This week's crypto weekly was co-authored by @serdave

PRICE CHANGE: WTD/YTD

- BTC ($21,185): +24% / +28%

- ETH ($1,575): +22% / +32%

- XRP ($0.40): +17% / +18%

- UNI ($6.69): +20% / +30%

MARKET CAP CHANGE: WTD/YTD

- Crypto Market Cap ($998B): +19% / +26%

- BTC Dominance: 41%

- ETH Dominance: 19%

- Tether ($66B): 0% / 0%

- USDC ($44B): 0% / -1%

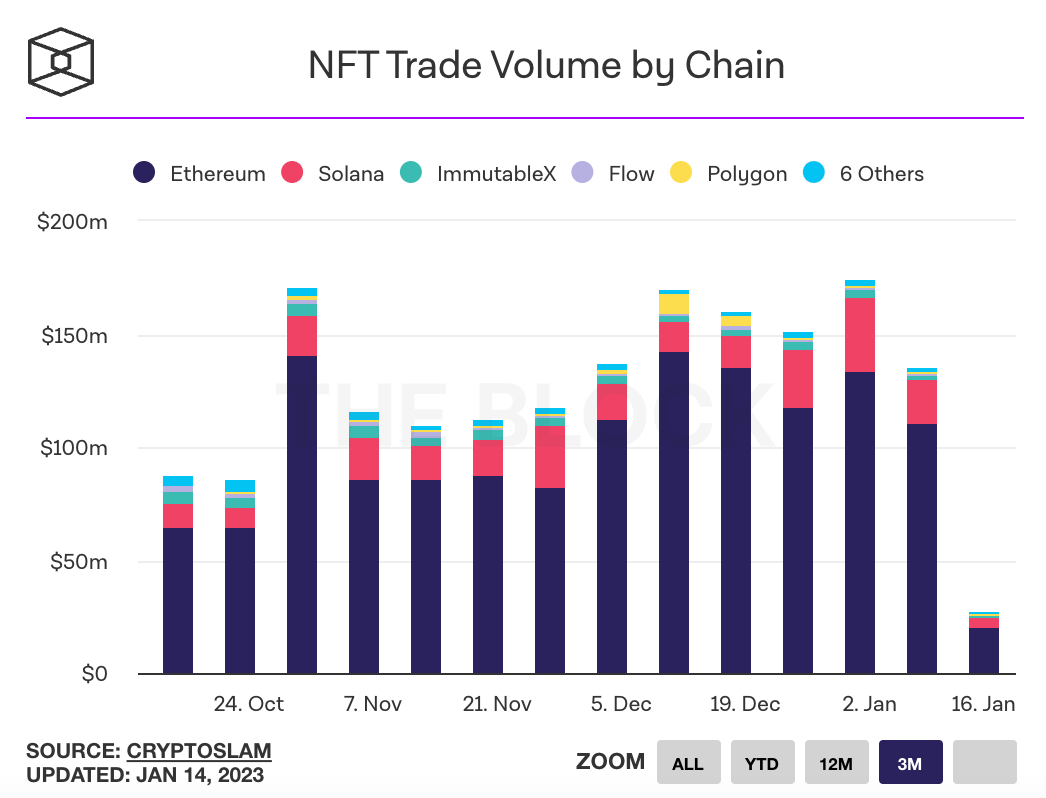

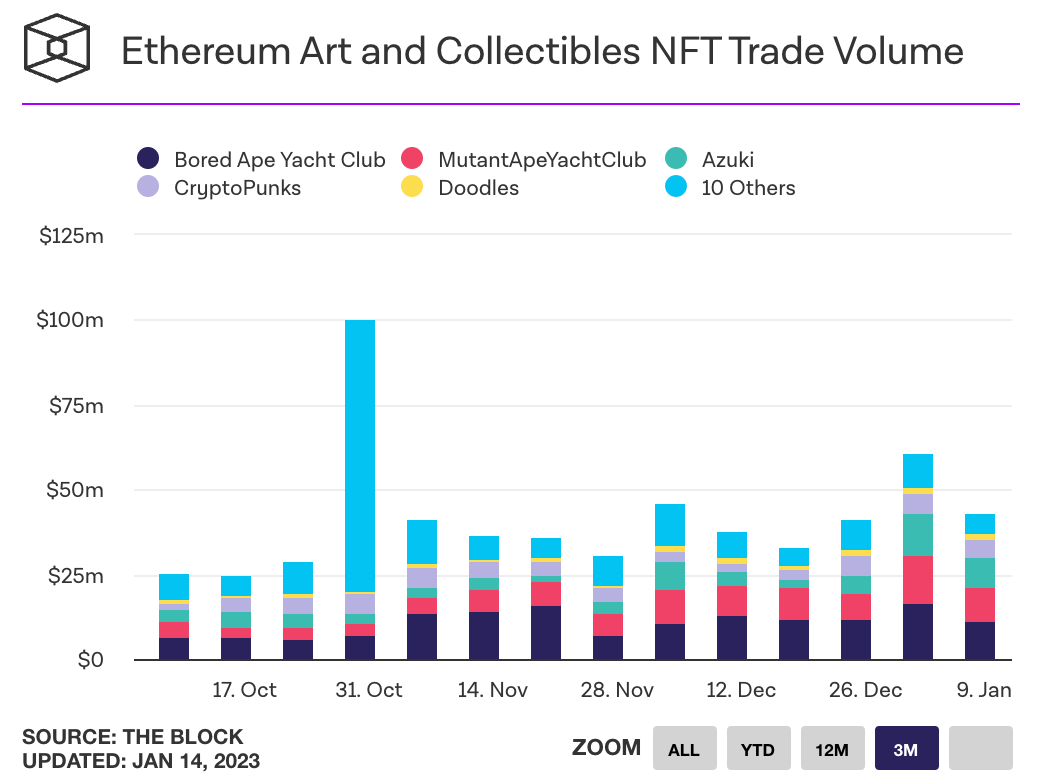

NFT 3M TRADING VOLUMES

THIS WEEK IN CRYPTO

- Positive macroeconomic news, including reports that inflation is easing, caused a price surge in digital assets most notably Bitcoin. Link.

- The Ethereum Shanghai upgrade, which includes the ability to withdraw staked ETH, is on track to release in March. The update will not include proto-danksharding, an update that will make L2s faster and cheaper. Link.

- BNY Mellon’s CEO said that digital assets were the bank’s “longest-term play” on its latest earnings call. Link.

- The SEC announced charges against Gemini and Genesis, alleging that Gemini Earn is an unregistered security that bypassed disclosure laws. Genesis held $900 million of Gemini Earn deposits and couldn’t meet liquidity demands after the collapse of FTX. Link. Link.

- FTX has recovered over $5 billion in cash and various liquid cryptocurrencies. The amount FTX owes to creditors is unknown but expected to be between $1 and $10 billion. Link.

- Former FTX CEO Sam Bankman-Fried claims that CZ, the CEO of Binance, orchestrated a targeted crash of the FTT token, causing FTX and its sister hedge fund Alameda Research to go insolvent. He also said that had the exchange not been forced to file for bankruptcy, it would have been able to meet customer redemptions. SBF, who is under house arrest, vowed he had “a lot more to say” about the collapse of FTX. Link. Link. SBF Substack.

- Metamask is rolling out a new feature that will enable users to stake their ETH via Lido and Rocket Pool. Link. Link.

- AWS and Avalanche announced a partnership to make it easier for developers to deploy Avalanche nodes and subnets on the AWS platform. Link.

- DCG is considering a sale of its venture portfolio to shore up a $3 billion shortfall in its subsidiary Genesis. The portfolio, which includes investments in Dune Analytics, Coinbase, Etherscan and Circle, is estimated to be worth $500m. Link.

