrate infrastructure to issue things like CBDC-linked payment cards or wallet credentials, and could provide an on-ramp for existing networks. Link.

- Crypto hedge funds significantly outperformed in 2021, returning 214% on average compared to just over 10% for the average hedge fund, which was below the S&P 500's index return of 26.9%. Link.

- Music NFT platform Royal delayed its mint to Jan 20 after the site crashed a minute into the original mint on Jan 11. The drop is for 760 music NFTs from rapper Nas. The NFTs come in three price tiers with different royalties on resales, from 7% at the lowest to 21% at the highest. Link.

- Fees.wtf, a site that lets crypto users see how much they've spent on Ethereum transaction fees, released an airdrop that didn't perform as expected. WTF tokens were allocated proportionally to wallets based on the amount of fees paid, as long as they met the minimum 0.05 ETH threshold. The team had failed to provide enough liquidity for WTF tokens on Uniswap, which led trading bots to game the system and cause the price of WTF to spike and crash dramatically within the first 5 minutes of trading. Link.

- OHM, the token underpinning DeFi stablecoin protocol OlympusDAO, fell 28% in 24 hours as the broader crypto markets fell. Link.

- Kim Kardashian, Floyd Mayweather and Paul Pierce are being sued for their promotion of the EMAX token in Q2 2021. Ethereum Max (EMAX) has lost over 97% of its price value since being promoted by the influencers. Link.

- FTX is launching a $2 billion venture fund, FTX Ventures. Amy Wu from Lightspeed will lead the new fund. Link.

- Rio de Janeiro's mayor Eduardo Paes plans to invest 1% of the city's treasury in cryptocurrency. He also suggested the city may offer a discount on property taxes if paid in bitcoin. Link. Link.

- Crypto accelerator DeFi Alliance is rebranding to "AllianceDAO" and transitioning to an investment DAO. 300 members contributed around $50 million, including the Winklevoss twins and OpenSea CEO Devin Finzer. Link.

- Digital collectible company Candy Digital, launched its marketplace for trading previously released officially licensed MLB NFTs. Candy Digital was formed by Michael Rubin (CEO of Fanatics), Mike Novogratz (CEO of Galaxy Digital), and Gary Vaynerchuck. It raised a $100 million Series A at a $1.5 billion valuation in October 2021. Link.

- Seashell, a startup building an investment app to offer high yields of up to 10%, raised $6 million in a seed round co-led by Khosla Ventures and Kindred Ventures, with participation from investors like Coinbase Ventures, Avalanche Foundation, Mark Cuban, and Robinhood CEO Vlad Tenev. Link.

- Crypto exchange Gemini acquired BITRIA (formerly Blockchange), a crypto portfolio management platform for financial advisors and asset managers. Link.

- Crypto services startup Zero Hash raised $105 million in Series D funding. The startup powers crypto infrastructure for neobanks like MoneyLion, payment processors like MoonPay and Ramp, and retail brokers like TradeZero. Link.

- Gap launched an NFT collection on Tezos in collaboration with Brandon Sines, the artist behind Frank Ape. Customers unlock the opportunity to buy digital art by Sines and a limited edition, physical Gap hoodie. Link.

- Crypto data and software provider Lukka raised $110 million Series E at a $1.3 billion valuation. Lukka provides institutional customers like exchanges, miners, financial institutions and accounting firms with middle and back-office software and data tools. Link.

- The Associated Press is launching an NFT marketplace on Polygon at the end of this month. Blockchain as a service firm Xooa built out the marketplace. Link.

- Crypto accounting firm TaxBit will allow users to connect accounts across multiple platforms including PayPal, gemini, Binance, FTX, Uniswap, SuperRare and Nifty Gateway. Link.

- Coinbase acquired FairX, a CFTC-regulated derivatives exchange. Link. Link.

- The NEAR Foundation raised $150 million via funding round led by Three-Arrows Capital. On Jan 1 Marieke Flament, who was previously leading a fintech bank in London, joined the foundation as its new CEO. Link.

- Parler, a social media platform popular with conservatives, is launching an NFT collection featuring former President Donald Trump. The first collection includes 10,000 NFTs derived from artist Jon McNaughton's hand-painted images of the president. The NFTs will be sold for 0.10 ETH each. Link.