- FTX has been given permission to sell assets such as LedgerX, FTX Europe and FTX Japan to repay creditors. Preliminary bids are being accepted over the next 4-6 weeks. Link.

- Crypto.com is cutting its workforce by 20%, citing the collapse of FTX causing the firm to cut more staff after announcing layoffs over the summer. Link. Link.

- The Polygon blockchain will be undergoing a hard fork on January 18th when it switches to a proof of stake consensus. The hard fork will also update gas fees to match the Ethereum network. Link.

- A bankruptcy court granted initial approval for Binance.US to acquire bankrupt crypto lender Voyager for $1 billion. The deal would allow Voyager customers to get 51% of their money back. Link.

- PleasrDAO is launching a series of live NFT auctions featuring notable figures such as Edward Snowden and Daniel Ellsberg. Link.

- FTX Japan plans to repay funds to customers starting next month. The exchange had kept customer deposits segregated from other FTX entities. Link.

- The CFTC filed a lawsuit against crypto trader Avraham Eisenberg for allegedly manipulating the price of swaps contracts on decentralized exchange Mango Markets. The scheme allowed Eisenberg to withdraw $114 million of digital assets from the exchange. Link.

- A record $20.1 billion was collected by illicit addresses in 2022, though this was less than 1% of all crypto transactions. Volumes related to terrorism, darknet, and scams decreased year-over-year, but stolen funds increased 7% compared with 2021. Link.

- Bitcoin mining difficulty rose 10% this month, its largest move since October. Link.

- Alameda Research, the trading firm connected with defunct crypto exchange FTX, lost over $1 million in assets from forced liquidations. Link.

- A US trustee filed objections to FTX’s liquidators, citing potential conflicts of interest. Link.

- Crypto exchange Gemini was hit with a class action lawsuit for offering unregistered securities. Link.

- Former president Donald Trump launched a new NFT collection where users could purchase a one-on-one zoom meeting with Trump for 200 ETH, a gala dinner ticket for 50 ETH, and a meeting with Trump for 21 ETH. Link.

- A federal bankruptcy judge terminated FTX’s naming-rights deal with the Miami arena where the Miami Heat play. Link.